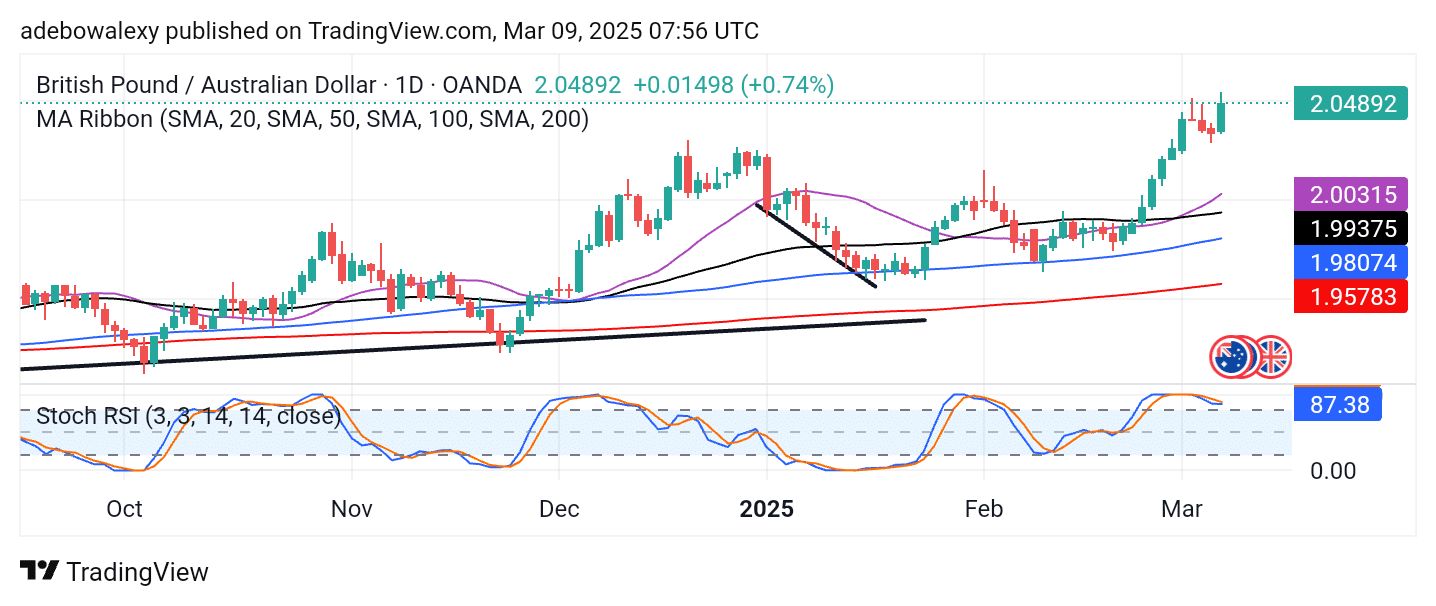

The GBPAUD market has maintained an upward trajectory since last year, largely supported by the weaker performance of the Australian economy. The previous week’s closing session ended in the green on the daily chart, reinforcing the bullish trend. However, the new week introduces key fundamental data releases, which could influence the future price direction depending on their outcomes.

Key Price Levels

Resistance Levels: 2.0500, 2.1000, 2.1500

Support Levels: 2.0000, 1.9500, 1.9000

GBPAUD Bulls Stay Strong Despite Contractions

Price action in the GBPAUD market surged on Friday, but a subsequent retracement followed, as indicated by the downward contraction in the last price candle on the chart. Despite this minor pullback, price action remains above all Moving Average (MA) lines.

Additionally, the Stochastic Relative Strength Index (Stochastic RSI) bounced off the 100 mark and is now forming another upside crossover in the overbought region.

Technically, bullish momentum still appears strong, suggesting that price action may continue toward higher levels.

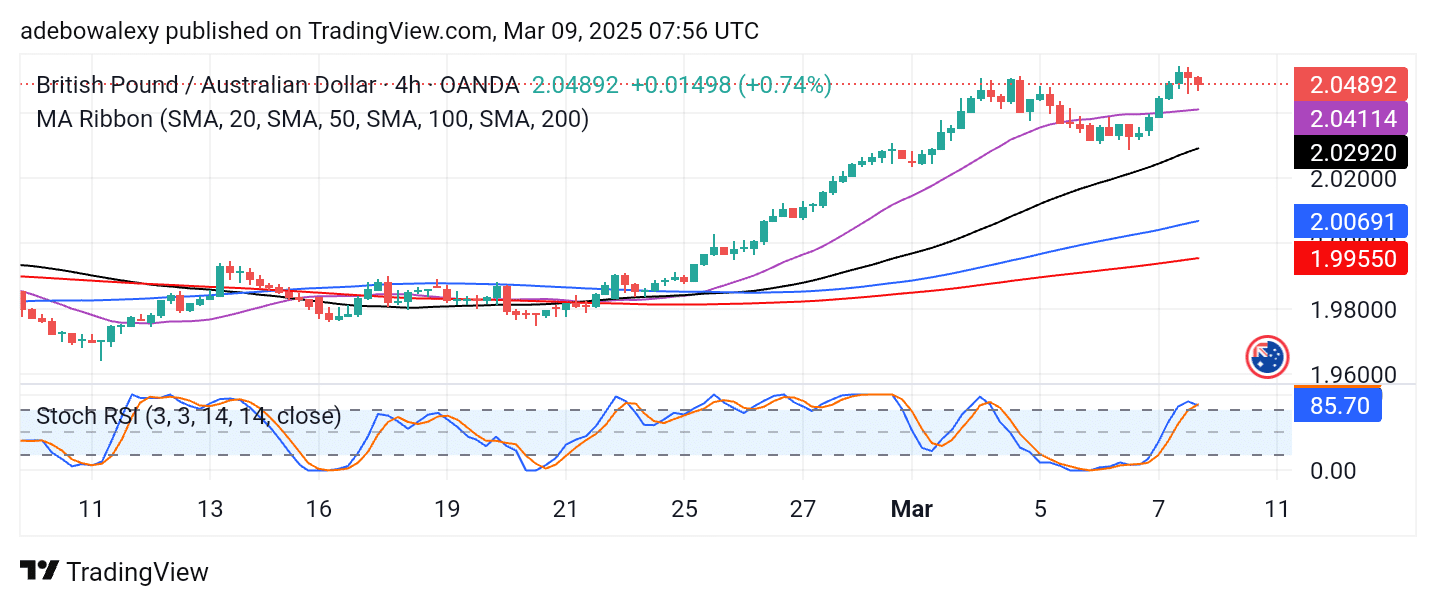

GBPAUD Sees a Slight Downward Retracement

Although the GBPAUD market remains above all MA lines, price action has experienced a slight downward retracement. This pullback has lasted two sessions on the 4-hour chart, confirming the contraction seen in the last price candle on the daily chart.

Despite this, the Stochastic RSI lines remain projected upward into the overbought region, even as the indicator lines begin to converge.

That said, bullish momentum still holds, as price action remains in positive territory. Therefore, traders should monitor key upcoming data releases, including the Westpac Consumer Confidence, NAB Business Confidence, and UK GDP (MoM) reports.

If bullish momentum persists, the next key price target stands at the 2.0600 level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.