GBPJPY Price Analysis – December 20

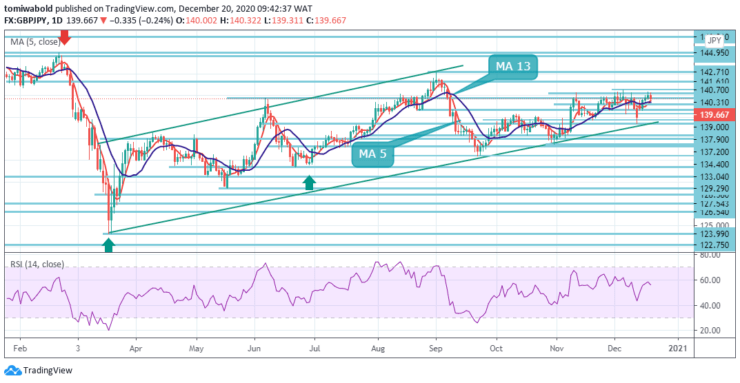

GBPJPY fell to a low of 139.31 and closed around 139.66 in the previous session. A dip below 140.31 pushed the pair to further losses as optimism about Brexit fades at the last minute. Against this backdrop, the risk tone weakens the previous upward momentum and could drop sharply in the next session.

Key Levels

Resistance Levels: 147.95, 144.95, 140.31

Support Levels: 138.38, 136.78, 134.40

Technical indicators on the daily chart have stopped gaining momentum and support the prospects for continuing sideways trading. Consequently, a subsequent move to swing lows around 136.78 remains in place and, on the other hand, another move to swing highs around 140.70 on the way to 141.00 looks very likely.

Meanwhile, any significant pullback could be seen as a buying opportunity around 139.00. Failure to protect said support will exacerbate a strong barrier near current levels and leave the GBPJPY cross vulnerable to an accelerated slide towards 138.38.

As seen in the 4-hour timeframe, the GBPJPY bounced strongly last week but failed to break through the resistance level of 140.70. Initial sentiment remains neutral this week. On the other hand, a solid breach of 140.70 could initiate a rough bounce off 133.04 to retest the high of 141.71.

On the other hand, a breach of 136.78 could initially reverse the downtrend for the 134.40 support. However, bears are less likely to enter unless they witness a clear breach beneath the ascending trendline support and confluence around 137.90.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.