GBPUSD Price Analysis – November 1

The GBPUSD pair posted a modest intraday advance in the prior session but selling bias holds lower under the 1.3000 level. Prime Minister Boris Johnson announced a UK nationwide lockdown on Saturday, also extending coronavirus wage subsidies. GBPUSD may trend lower at the weekly opening and lose the 1.2881 level.

Key Levels

Resistance Levels: 1.3356, 1.3190, 1.3007

Support Levels: 1.2881, 1.2675, 1.2252

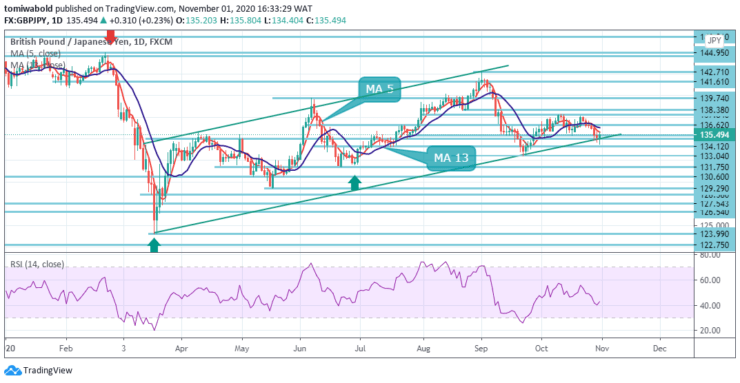

GBPUSD started a deep fall after a pullback at 1.3177 resistance, causing the pair to dip below the 5 and 13 moving averages to retrace at 1.2881. From a technical point of view, the RSI is holding in negative territory. The continued decline could open the door to support at 1.2813.

In a broader context, attention remains at the key resistance level of 1.3482. A decisive breakout in this area should also occur with sustained trading above the horizontal resistance level, which is currently at 1.3356. This should confirm the mid- to long-term bottom at 1.1409. Nonetheless, a deviation at 1.3482 would maintain bearish sentiment for another decline below 1.1409 in a later cycle.

GBPUSD dropped to 1.2881 last week but recovered quickly. Initial bias remains neutral this week. On the other hand, a break of 1.2881 should turn intraday bias downward to retest the 1.2675 low as well as the 38.2% retracement from 1.1409 to 1.3482 at 1.2750 levels.

On the other hand, however, a break of 1.3190 will resume the rebound from 1.2675 to retest the 1.3482 high. In the 4 hours chart, the risk is shifting to the downside as the pair meets sellers near the bearish 5 and 13 moving average, which continues to fall below the uptrend line. The weekly low at 1.2881 is the closest support level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.