GBPJPY Price Analysis – August 9

In the prior session, GBPJPY consolidated around 138.50 marks, that said, while increasing trend patterns indicate some possible downside correction may be temporary. The Bank of England delivered Britain’s economy a remarkably positive assessment which may fuel confidence that the sector may see more trend progress this week.

Key Levels

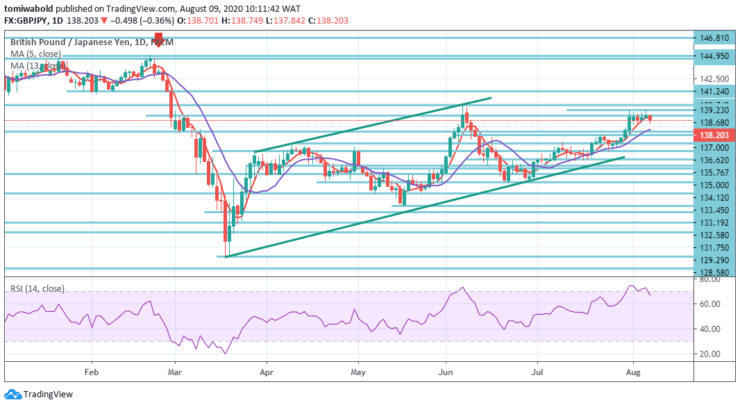

Resistance Levels: 144.95, 141.24, 139.74

Support Levels: 136.62, 131.75, 129.29

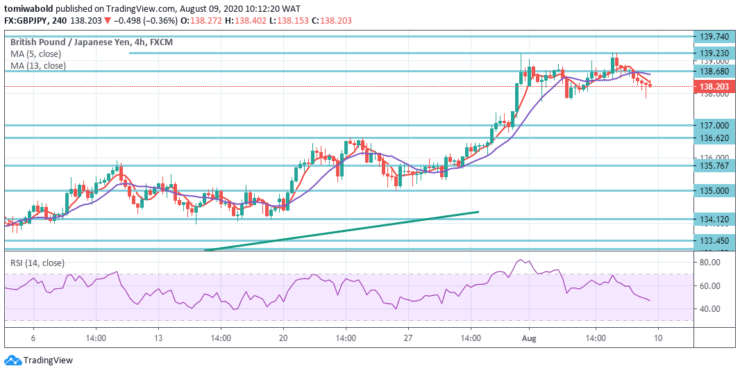

The pair is trading close to the ascending moving average of 13 support at 138.00 level, reflecting a decline of 0.36 percent, having in the prior session set a high of 138.75 level. From a viewpoint of technical analysis, 139.00 is the level for the bulls to smash. That’s because last week, the pair confronted rejection several times over that level.

As long as resistance level 147.95 holds, there is the possible downside breakout in favor. Firm breach of 147.95 level, however, may increase the risk of bullish long-term reversal. Validation of the target would then be shifted to the resistance level 156.59.

Last week GBPJPY climbed higher to 139.23 levels but reversed swiftly. First of all, the initial bias this week stays neutral. Yet more increase is in support as long as the resistance level flipped to 136.62 support stays. On the upside, a solid 139.74-level breach may restart the entire increase from the 123.99 level.

The next target would be a 100% prediction of 123.99 to 135.76 levels at 141.24 levels, from 129.29. Nevertheless, to increase the consolidation trend from 139.74 level, a steady breach of 136.62 level may turn intraday bias back to the downside.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.