GBPUSD Price Analysis – October 25

The GBPUSD broke below the 1.3050 level and at risk of plunging in the short-term beneath the 1.3000 level, after hitting a fresh two day low in the prior session. The Pound is under pressure as US Dollar recovers momentum however the upbeat UK Retail Sales and expanding business activity in the country supported the pound.

Key Levels

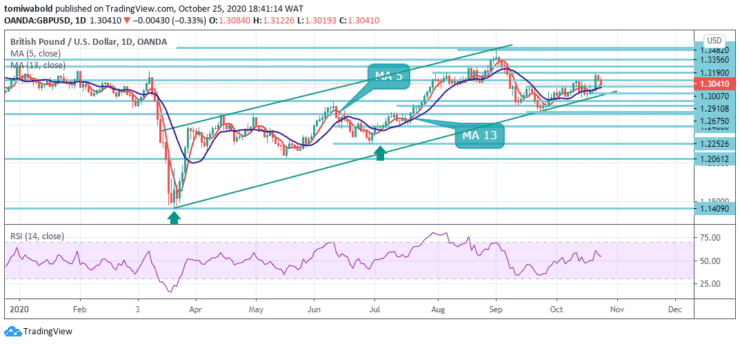

Resistance Levels: 1.3514, 1.3267, 1.3190

Support Levels: 1.2910, 1.2675, 1.2252

Technically speaking, GBPUSD has limited bullish potential when trading below 1.3190. The daily chart shows that it is developing primarily from its moving averages, which are in any case limited to a narrow range with moderate bullish slopes. RSI has declined within positive levels and is holding near its midline.

In a broader context, attention remains at the key resistance level of 1.3514. A decisive breakout should also occur on sustained trading above the 5 and 13 moving averages (currently at 1.3007). This should confirm the mid-term bottom at 1.1409. Nonetheless, a deviation at 1.3514 will maintain medium to long term bearish sentiment for the next decline below 1.1409 at a later stage.

GBPUSD Short term Trend: Ranging

The 4-hour chart shows that the pair has stopped below the moving averages 5 and 13, and the momentum indicator is moving steadily down within negative levels. The RSI indicator is flat within neutral levels, so the risk is shifted to the downside.

Last week, GBPUSD bounced off the 1.2675 level to hit 1.3175 but then retreated. Initial bias remains neutral this week. Another rise is expected as long as the support level of 1.2910 is held. A break below 1.3175 would target the 1.3482 high. On the other hand, a breakout of the 1.2910 level would indicate the completion of the bounce.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.