GBPUSD Price Analysis – December 15

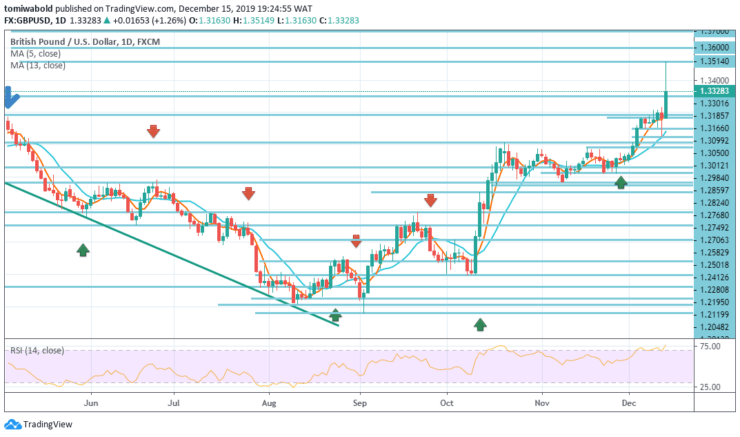

The GBPUSD pair reached 1.3514 level last Friday, a level that was last seen in May 2018, after the Conservative Party led by British Prime Minister Boris Johnson won the general elections in the United Kingdom. The pair fell all day on Friday, amid a higher dollar and profit-taking, ending the week with significant gains above the 1.3301 level.

Key Levels

Resistance Levels: 1.3700, 1.3600, 1.3514

Support Levels: 1.3050, 1.2824, 1.2195

GBPUSD Long term Trend: Bullish

In the long term direction, advance from the level at 1.1958, is viewed as a long term bottom on the right path to retest the level at 1.3700 in the near term resistance. The feedback from there may determine if it is combined from the level of 1.1958 (low).

On the other hand, a bullish breach of the level at 1.3700 might indicate a long term bullish reversal. However, for the time being, the outlook may remain bullish as long as the support level of 1.2824 remains constant.

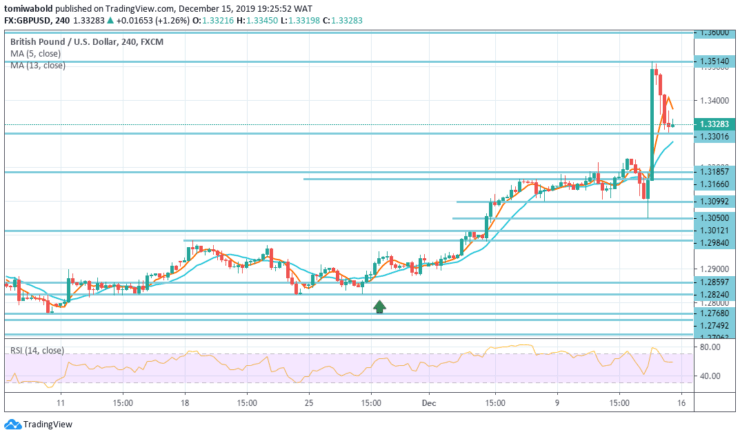

GBPUSD Short term Trend: Ranging

GBPUSD accelerated to a high of 1.3514 level last week. Given that a temporary top with a subsequent pullback is forming, the initial bias is neutral this week for consolidation first.

However, the downside may be limited above the level at 1.3050 support to bring in another high. On the upside, above the level at 1.3514, the rise could extend from the level at 1.1958 to full expectations for the level at 1.2195 to 1.3012 from 1.2824 to 1.3700 upside threshold.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.