GBPJPY Price Analysis – December 11

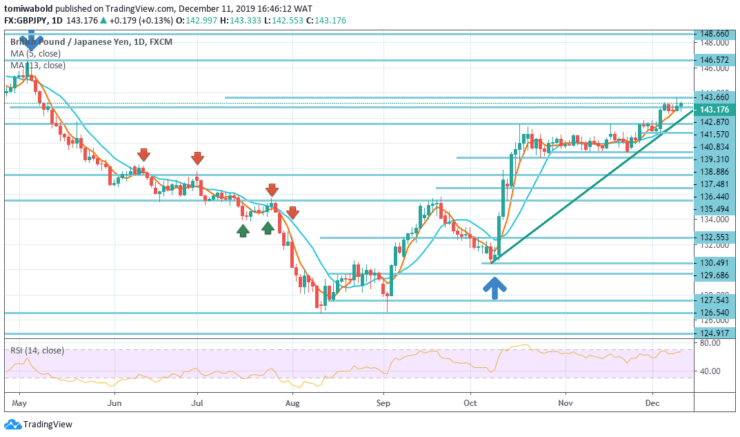

The British Pound gained slightly during the trading session on Wednesday while attempting to retest the 143.66 level after a slight plunge beneath the level at 143. We may likely continue to see this market trying to go up and get a start for the election results. The yen is among the worst-performing as it provides support to the pound sterling against the Japanese yen. Concerning the pound, it remains relatively stable before Thursday’s elections.

Key Levels

Resistance Levels: 148.66, 146.57, 143.66

Support Levels: 140.83, 135.49, 126.54

GBPJPY Long term Trend: Bullish

In the longer term, the advance from the level at 126.54 is viewed as that of consolidation structure from the level at 126.54 (low). A further advance may be recorded but for now, we expect strong resistance from the level at 148.66 to curb the upside.

As for the downside, breaking the resistance on the level at 135.49 that turned into support may suggest that this bounce has been completed. A further plunge may be recorded for a lower zone on the level at 126.54 retests. The outlook stays bullish, displaying an intact uptrend in the short, medium and long-term.

GBPJPY Short term Trend: Bullish

The GBPJPY pair advance to the level at 143.66 but retreated quickly. Its bias stays on the upside meanwhile a deeper regression cannot be ruled out. However, the downside may be contained above the level at 139.31 support to continue the resumption of the uptrend.

Notwithstanding the upside, a break of the level at 143.66 may resume the advance from the level at 126.54, where the sustained break of the horizontal resistance zone on the level at 143.66 may pave the way for the main resistance on the level at 148.66.

Instrument: GBPJPY

Order: Buy

Entry price: 142.87

Stop: 140.83

Target: 148.66

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.