The GBPAUD market has edged higher over the past week. However, this appears to be primarily due to weakness in the Australian economy, while the UK maintains a stable outlook. As a result, the pair climbed above the 2.0000 price level. On Friday, the market experienced a major setback as the AUD strengthened following gold’s surge to a new record high. Let’s take a closer look at this market below.

Key Price Levels

Resistance Levels: 2.0500, 2.1000, 2.1500

Support Levels: 2.0000, 1.9500, 1.9000

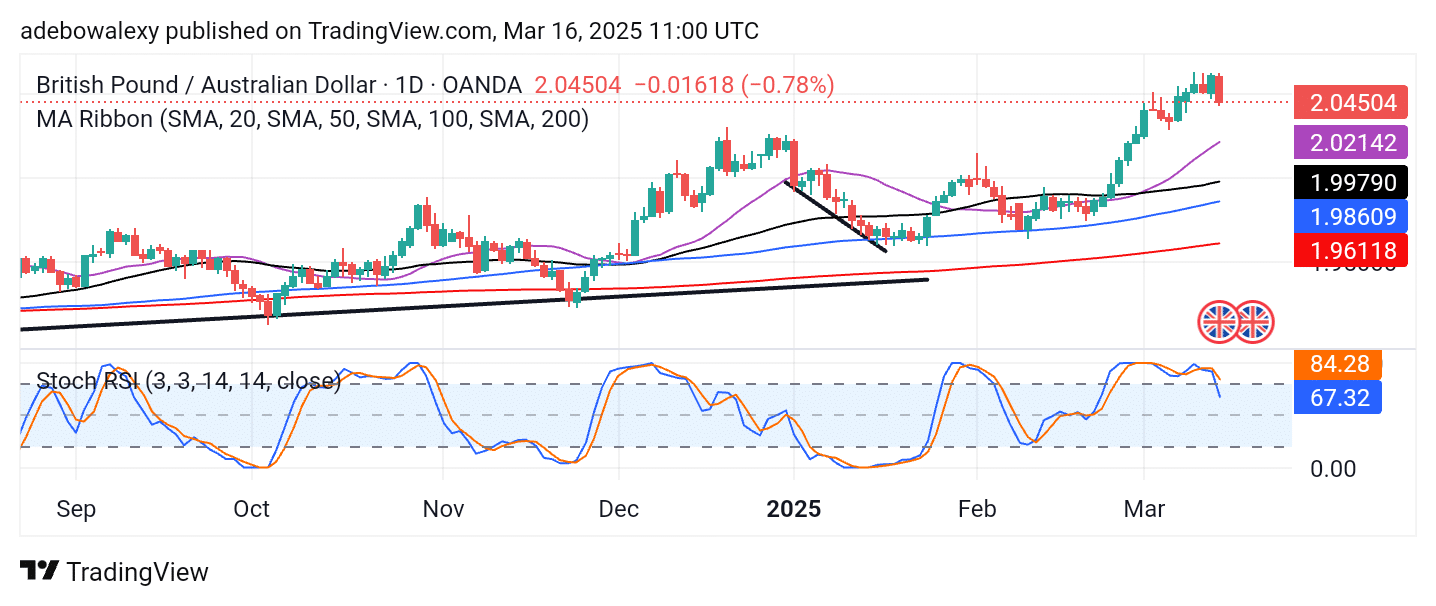

GBPAUD Retreats Below the 2.0500 Price Level

While the GBPAUD market has maintained a general upward trajectory, Friday’s trading session introduced a significant setback to the ongoing upside correction. The last price candle on the chart is a solid red, signaling a dip below the 2.0500 threshold. This effectively erases all the gains accumulated in the previous days of the week.

Despite this, price action remains above all the Moving Average (MA) lines. Meanwhile, the Stochastic Relative Strength Index (RSI) lines have dipped below the 80 level, indicating a weakening bullish momentum. From a broader perspective, the upside retracement may continue, as price action still has the necessary technical support.

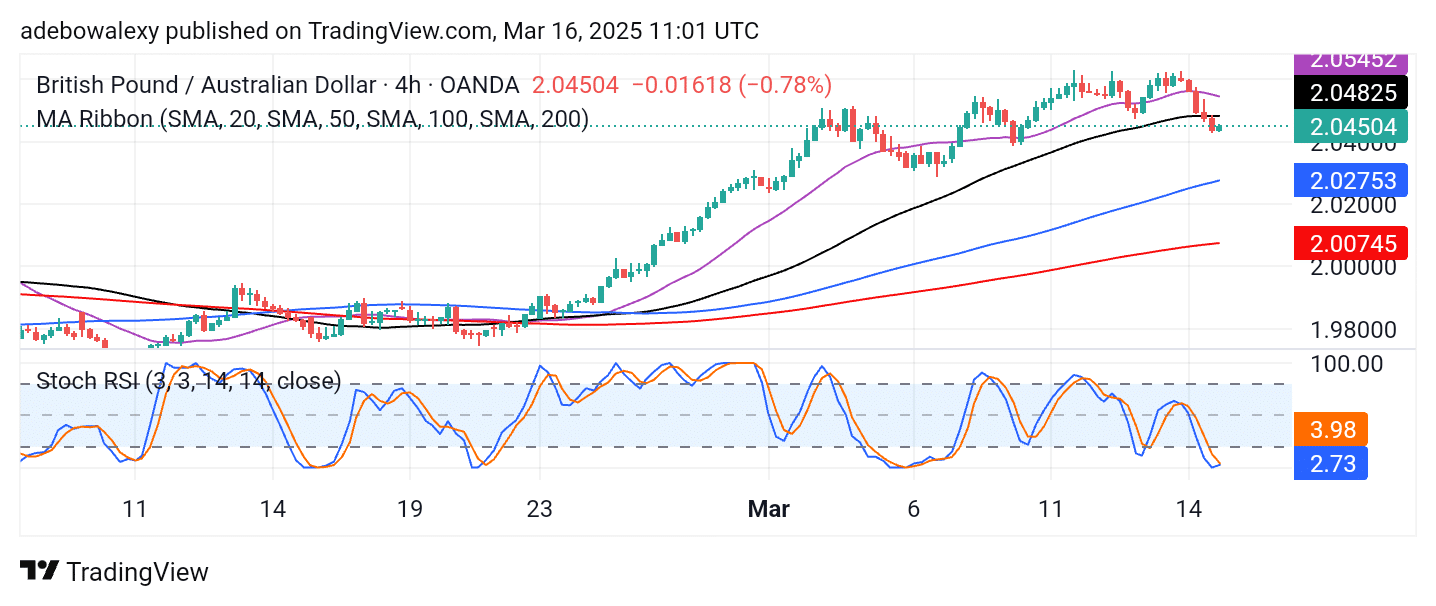

GBPAUD Bulls Make an Effort to Retain the 2.0400 Baseline

The 4-hour chart of the GBPAUD market reveals that bullish forces are attempting to keep price action afloat above the 2.0400 psychological level. The last price candle on the chart is green, although relatively small. Nonetheless, it appears to have temporarily halted the downward retracement toward the 2.0400 price mark.

Additionally, the Stochastic RSI lines are converging in the oversold region, suggesting the potential for an upward rebound. Given these technical indicators, a price recovery from this level seems likely. However, traders should closely monitor upcoming UK interest rate and unemployment data, as these could significantly impact price dynamics.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.