GBPUSD Price Analysis – June 7

The GBPUSD pair progressed to stabilize in the 1.2660 price area for the seventh day in a row since reaching a daily high level of 1.2731. The pair first became influenced by optimistic US job data but rather stayed bolstered by growing demands for high-yielding securities.

Key Levels

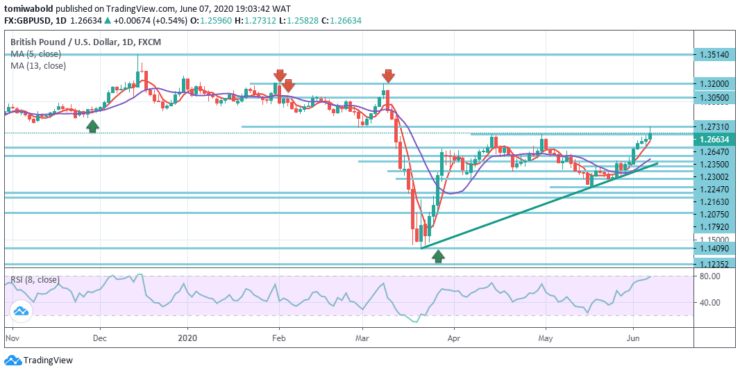

Resistance Levels: 1.3514, 1.3050, 1.2731

Support Levels: 1.2500, 1.2075, 1.1409

While the pullback from the 1.1409 level is strong in the larger context, there may not be enough indication of a trend reversal. Eventually, the downward trend from the level 2.1161 (high) may still proceed.

The pivotal breach of 1.3514 level, nevertheless, may at least indicate bottoming in the medium to long term and alter the trend to bullish for 1.4376 resistance level initially.

The upsurge of GBPUSD from level 1.2300 expanded last week and reach as high as level 1.2731. This week’s initial bias is now on the positive side. The next aim is an estimate of 61.8 percent from 1.1409 to 1.2647 from 1.2075 to 1.2830 levels next.

The continuous breach there, as seen on the daily, may aim 100 percent forecast at 1.3200 level. On the contrary, the intraday neutral bias may first be altered beneath 1.2500 minor support level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.