GBPJPY Price Analysis – September 20

The GBPJPY cross edged lower during the prior trading session and was last seen hovering near lows, just around 135.00 level. A strong pickup in demand for the safe-haven JPY was seen as a key factor exerting pressure. The JPY was further supported by the Bank of Japan’s less gloomy view on the economy following the latest monetary policy update.

Key levels

Resistance Levels: 147.95, 142.71, 138.38

Support Levels: 134.12, 131.75, 129.29

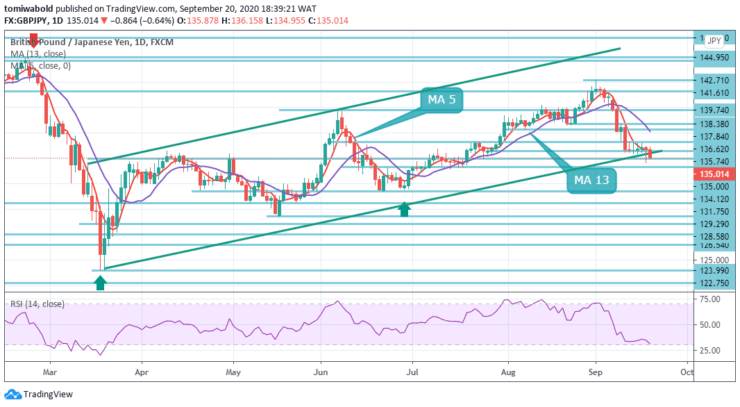

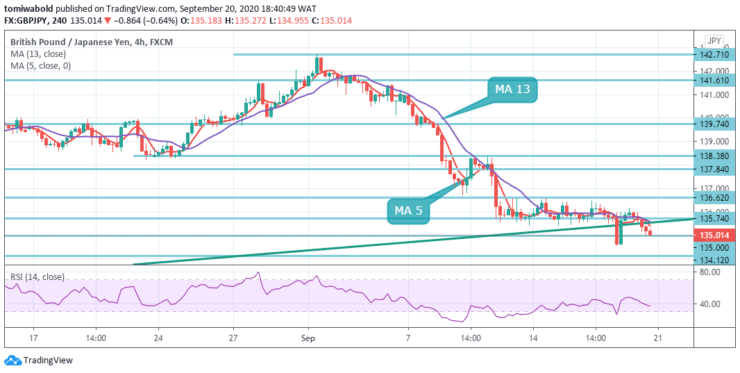

From a technical perspective, the end of week plunge validated a near-term bearish break through the ascending trendline range. This combined with the pair’s struggle to achieve any tangible traction support potentials for a further near-term depreciating move.

Therefore, a corresponding retreat well below the main psychological mark of 135.00, swinging low in the last week, around the region of 134.55, currently appears a high possibility. As long as the level of resistance is 147.95, an inevitable downside breakout stays in support.

GBPJPY ‘s fall from level 142.71 continued last week and the progression now claims that the entire 123.99-level recovery is over. For the 61.8 percent retracement of 123.99 to 142.71 at 131.75 levels, the initial bias persists on the downside this week.

On the upside, the lower resistance level beyond 136.62 may transform neutral bias and offer consolidations, before another decline is triggered. Similarly, the short-term bias stays overwhelmingly bearish, as the RSI has a negative slope to endure.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.