GBPUSD Price Analysis – March 16

With the Fed’s surprise activity reminiscent of the US dollar bears, GBPUSD bounces off lows in an early attempt to rebound past the level of 1.2300 to 1.2412 and higher than 0.50 percent on Monday as it heads into open European and American session. During the early Asian session, the US Federal Reserve reported a surprise rate cut to 0.25 percent, in addition to $700 billion in Quantitative Easing (QE).

Key Levels

Resistance Levels: 1.3280, 1.2900, 1.2582

Support Levels: 1.2195, 1.2013, 1.1958

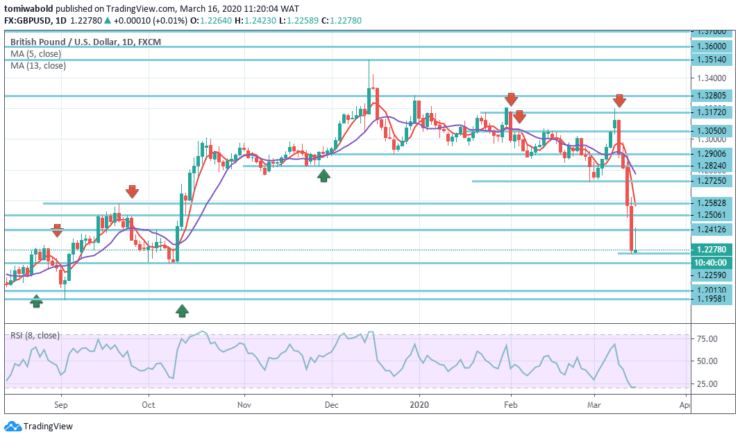

GBPUSD Long term Trend: Bearish

In the larger structure, the present scenario suggests that price actions from 1.1958 (low) level are merely a trend of consolidation, with the third leg being completed at 1.3514 level. Rejection of the level at 1.3172 by upside horizontal zone also solidifies long-term bearishness.

Focus is back on the low level of 1.1958 where there could be a definitive break with a larger downward trend of 2.1161 (high). So long so 1.3514 resistance level holds, this may remain the preferred scenario.

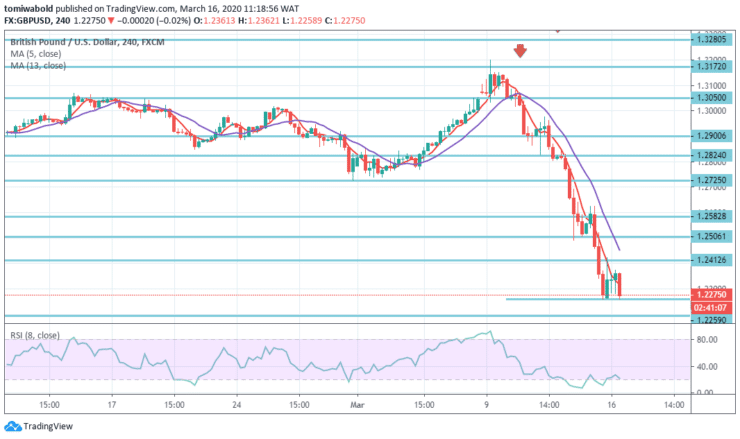

GBPUSD Short term Trend: Bearish

At the moment the intraday bias in GBPUSD remains on the downside while retesting a low level of 1.1958 can be seen as a further decline.

On the upside, past the level of 1.2490 minor resistance may first alter neutral intraday bias while further decline may be expected as long as 1.2725 support level turned resistance holds.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.