GBPJPY Price Analysis – June 14

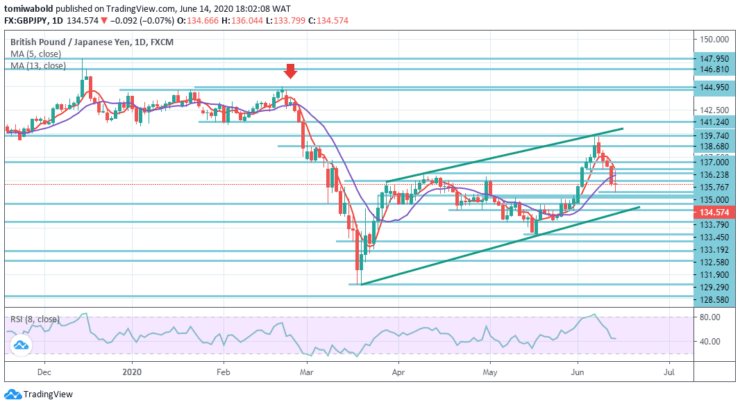

GBPJPY increases its downward trend from 140.00 area through one-week lows at 133.79 levels after the pullback attempt failed at 135.00 level. Market volatility is strengthening the yen against a weak GBP even as sterling is weakening from Brexit anxieties and negative interest rate sentiment.

Key levels

Resistance Levels: 147.95, 139.74, 135.76

Support Levels: 133.79, 129.29, 122.75

Despite sinking nearly 5 days in a row over the past week, the pair is trying to set a floor at 133.79 levels, and with the daily levels not yet over-sold leaving space for further weakness.

On the downside, additional weakening beneath the aforementioned 133.79 levels may pull the pair to 133.45 level before 133.19 levels towards the ascending trendline. On the positive side, the pair may also gain back the moving average of 13 at level 135.70, limiting bearish momentum beyond 137.00 level and elevating to level 137.35.

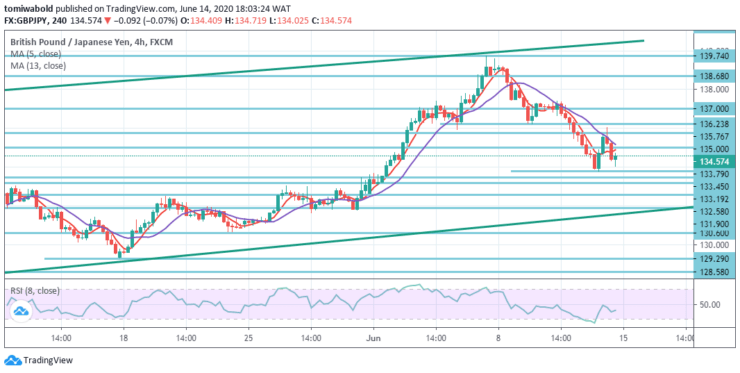

Last week’s drop in GBPJPY on the 4-hour time frame indicates a short-term topping at 139.74 level. Yet more decline is in favor this week as long as the minor level of resistance stays unchanged at 136.23 level.

Continued trading beneath moving average 5 (now at area 134.57) may claim the entire rebound from level 129.29 has been achieved.

A decline from level 139.74 would then strive for support level 129.29 to confirm this bearish scenario. On the positive side, however, beyond the level of minor resistance of 136.23 may shift bias back to the upside instead of re-testing the level of 139.74.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.