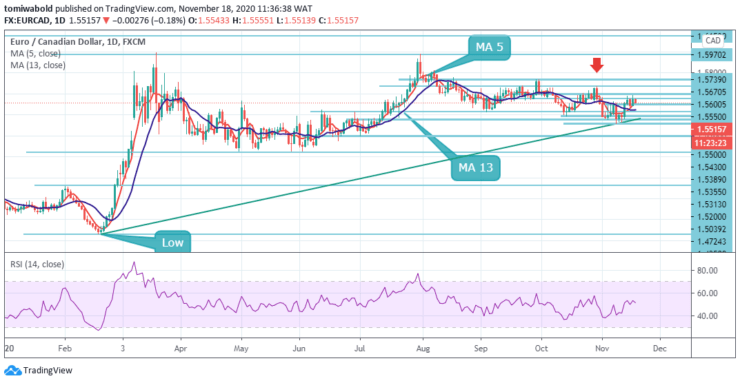

EURCAD Price Analysis – November 18

The common European currency has surged by 11 pips or 0.83% against the Canadian Dollar since the day’s start. The EURCAD pair tested the upper channel and breached beyond the horizontal barrier at 1.1550 level. Euro’s recent strength is also worth a note, while CAD is partly weighed down by crude oil’s decline.

Key Levels

Resistance Levels: 1.5970, 1.5739, 1.5600

Support Levels: 1.5500, 1.5313, 1.5200

As observed on a daily the forex pair shows strength in the near-term supported by its long-term uptrend returning to a 1.5970 high level. Given that the exchange rate has breached the resistance level at 1.5550, bullish traders might continue to pressure the EURCAD pair higher during the following trading sessions.

In the larger context, the decline from the 1.5739 level is seen as the third phase of the corrective pattern from the 1.5970 (high) level. But we’d expect a loss of downside momentum as it approaches this key support at the 1.5500 level. On the upside, a firm break of 1.5600 resistance level is needed to indicate medium term bottoming. Otherwise, the outlook will remain in consolidation in case of rebound.

The intraday bias in EURCAD is staying in a range for the moment. Another rise could be seen beyond moving average 5 (now at 1.5550 level) and above. Still, the near-term outlook remains in a range as long as the 1.5600 resistance level holds, and downtrend resumption is expected.

On the downside, a break of 1.5500 minor support level may shift bias to the downside for retesting 1.5313 low level. Technical indicators flash sell signals on the 4-hour time-frame chart. Most likely, bears are likely to pressure the exchange rate lower within this week’s trading sessions.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.