GBPJPY Price Analysis – October 28

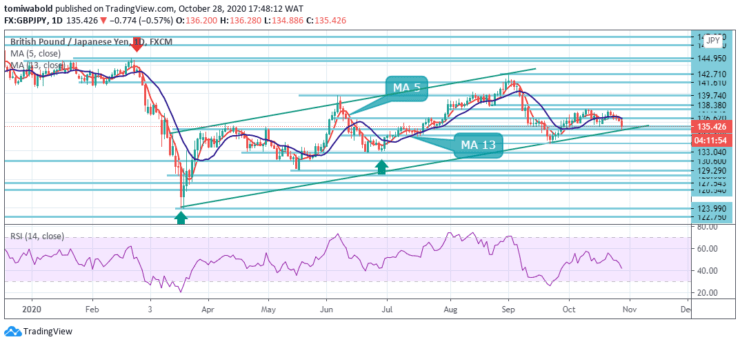

The GBPJPY cross has come under fresh selling bias during the American session and plunged to 14 days low beneath the 135.00 level. Persistent Brexit-related concerns add to selling bias while keeping the GBP lower forcing investors to take refuge in the safe-haven Japanese yen.

Key Levels

Resistance levels: 144.95, 138.38, 136.62

Support levels: 133.04, 131.75, 129.29

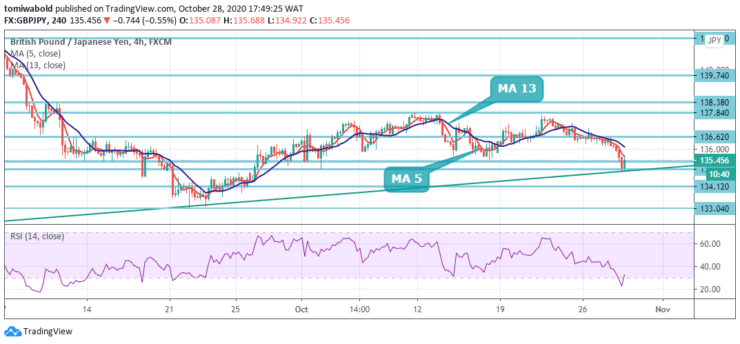

GBPJPY reversed from daily highs around 136.28 and fell below support at 135.00. GBPJPY showed some stability near the very important ascending trendline support and made a brilliant bounce off the 134.88 marks. Despite the decline in GBPJPY, it still managed to maintain a modest gain, around 135.00/135.60 level.

In a broader context, the rise from 123.99 is seen only as an upward phase of the consolidation sideways trend from 122.75 (low). As long as the resistance level of 144.95 remains, a possible downside breakout remains in favor. However, a solid break of the 144.95 level would increase the likelihood of a long-term bullish reversal. Attention will then be drawn to the 147.95 resistance level for a re-attempt.

A break of the GBPJPY support level of 135.38 suggests that the recovery from 133.04 is complete. Perhaps the corrective fall from 142.71 is about to resume. Intraday bias initially turned towards 133.04 low support.

A break would confirm and target a 61.8% recovery from 123.99 to 142.71 at 131.75. On the other hand, the minor resistance levels at 136.62 will retrace the uptrend to the resistance level at 137.84. Meanwhile, the short-term oscillators are currently showing momentum that is far from effective as the 4-hour bearish RSI returns, pointing up.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.