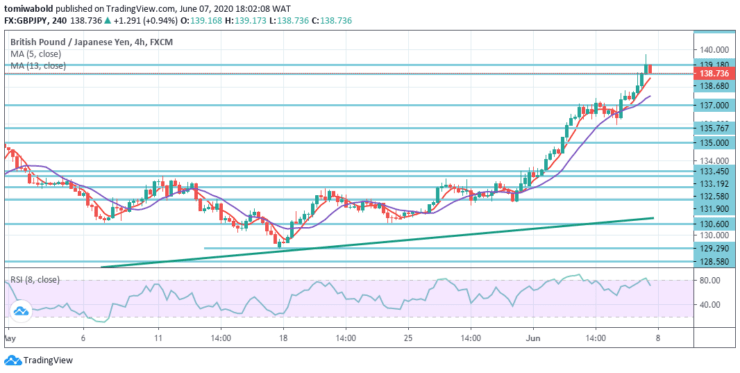

GBPJPY Price Analysis – June 7

The buyers have been driving GBPJPY to its peak after late February 2020 without yielding. The upward pressure stays intact with the spot continuing for a breach beyond the level of 140.00. Amidst some new buying pressure emerging, it becomes worth waiting for some follow-through buying before validating its top.

Key Levels

Resistance Levels: 147.95, 144.95, 141.24

Support Levels: 135.00, 129.29, 122.75

In the wider sense, we are also seeing market behavior at a level of 122.75 (low) being that is seen as a trend of consolidation on the side. So long whilst resistance level 147.95 holds, there is a potential downside breakout in support.

A solid breach of 147.95 level, nevertheless, may increase the risk of bullish long-term reversal. Hence its emphasis can then be shifted to a validation level of 156.59 resistance.

The growth of GBPJPY from level 132.58 continued last week by smashing the resistance level 135.76 and speeding up to level 139.74. The initial bias stays on the upside this week with a 100 percent forecast of 123.99 to 135.76 at 141.24 levels from 129.29.

There the strong break aims 147.95 key resistance level as observed on the daily chart. On the contrary, support level break 135.00 is required to indicate short term topping. Anyway, in the event of retreat, the trend may remain bullish.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.