Market Analysis – March 3

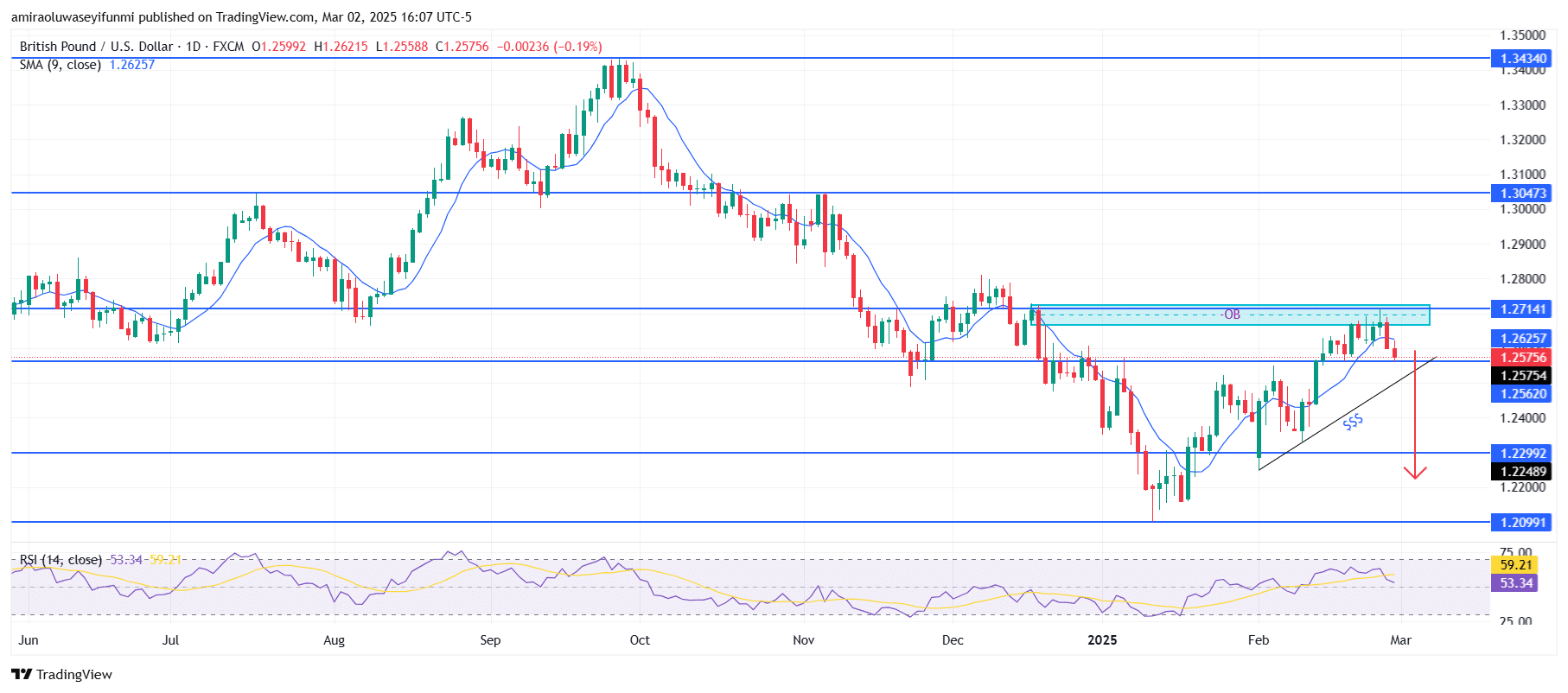

GBPUSD is exhibiting bearish pressure as it pulls back from the $1.27140 supply zone. The 9-period SMA at $1.26260 is acting as dynamic resistance, with the price struggling to stay above this level. The RSI at 59.21 is turning downward, signaling weakening bullish momentum and a possible shift in control to sellers. If RSI continues to decline toward 50, it could confirm a bearish continuation for GBPUSD.

GBPUSD Key Levels

Supply Levels: $1.27140, $1.30000, $1.34340

Demand Levels: $1.25620, $1.23000, $1.21000

GBPUSD Long-Term Trend: Bullish

Price action indicates rejection from the $1.27140 order block, a critical supply zone that has restricted upward movement. A rising trendline that previously provided support is now being tested, and a breakdown below this level could accelerate bearish momentum. Repeated rejections from the resistance zone suggest that buyers are losing strength while sellers gain control.

