Market Analysis – December 29

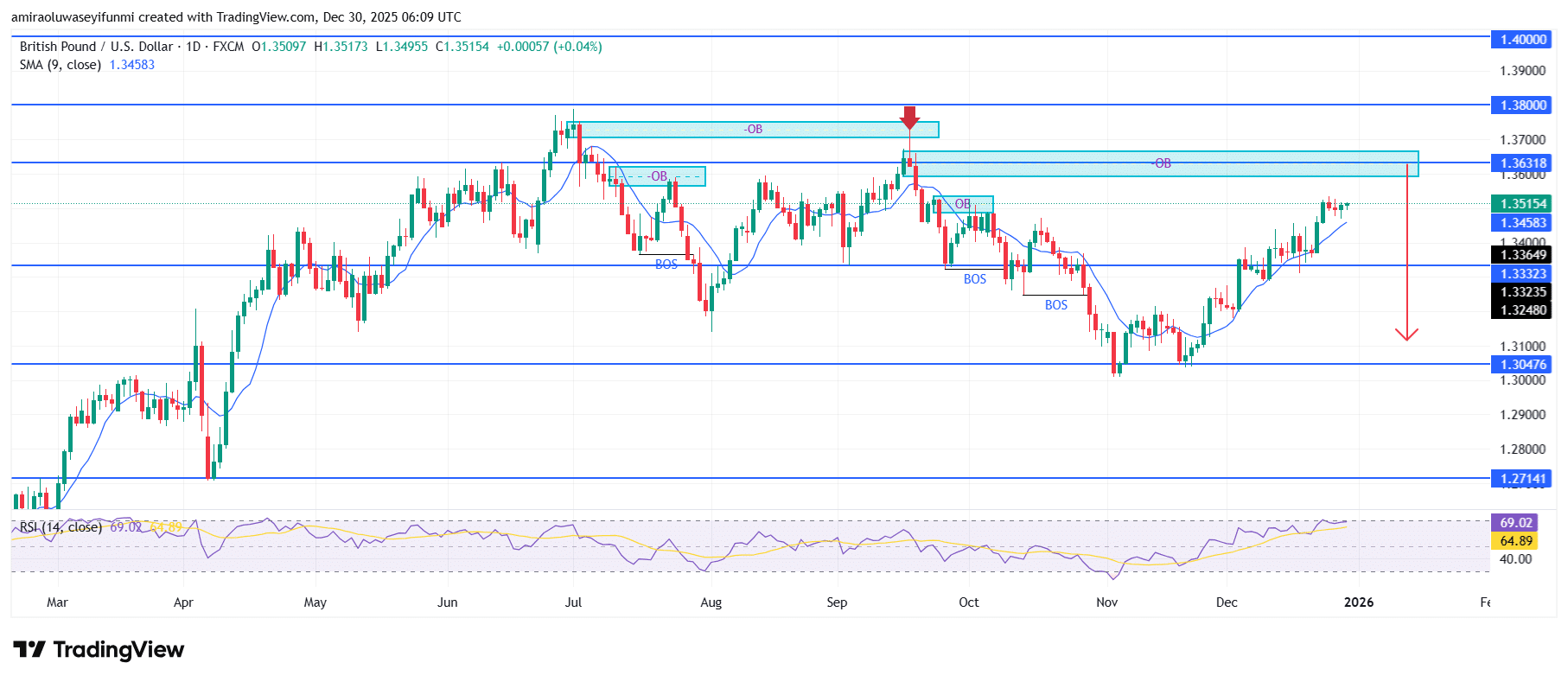

GBPUSD faces renewed bearish risk amid fading upside momentum. The GBPUSD market is displaying a cautious-to-negative tone, as recent upside attempts remain out of sync with broader momentum signals. While price is trading marginally above the short-term moving average near $1.34580, trend strength appears overstretched, with RSI hovering close to the upper threshold around 69, indicating waning upside efficiency. This indicator alignment points to late-stage bullish participation rather than fresh demand, reinforcing a market environment where sellers maintain strategic control beneath higher resistance bands.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bearish

The pair continues to respect a well-defined supply region between $1.36000 and $1.36320, where prior distribution and order block activity have capped earlier rallies. Repeated failures to secure acceptance above this zone underscore weak follow-through buying and a tendency for price to reverse after liquidity sweeps. Structurally, the market has printed successive lower highs since the September peak, while interim supports around $1.33650 and $1.33240 have been tested with increasing frequency, highlighting internal fragility despite the recent rebound.

