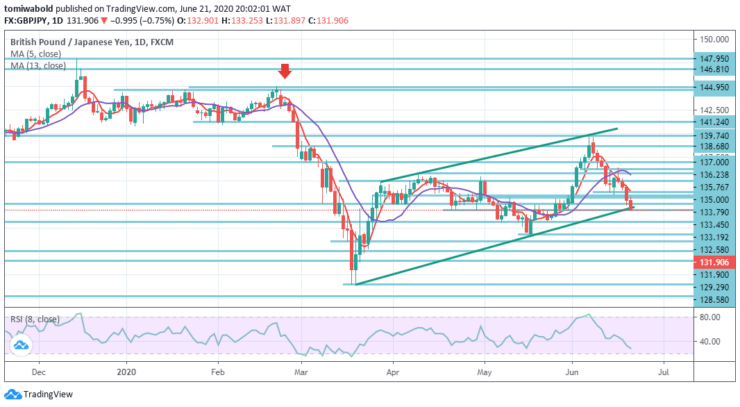

GBPJPY Price Analysis – June 21

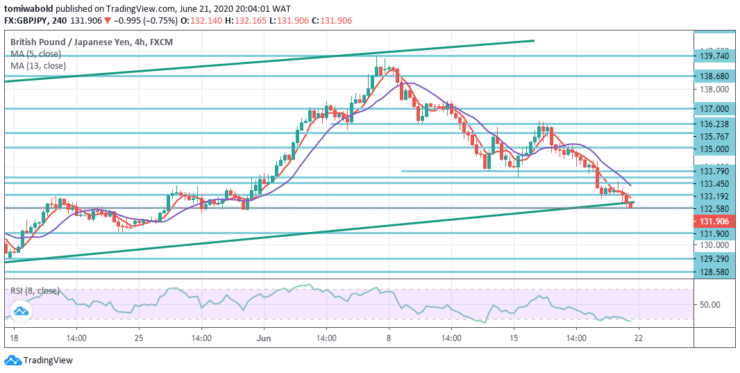

In the last session, the GBPJPY cross lost some extra ground and slipped to new monthly lows while staying beneath the 132.00 level. The collapse was supported by the strongly offered tone encircling the British pound which accompanied the last session’s policy decision by the Bank of England (BoE).

Key Level

Resistance Levels: 147.95, 139.74, 136.23

Support Levels: 129.29, 123.99, 122.75

In the wider context, we’re witnessing price actions from 122.75 (low) level, which is observed as a sideways consolidation trend. So long the resistance level of 147.95 holds, there is a potential downside breakout in support.

A strong breach of 147.95 level may however increase the risk of a long-term bullish reversal. Then the emphasis is shifted to the level of resistance of 156.59 for validation.

GBPJPY’s decline from the short term high level of 139.74 stretched to as low as last week’s level of 131.90. A recent trend implies a corrective recovery from level 123.99 has been accomplished with 3 phases to level 139.74. This week’s initial bias stays on the downside with support level 129.29.

A strong breach there will affirm this bearish scenario and open the way for low-level retests of 123.99. On the positive side, to signify the finalization of the collapse, a breakage of 136.23 minor resistance level is required. Alternatively, in the circumstance of recovery, further collapse is anticipated.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.