GBPUSD Price Analysis – June 28

The GBPUSD pair briefly crashed, hitting a fresh June low of 1.2314 level, gaining some mere 15 pips regardless of the closing. The crash was the result of demand from the revived dollar on a risk-averse market.

Key Levels

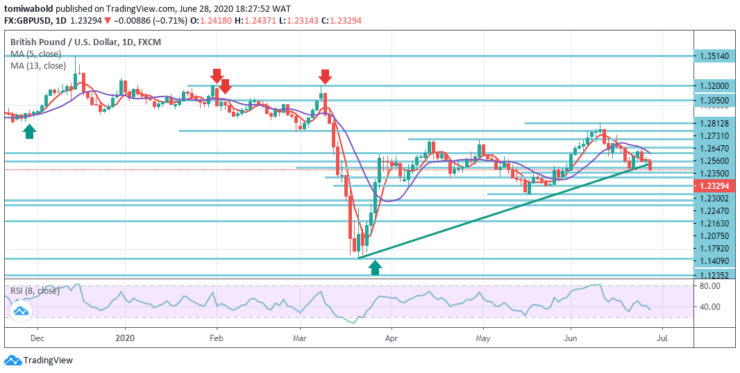

Resistance Levels: 1.3514, 1.2812, 1.2560

Support Levels: 1.2300, 1.2075, 1.1409

The GBPUSD pair’s daily chart shows there is still potential for a more downward trend, as the pair has stayed beneath its moving average of 13 all through the prior week, while technical indicators are moving steadily beneath negative levels.

Whereas the rebound from 1.1409 level is intense in the wider context, there still isn’t enough indication for a trend reversal. Nonetheless, a significant breach of 1.3514 level may at least indicate bottoming in the medium to long term and bring out the bullish potential for 1.4376 resistance level initially.

The bearish scenario is also evident in the 4-hour chart, as the pair has intensified its decline after falling beneath the ascending trendline, now beneath all its moving averages, while the RSI holds its bearish slopes close to oversold level.

Given a brief rebound, GBPUSD’s fall from level 1.2812 continued last week. Initial bias is now on the downside for support level 1.2075 this week. The significant breach there will indicate the conclusion of the entire recovery from level 1.1409. At the upside, however, a breach of 1.2560 level may suggest that a decline from 1.2812 level is already achieved.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.