GBPJPY Price Analysis – June 28

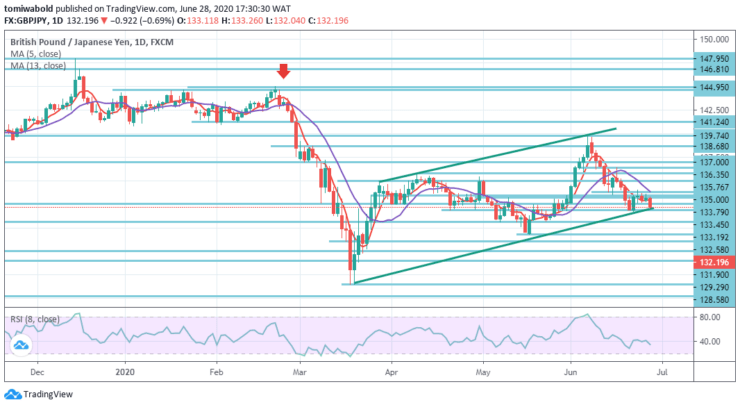

In the previous session, the sterling plunged by around 0.69 percent against the yen, after being resisted at the price level of 132.58 as GBPJPY selling bias renewed beneath the 133.00 marks. Combined with Brexit fears, the overall risk-averse bias amid the global rise of COVID-19 instance darkens the trend for a bilateral agreement.

Key Levels

Resistance Levels: 147.95, 139.74, 136.35

Support Levels: 131.90, 129.29, 123.99

The GBPJPY cross to the 134.00 regions has now eliminated a significant part of its weekly gains. A potential slide beneath the current week’s 132.00 round-figure marks may trigger more intense technical selling and pave the way for the pair’s two-week-old bearish trend to restart.

Initial resistance on the upside stays at the horizontal level, now at 133.79 level. The pair may acquire bullish traction beyond here, targeting at a level of 135.00 about 50% retracing the drop of February-March and ultimately 136.35 level (high June 16).

As seen during last week’s 4-hour time frame, GBPJPY declined slightly to 131.75 level but has since rebounded. The initial bias this week is optimistic, and consolidation may continue. On the downside, beneath the level of 131.90, negative pressure on the pair may intensify sending it down at 130.60 level.

The more downward trend is anticipated, and the breach of level 131.75 may restart the downfall from level 139.74 for support level 129.29. The crucial break there will affirm that the rebound from level 123.99 is finished. Where it would be seen that a wider decline would retest a low level of 123.99.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.