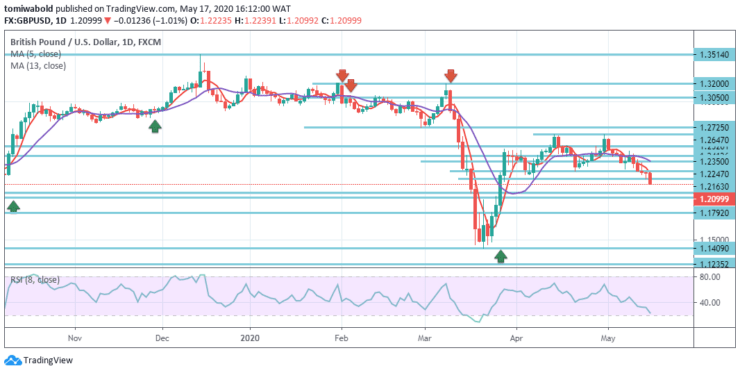

GBPUSD Price Analysis – May 17

From the previous session into the new week, GBPUSD holds in red and continues to trade under strong selling pressure towards the mid-1.2000 handle. Sterling is under severe pressure due to extended lockdown that caused record-breaking economic contraction while basing that the central bank does not consider negative rates, but has failed to point it out, offered slight support.

Key Levels

Resistance Levels: 1.3514, 1.3050, 1.2647

Support Levels: 1.2013, 1.1792, 1.1409

GBPUSD Long term Trend: Ranging

Markets predict that pound in the coming days may sink to 1.20 zone vs. USD, requiring steady slip beneath 1.2099 pivot level, which would also validate double-top at 1.2647 level.

The increasing negative traction and the daily moving average of 5 and 13 are in full bearish setup, contributing to the downward trend, as the pair is on a path for the largest weekly fall in two months. For any scenario, in case of a quick turnaround, the trend may stay bearish as long as 1.3514 resistance level holds.

GBPUSD Short term Trend: Bearish

From a technical perspective, it is possible that within the falling wedge trend in the short term, the currency pair may shift downwards. In this situation, the pair may reach the level of 1.2013. The picture is showing that the entire corrective surge from level 1.1409 has now been finished.

This week the initial bias remains on the downside for a 1.1409 low-level retest. On the bright side, the level of minor resistance above 1.2247 may first alter neutral intraday bias. And therefore the risk for yet another decrease may persist on the downside.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.