If GBPUSD breaks below the trendline, the next significant target is $1.23000, a strong support level. A further decline could potentially push the pair toward $1.21000 in the coming days. Traders should watch for confirmation of a trendline break and increasing bearish volume before considering short positions.

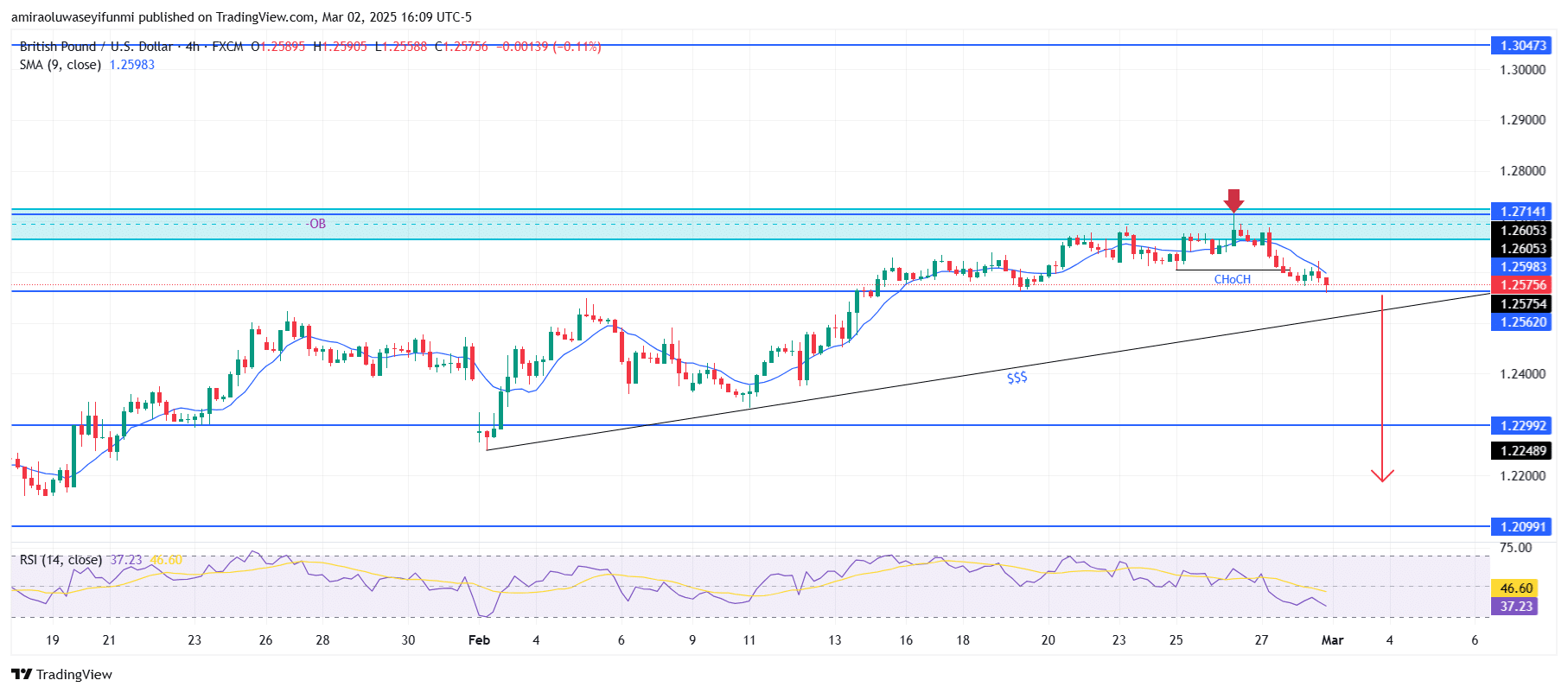

GBPUSD Short-Term Trend: Bearish

GBPUSD is displaying bearish momentum after rejecting the $1.27140 order block, confirming strong resistance. A Change of Character has occurred, signaling a shift in market structure to the downside.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.