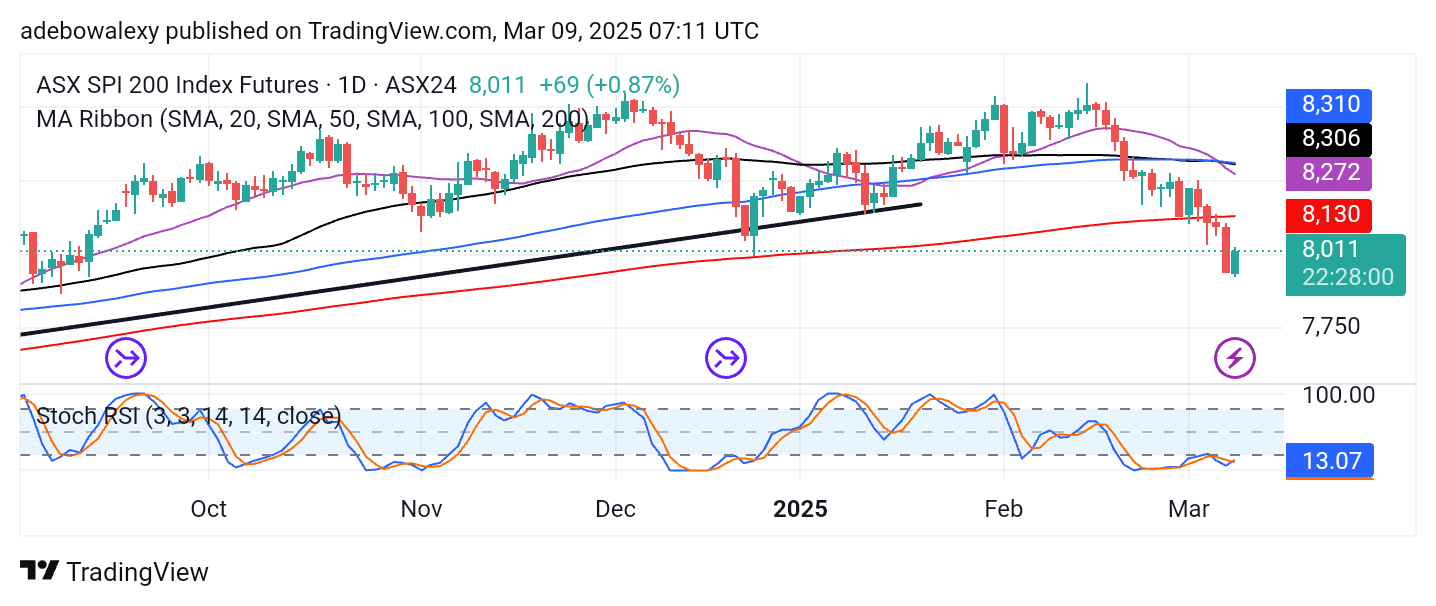

Australian stocks have dropped to a six-month low, with a downtrend that began over two weeks ago. The Australia 200 market has seen a sustained bearish streak, largely driven by massive sell-off pressure from banks. However, by the end of the week, the market slightly rebounded, raising questions about its next move.

Key Price Levels

Resistance Levels: 8,200, 8,400, 8,600

Support Levels: 8,000, 7,800, 7,600

Australia 200 Stays Vulnerable Despite Rebounding

On Friday, the ASX 200 market saw an upward rebound. On smaller timeframes, the market appeared to maintain this trajectory until the close of the day. However, this rebound was not particularly significant, as similar recoveries have been observed before, only for the market to resume its downward correction.

On the daily chart, price action remains below all Moving Average (MA) lines. Additionally, the Stochastic Relative Strength Index (Stochastic RSI) has delivered an upward crossover, yet its lines are still deep in the oversold region.

Technically, this suggests that while a short-term upward movement is possible, the market has not fully escaped bearish pressures. As a result, bullish traders should tread carefully.

ASX 200 Upside Retracement Eyes a Key Technical Mark

The Australia 200 market continues to approach the 20-day MA line. The latest price candle on the chart indicates a significant boost in the closing session. However, price action remains below all MA lines.

Meanwhile, the Stochastic RSI lines are advancing toward the 50 level, signaling a gradual increase in bullish momentum. The smooth upward movement of the Stochastic RSI suggests a steady strengthening of buying pressure.

As a result, while bullish traders may consider entering early, they should limit positions to short-term trades around the 8,150 level, at least until price action decisively moves past the 20-day MA line.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.