Market Analysis – July 11

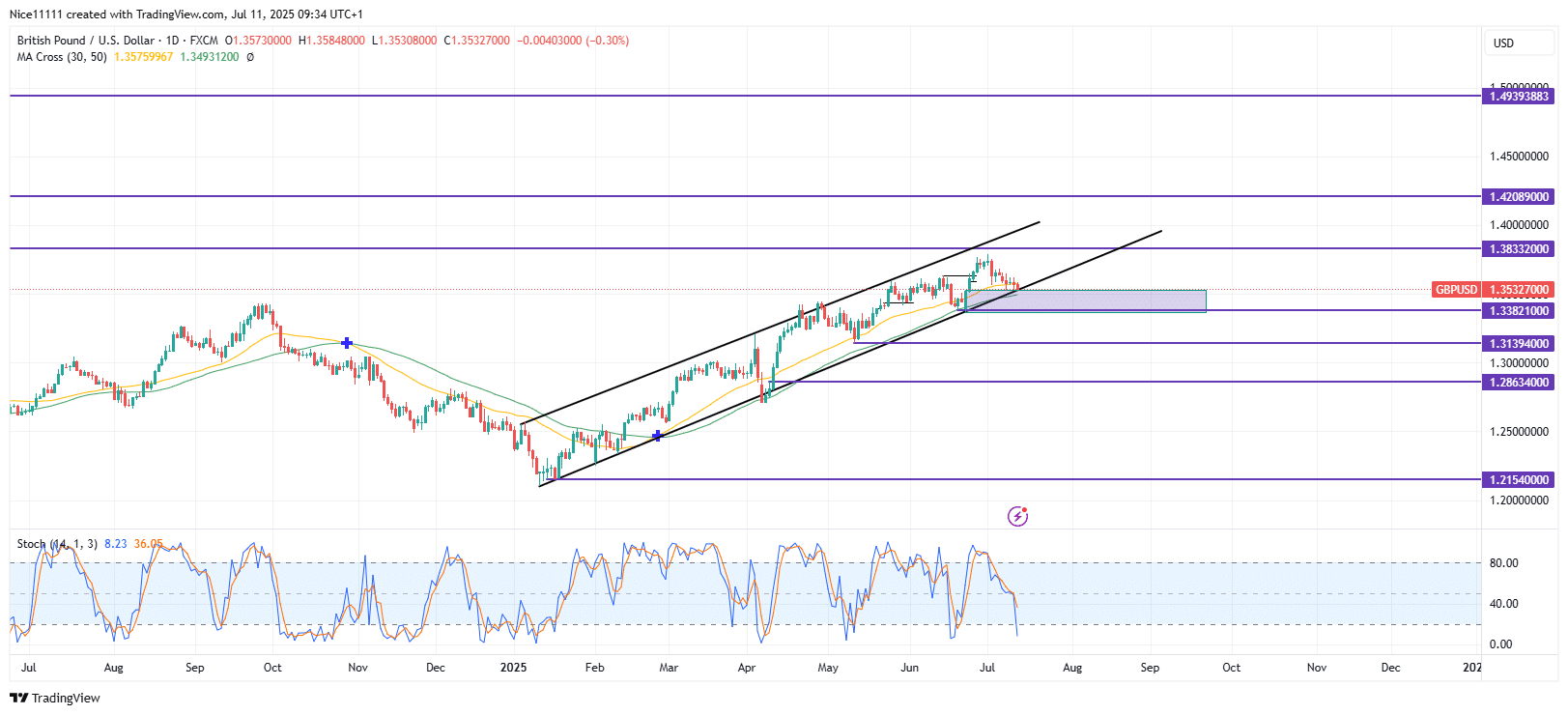

GBPUSD experienced a significant bullish reversal in January when the market reached an oversold condition. This shift marked the beginning of a broader bullish trend, characterized by impulsive moves and strong price correlations. Currently, the price action is undergoing a corrective bearish pullback within the context of this prevailing upward trend.

GBPUSD Key Levels

Demand Levels: 1.33820, 1.31390, 1.28630

Supply Levels: 1.38330, 1.42090, 1.49390

GBPUSD Long-term Trend: Bullish

The price previously declined to a critical support level at 1.21540. A bullish crossover of the Moving Averages (periods 30 and 50) in March confirmed the reversal of trend to the upside. Following this confirmation, the price ascended through a well-formed parallel channel, ultimately reaching the 1.33350 level.

