Market Analysis – March 17

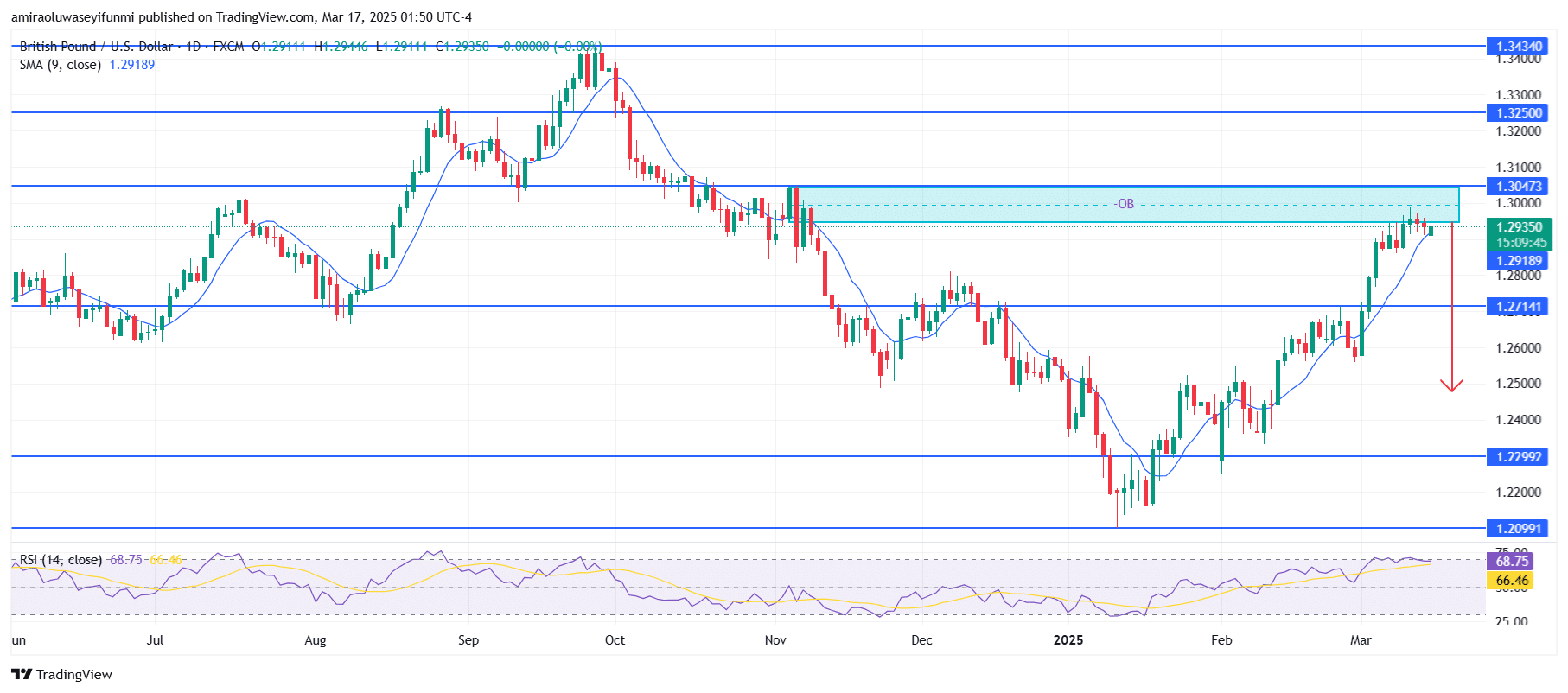

GBPUSD is poised for a significant downtrend amidst bearish signals. The Simple Moving Average (SMA) indicator (9-period) is currently positioned at $1.29190, slightly below the current price of $1.29340, indicating a potential reversal. Additionally, the Relative Strength Index (RSI) is hovering around 68.56, approaching the overbought threshold of 70, suggesting that the pair is losing upward momentum. This combination of an overextended RSI and a price trading above the SMA signals that the bullish momentum may be weakening, increasing the likelihood of a bearish correction.

GBPUSD Key Levels

Supply Levels: $1.30470, $1.32500, $1.34340

Demand Levels: $1.27140, $1.23000, $1.21000

GBPUSD Long-Term Trend: Bearish

The GBPUSD pair recently tested a key supply zone near $1.30470, which aligns with an existing order block. This area has acted as a strong resistance level, preventing further upward movement. Recent candlestick formations show rejection wicks, indicating that sellers are actively stepping in around the $1.30000 region. Furthermore, the pair has failed to establish a higher high above $1.30473, confirming a weakening bullish drive and increasing the likelihood of a sell-off.

