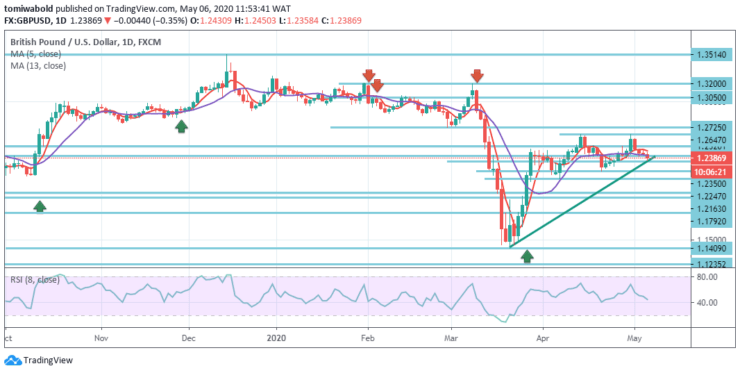

GBPUSD Price Analysis – May 6

The GBPUSD pair eventually broke down the consolidation stage of its Asian session and in the last few hours crashed to over one-week lows, along the 1.2360 marks. The initial reversal was motivated by some follow-up bullish activity in the US dollar, that stayed widely sustained by its position as the global reserve currency during a US-China dispute regarding the coronavirus’ roots.

Key Levels

Resistance Levels: 1.3514, 1.3050, 1.2647

Support Levels: 1.2247, 1.1792, 1.1409

GBPUSD Long term Trend: Ranging

Although the recovery from level 1.1409 is significant in the larger sense, there is no evidence of trend reversal currently. The downward trend from the level 2.1161 (high) may continue quite probably eventually.

The next medium to the long-term goal might be a forecast of 61.8 percent from 1.7190 to 1.1792 at 1.0273 levels from 1.3514 level. The pattern may stay bearish in either scenario as long as the resistance level of 1.3514 stays intact in the event of a significant recovery.

GBPUSD Short term Trend: Ranging

GBPUSD’s intraday bias stays neutral, as range trading persists. As long as 1.2247 support level remains unchanged, another advance is in support. A 1.2647 level breach may increase the advance from 1.1409 to 1.3200 levels of resistance.

On the contrary, a breach of 1.2247 support level may indicate a recovery from a 1.1409 level is achieved. Intraday bias may be altered back to the downside to re-test low level 1.1409.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.