The market’s most recent impulsive move peaked at 1.33350, where the Stochastic Oscillator indicated an overbought condition. This signal contributed to the formation of a swing high, prompting the ongoing retracement. The current pullback is targeting a bullish order block positioned just above the 1.33820 support level, where a potential reaction may resume the upward trend.

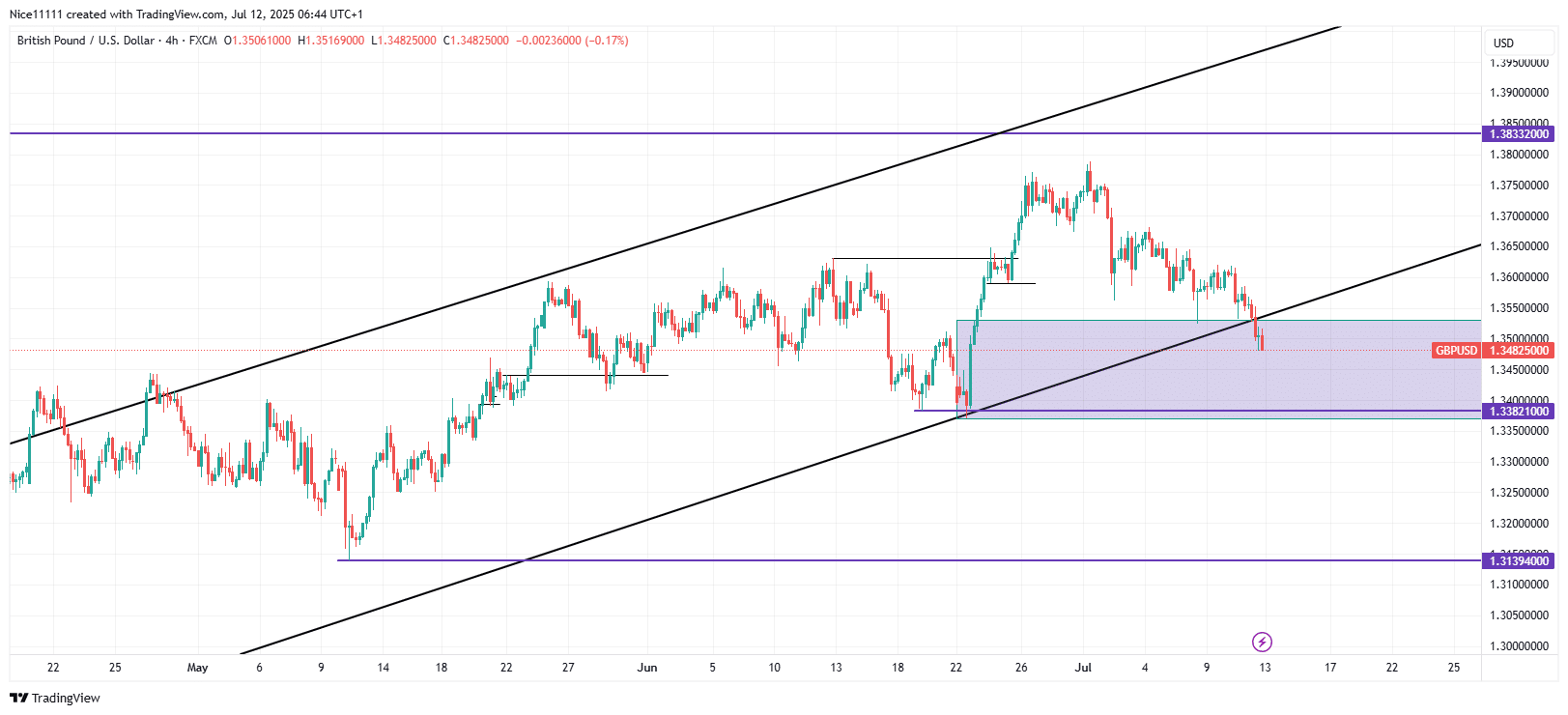

GBPUSD Short-term Trend: Bearish

On the lower timeframe, GBPUSD is currently exhibiting a short-term bearish trend. The formation of the swing high on the higher timeframe led to a shift in market structure on the 4-hour chart. This was accompanied by a bearish crossover of the Moving Averages on the same chart. Multiple bearish Breaks of Structure (BOS) are now guiding the price action toward the nearby demand zone.

A bullish shift in market structure on the lower timeframe would serve as an early indication to generate long forex signals aligning with the continuation of the bullish trend established on the higher timeframe.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.