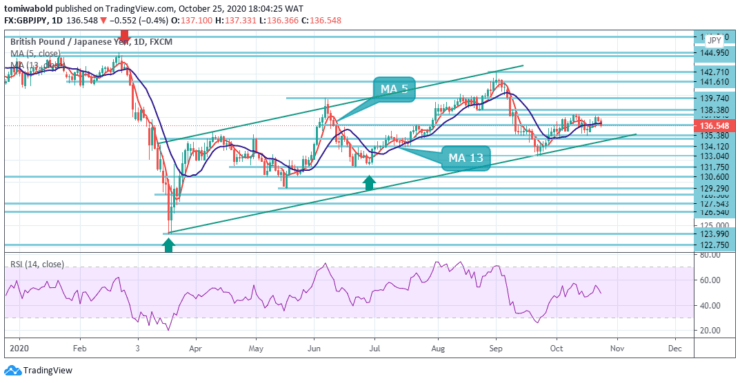

GBPJPY Price Analysis – October 25

The Pound sterling vs safe-haven Yen stays fragile under selling pressure at the end of the week, despite trading in a consolidation channel between 137.84 and 135.38 levels. Persistent Brexit-related uncertainties continued undermining the sentiment around the GBP.

Key Levels

Resistance levels: 147.95, 142.71, 137.84

Support levels: 135.38, 133.04, 131.75

During the prior week, GBPJPY tries to push through the moderate resistance at 137.84 and draws out some supply with a response that is currently underneath the level of 136.62. In the larger sense, meanwhile, the increase from the level of 123.99 is seen only as an increasing phase of the sideway consolidation trend from the level of 122.75 (low).

As long as the level of resistance is 147.95, an inevitable downside breakout stays in support. Nevertheless, the steady breach of the 147.95 marks would increase the probability of a bullish long-term reversal. Emphasis on validation may then be shifted to a 156.59 resistance level.

GBPJPY seems to be drifting into a sideways market in the short-term picture, as no dimensional signals are gaining traction. The next path is anticipated to be formed by a simple breach beneath level 133.04 or over level 137.84. Second, this week’s initial bias holds firm.

On the upside, the rebound from the 133.04 level may get prolonged by a breach of the 137.84 level as the intraday bias will be turned back to the upside to retest the high level of 142.71. On the downside, the 135.00 level breach may suggest that the fall is restarting from the 142.71 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.