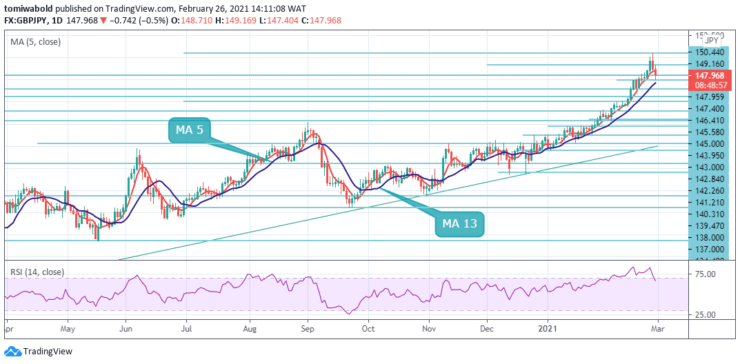

GBPJPY Price Analysis – February 26

The GBPJPY exchange rate has declined to the 147.40 low level. It is unlikely that some upside potential could prevail in the market due to the seller pressures as the pair aligns while indicating a significant correction. The Japanese Yen rides on the turn-in risk sentiments and rebounded after positive data from BoJ.

Key Level

Resistance Levels: 151.80, 150.44, 149.16

Support Levels: 147.40, 146.41, 145.58

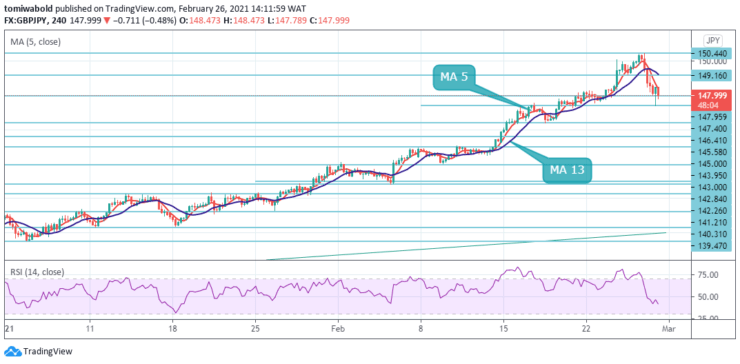

In the meantime, note that the currency pair could gain support from the moving average 13 support at 147.20 level. Thus, the pair could rebound and approach the predetermined resistance around 149.16 level in the coming session. On the lower end, the rate could target the psychological level at 146.81 level.

An increase from the 123.99 level is seen as the third phase of the consolidation from the 122.75 (low) level. With 147.95 resistance level flipped, a further ma is seen to 156.59 resistance (high) level. The continuous breach there may validate long-term bullish trend reversal. On the downside, breach of 142.84 resistance altered support is required to be the initial sign of completion of the advance from 123.9 level.

The Intraday bias in GBPJPY is altered slightly bearish with an immediate steep decline. However, some range-trading could be seen beneath the 150.44 temporary high. A continuous increase is yet anticipated for as long as 142.84 resistance turned support level holds intact.

The breach of 141.21 may approach the 100% forecast of 123.99 to 142.71 from 133.03 at 151.80 levels next. In the near term, support awaits at 147.40, the 4 hours low, and then by 146.41 level. On the upside the resistance is at the 149.16 level, followed by 150.44, the weekly high.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.