One of the short-term implications of the halving is that miners are now taking swift actions to keep mining profitable. This can be seen in Bitcoin’s hashing rate and is indicative that miners are upgrading their equipment to bolster efficiency and profitability.

Bitcoin’s hash rate is an industry-wide recognized indicator of the cryptocurrency’s fundamental strength. For several weeks now, the hash rate has surged to new all-time highs alongside Bitcoin’s difficulty level.

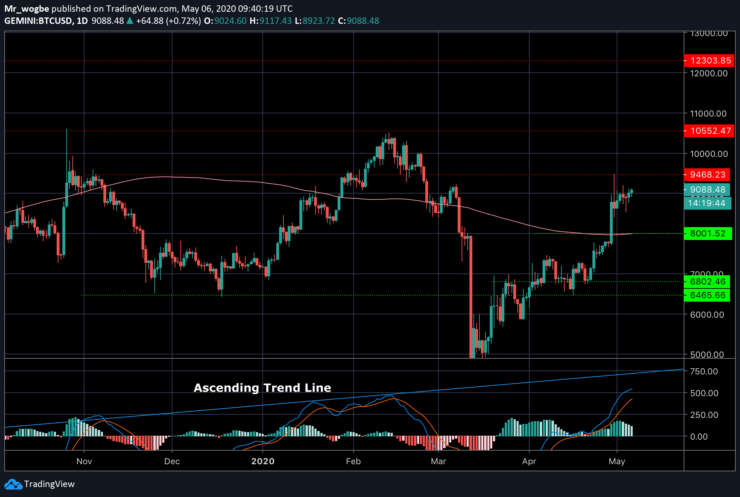

Bitcoin (BTC) Value Forecast — May 6

BTC/USD Major Bias: Sideways

Supply Levels: $9,500, $10,500, and $12,300.

Demand Levels: $8,000, $6,800, and $6,400.

BTC continues to show strong bullish strength, however, it is still locked in a battle with the $9,000 – $9,200 levels. Failure to successfully conquer the resistance at $9,500 could send the price of BTC to the $8,800 region or on a full retrace to the 200MA and support at $8,000.

The MACD oscillator depicts the steady rise of BTC and how it is expected to continue in that trajectory. The next 24 hours could be very determining for BTC’s next move.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.