GBPUSD Price Analysis – October 18

On Friday, the GBPUSD exchange rate fell to the 1.2862 level and later the rate reversed north to reach a high level of 1.2962. As Boris Johnson made sobering comments that the UK should get ready for a no-deal Brexit, some downside risk could likely prevail in the market.

Key Levels

Resistance Levels: 1.3514, 1.3267, 1.3082

Support Levels: 1.2813, 1.2675, 1.2252

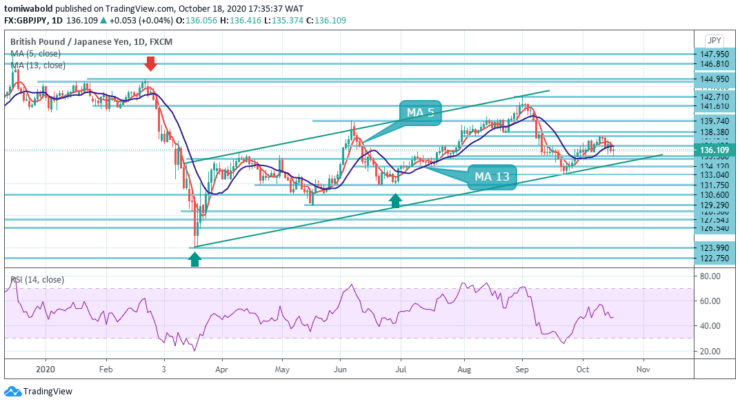

GBPUSD Long term Trend: Ranging

As seen on the daily chart, although it ended the week trading beyond the ascending trendline support retained beneath the MA 5 and MA 13, which is also directionless, as GBPUSD pair ranges. Meanwhile, the RSI has retreated near positive levels, now floating around its midline of 50.

In the wider context, the attention remains on the key resistance level of 1.3514. Continued trading beyond its moving average of 5 and 13 (now at level 1.2970) might also be the definitive breach above. Nonetheless, rejection at the 1.3514 level will at a later point sustain medium-term bearishness for another low beneath the 1.1409 level.

Last week, GBPUSD soared to 1.3082 level, but soon lost steam and turned sideways. Second, this week’s initial bias stays neutral. As long as the 1.2813 minor support level holds, the further spike may be slightly in favor. The recovery from level 1.2675 for re-testing high level 1.3482 may restart beyond level 1.3082.

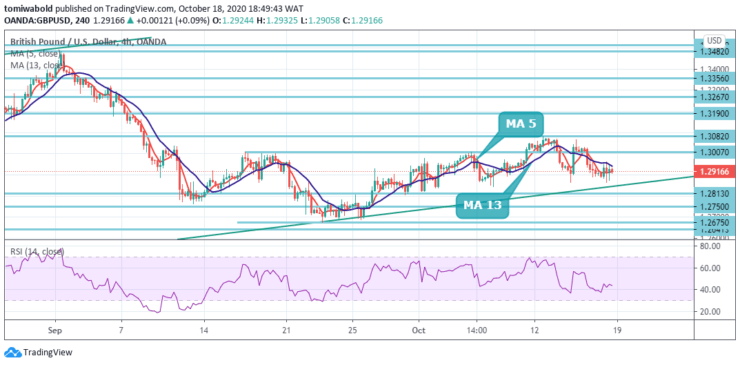

On the downside, though, the drop at the level of 1.2813 may imply that the decline from the level of 1.3482 is not over. For a 38.2 percent pullback of 1.1409 to 1.3482 at the 1.2675 level, intraday bias might be switched back to the downside. All in all, the pair is at risk of dropping on the 4-hour chart, since it closed around a slightly bullish MA 5 but beneath a bearish MA 13.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.