Projections suggest that GBPUSD may experience a downward movement toward the $1.27140 support level in the near term. A decisive break below this point could accelerate the decline to $1.23000, with further downside potential extending to $1.21000 if selling pressure intensifies. The combination of a bearish rejection at resistance, overbought RSI conditions, and proximity to key technical levels strongly indicates that the market is gearing up for a sharp downturn in the coming sessions.

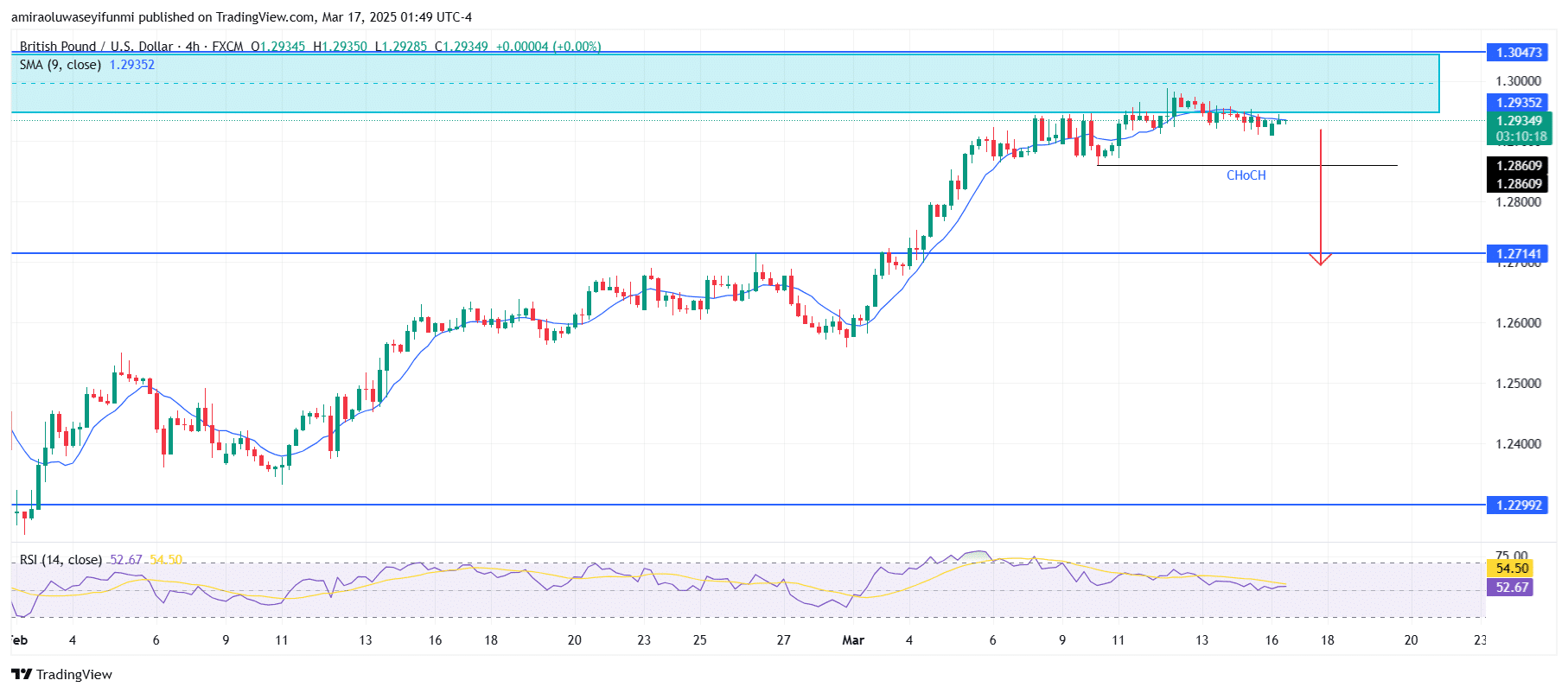

GBPUSD Short-Term Trend: Bearish

On the 4-hour chart, GBPUSD exhibits clear bearish signals after failing to break through the $1.30470 resistance zone. A Change of Character (CHoCH) near $1.28610 suggests a shift from bullish to bearish momentum. The Simple Moving Average (SMA 9) at $1.29350 is now acting as dynamic resistance, reinforcing downward pressure. If the price falls below $1.28610, a further decline toward the $1.27140 support level is likely. Traders relying on forex signals may watch for confirmation of these bearish movements to identify potential trading opportunities.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.