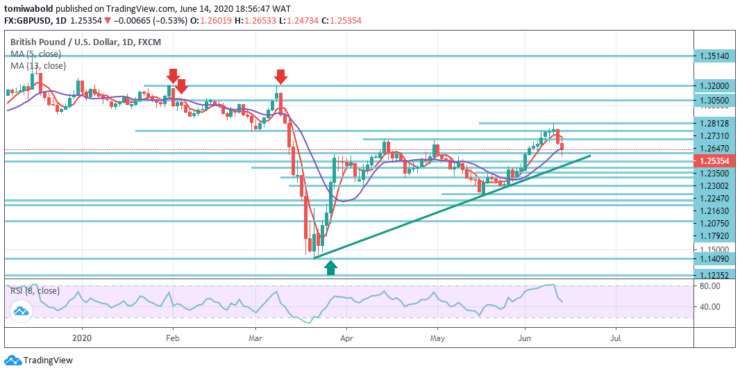

GBPUSD Price Analysis – June 14

GBPUSD appears lower as sellers ride the pair down, after a higher-level turnaround that tends to have discovered a high at the level of 1.2812. And once the mood of global risk shifts south further, cable with the UK gets entrenched in the middle of the economic recession.

Key levels

Resistance Levels: 1.3514, 1.3050, 1.2812

Support Levels: 1.2500, 1.2075, 1.1409

GBPUSD crept upward to 1.2812 level last week but established a medium-term high ahead of a forecast of 1.1409 to 1.2647 at 1.2830 levels from 1.2065 and reversed. This week’s initial bias is marginally down. The continuous breach of the ascending trendline support (now at level 1.2412) may suggest that the entire recovery from level 1.1409 has been achieved.

In this scenario, a further collapse may be seen for confirmation to the 1.2065 support level. On the positive side, the lower resistance level beyond 1.2653 may shift bias back to the upside rather than re-test level 1.2812.

Within positive levels, technical indicators ease, all of which imply softening bullish focus. The bearish potential is constrained in the shorter-term, and as per the 4-hour chart, as the pair bounced at 1.2500 from a horizontal support line on the level, while technical indicators rebounded from the over-sold RSI readings.

Nonetheless, on the flip side, the 5 and 13 moving average remains higher than the current level. For the bearish case to lose the appeal, GBPUSD may need to rebound beyond 1.2647 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.