GBPJPY Price Analysis – October 18

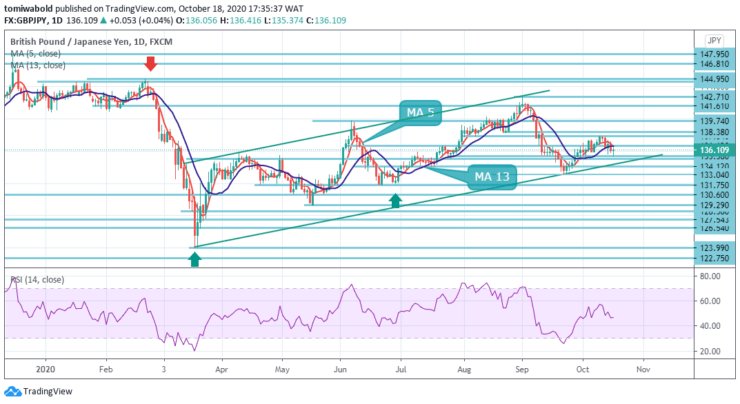

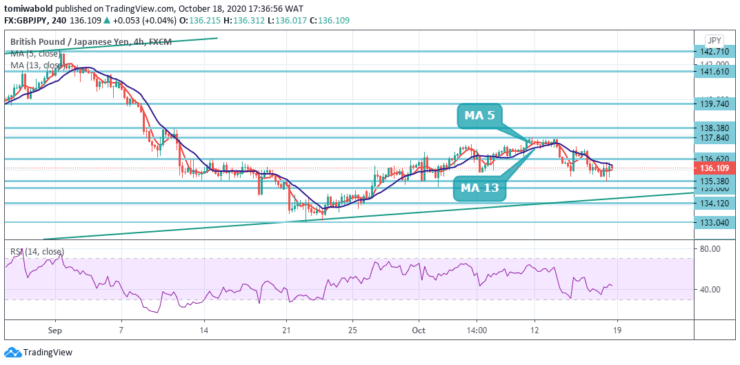

GBPJPY tends to have been capped at 136.62 level around the upside horizontal barrier after attempts to drive higher were curtailed on the daily chart by the moving average of 5 and 13. The pair is edging sideways as the trend has been taken by horizontal traction.

Key Levels

Resistance Levels: 147.95, 142.71, 137.84

Support Levels: 135.38, 133.04, 131.75

In the wider sense, the increase from the level of 123.99 is only seen as an increasing phase of the sideway consolidation trend from the level of 122.75 (low). As long as the level of resistance is 147.95, a potential downside breakout stays in support.

The weakening curves of the intersecting MA 5 and MA 13 have embraced a sideways market amid the recent bullish crossovers. Even so, the firm breach of the 147.95 marks may increase the probability of a bullish long-term reversal. For validation, the emphasis may then be switched to a 156.59 resistance level.

Last week, GBPJPY declined slightly to 135.38 but bounced back. Second, this week’s initial bias holds firm. On the upside, the recovery from level 133.04 to re-test high level 142.71 may continue beyond level 137.84. Currently, the short-term oscillators in the directional traction represent mixed signals.

On the downside, a steady break from the support level of 135.00 might well mean that the recovery from the level of 133.04 has concluded. In this scenario, the plunge from the level of 142.71 is also restarting. For the level of 133.04, and then 61.8 percent retracement from 123.99 to 142.71 at 131.75 levels, intraday bias might be turned back to the downside.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.