Market Analysis – August 18

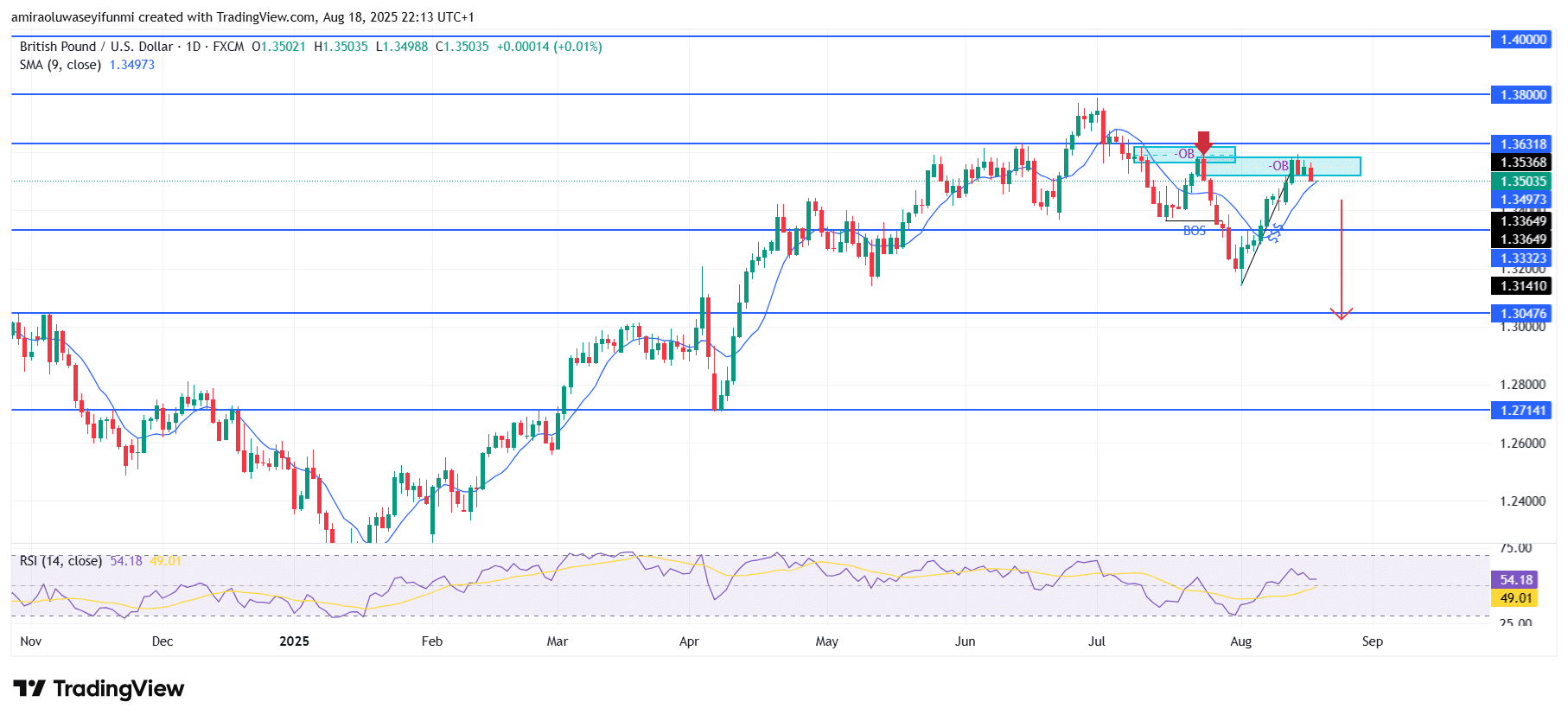

GBPUSD is showing renewed bearish momentum amid signs of technical weakness. The pair has recently displayed fading bullish strength, with price struggling to maintain upward momentum around the $1.3530–$1.3630 resistance zone. The 9-day Simple Moving Average at $1.3500 is acting as a dynamic pivot, while the RSI reading near 54.18 reflects a neutral tone, failing to provide the overbought confirmation needed to sustain a bullish case. This combination of signals suggests that broader market sentiment is shifting away from buying pressure toward a more cautious, sell-oriented stance.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bearish

GBPUSD has faced repeated rejections at the $1.3530–$1.3630 order block, confirming this zone as a strong supply cluster. The visible break of structure (BOS) on the daily chart highlights weakening demand, with the failure to reclaim and hold above $1.3530 leaving the pair vulnerable to further downside. Immediate support levels near $1.3370 and $1.3330 are being tested, with sellers gaining traction as successive lower highs begin to form.

