GBPJPY Price Analysis – November 18

GBPJPY extends recovery from 137.84 level to around 138.05 level during the European session on Wednesday. Although the GBPJPY buyers’ anticipation of a Brexit deal, cautious sentiment ahead of October’s UK CPI, and the coronavirus (COVID-19) woes push for the immediate upside momentum.

Key levels

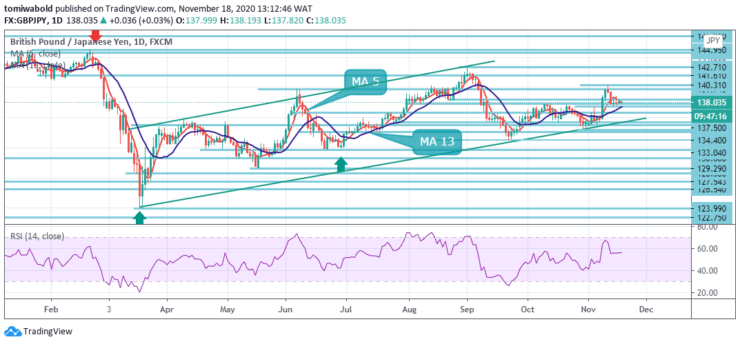

Resistance Levels: 144.95, 142.71, 140.31

Support Levels: 137.50, 134.40, 131.75

The technical context of the GBPJPY trade looks extremely well-positioned for another push higher into the mid 138.00 level. The 138 level was a major resistance level on the way up from the 134.00 level and now that it has broken the 138 level we expect this to act as a strong support zone.

In the long term, an increase from the 123.99 level is seen only as a rising phase of the sideway consolidation trend from the 122.75 (low) level. As long as the 147.95 resistance level holds, an eventual downside breakout remains in favor. However, a firm break of the 147.95 level will raise the chance of long term bullish reversal.

No change in GBPJPY’s outlook and intraday bias stays in a range. On the upside, a break of 140.31 level will resume the rebound from 133.04 level to retest 142.71 high level. Nevertheless, a sustained break of 137.84 resistance turned support level will argue that the rebound has been completed.

Intraday bias will be turned back to the downside for 133.04/134.40 support zone. GBPJPY sellers stay directed towards revisiting prior lows, meanwhile, a clear upside break of the immediate resistance line will escalate the latest recovery moves toward the 139.74 levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.