Looking ahead, the GBPUSD market remains technically positioned for bearish continuation if price fails to sustain momentum above $1.35000. A rejection from the $1.36000–$1.36320 resistance corridor would likely open downside risk toward $1.32480 initially, followed by a deeper retracement into the $1.30480 support level. In a broader risk-off scenario, an extended move toward $1.27140 remains possible, aligning with the prevailing bearish structure often tracked within forex signals for confirmation of renewed downside pressure.

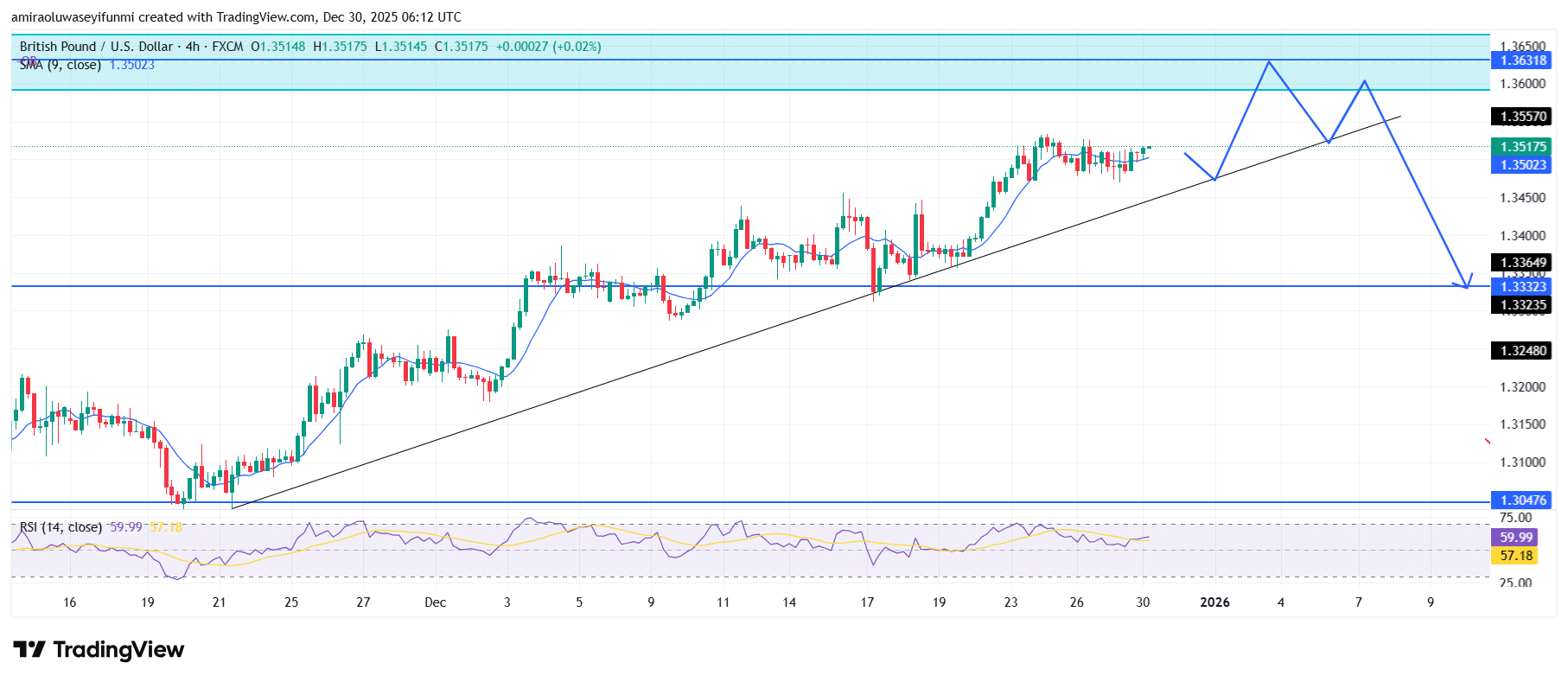

GBPUSD Short-Term Trend: Bearish

GBPUSD on the four-hour chart is showing signs of exhaustion, with price consolidating below the key supply zone around $1.36320 and momentum failing to extend meaningfully beyond recent highs. Although the pair remains above the rising trendline and the short-term moving average near $1.35020, the upside structure is weakening as RSI flattens around the mid-60 region, reflecting fading buying pressure.

Repeated rejection wicks near $1.35570 point to active distribution and a lack of sustained demand at elevated levels. A bearish rotation from this zone exposes downside risk toward $1.33650 initially, with a deeper pullback toward the $1.33320–$1.33235 area likely if trendline support gives way.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.