Looking ahead, momentum favors a bearish continuation, with price primed for a deeper pullback toward the $1.3040 support region. A decisive breach of $1.3330 would likely accelerate selling pressure, pushing the pair further into the mid-term demand zone. If bearish sentiment strengthens, an extended decline toward the $1.2710 handle is possible, where stronger institutional demand could provide support. Overall, the structure of the market maintains a bearish outlook unless price decisively reclaims $1.3630. Traders following forex signals may see these levels as important benchmarks for positioning.

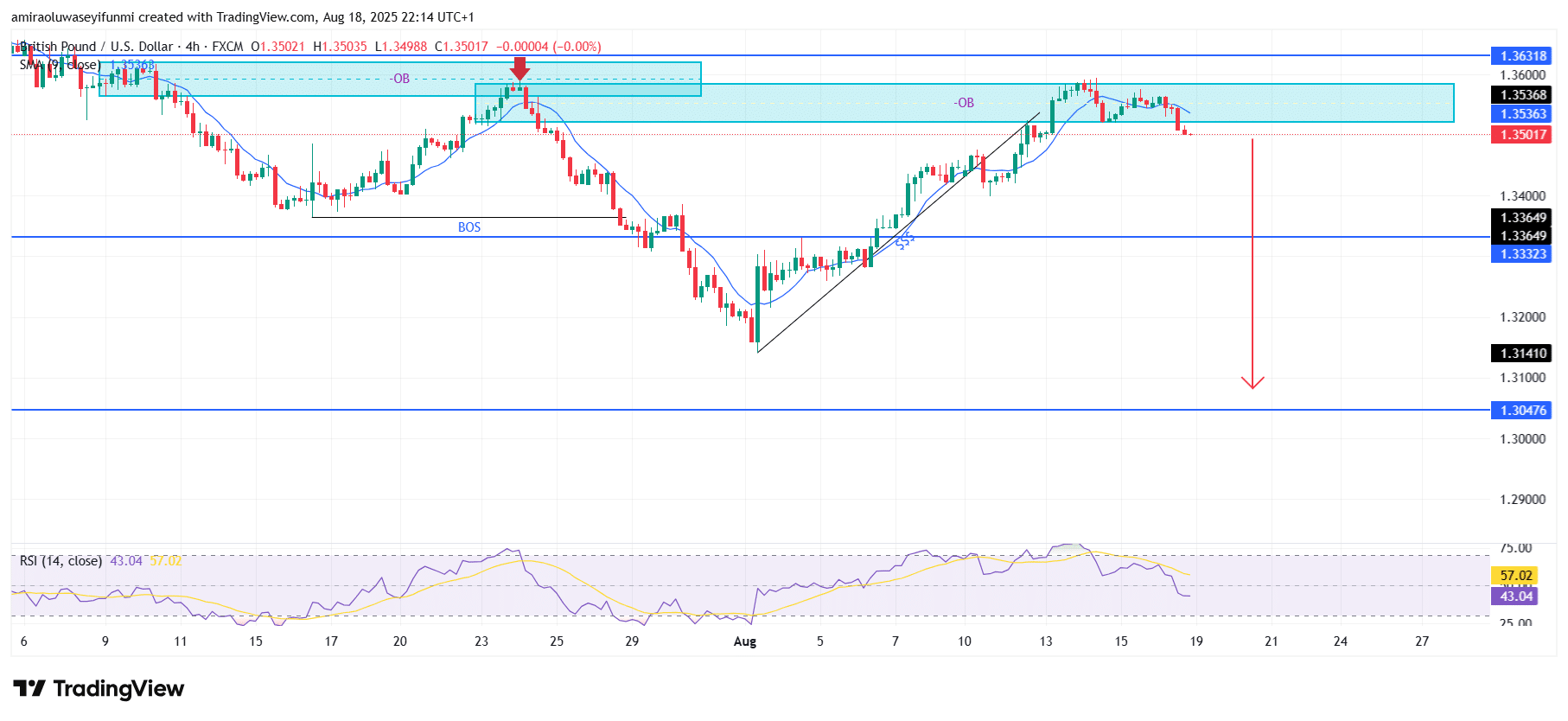

GBPUSD Short-Term Trend: Bearish

In the short term, GBPUSD has rejected the $1.3530–$1.3630 supply zone, confirming resistance overhead. The pair is now trading below the 9-period moving average, signaling renewed downside momentum.

RSI at 42.98 indicates weakening buying pressure and favors sellers. Price is likely to extend lower toward $1.3330, with a possible continuation to $1.3040.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.