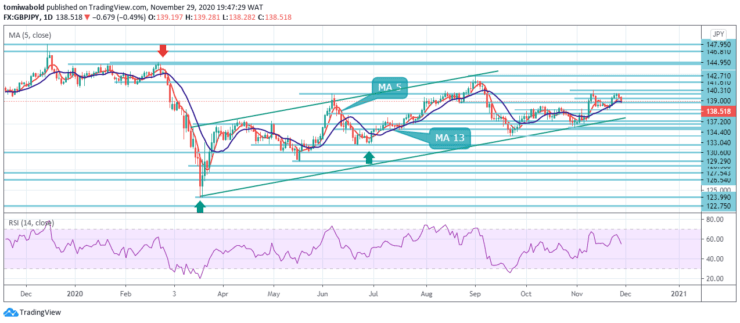

GBPJPY Price Analysis – November 29

GBPJPY is faced with sellers’ pressure as it stays depressed beneath the 139.00 level and ended the prior session at the lows around the 138.28 regions. The pair dumps after being weighed by the ongoing uncertainty about the Brexit negotiations adding negative pressure to the pound sterling.

Key Levels

Resistance Levels: 142.71, 140.31, 139.74

Support Levels: 138.38, 137.50, 134.40

GBPJPY Long term Trend: Ranging

As seen in the daily chart, the pair bounced off the support at 138.38 on the horizontal line from November 9th. The 138.00 and 137.20 levels (Nov 19 low) may be in focus below. On the other hand, immediate resistance is at 139.74 and above, at 140.31 (Nov 11 high).

In a longer-term context, a deviation from the resistance area at 140.00 indicates a long-term bearish trend in the cross. However, a sustained breakout of the 143.31 resistance level would weaken this view and could open further gains to 144.95 (February 2020 high).

GBPJPY Short term Trend: Ranging

GBPJPY rebounded strongly in the previous week but failed to break the 140.31 resistance level. The short-term trend is mixed and the initial bias remains neutral this week. On the other hand, a break of 140.31 could resume the general bounce from 133.04 and target the 142.71 high.

On the other hand, a break of the 137.20 level could indicate that the trend from 142.71 is starting a new phase of decline. Intraday drift could shift back downward towards support at 134.40 and possibly lower.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.