Market Analysis – December 19

The GBP/JPY pair is enjoying a strong bullish run today, with price action opening around the 208.00 mark before pushing convincingly above 210.00. The move suggests that traders are largely aligned on the upside, as buying interest remains firm across the session. This surge is not happening in isolation; it reflects growing confidence in the Pound relative to the Yen.

Much of the momentum can be traced back to the widening policy gap between the Bank of Japan and the Bank of England. While the BoJ recently raised interest rates by 25 basis points to 0.75—the highest level seen in nearly 30 years—the move was largely viewed as cautious and defensive, aimed at tackling inflation rather than tightening aggressively. On the other hand, the Bank of England delivered what markets described as a “hawkish cut,” trimming rates but maintaining a firm stance on inflation risks. After some initial volatility, this stance ultimately helped stabilize and support the Pound.

At the heart of the GBP/JPY rally is the still-wide interest rate gap between the UK and Japan. Investors continue to favor the higher-yielding Pound, using the Yen as a funding currency in classic carry-trade strategies. Crucially, the BoJ’s latest decision has done little to convince markets that this gap will narrow anytime soon, allowing bullish sentiment in GBP/JPY to remain firmly in place.

GBP/JPY Key Levels

Supply Levels: 212, 214, 216

Demand Levels: 208, 207, 206

The GBP/JPY Pair Surges Above 210

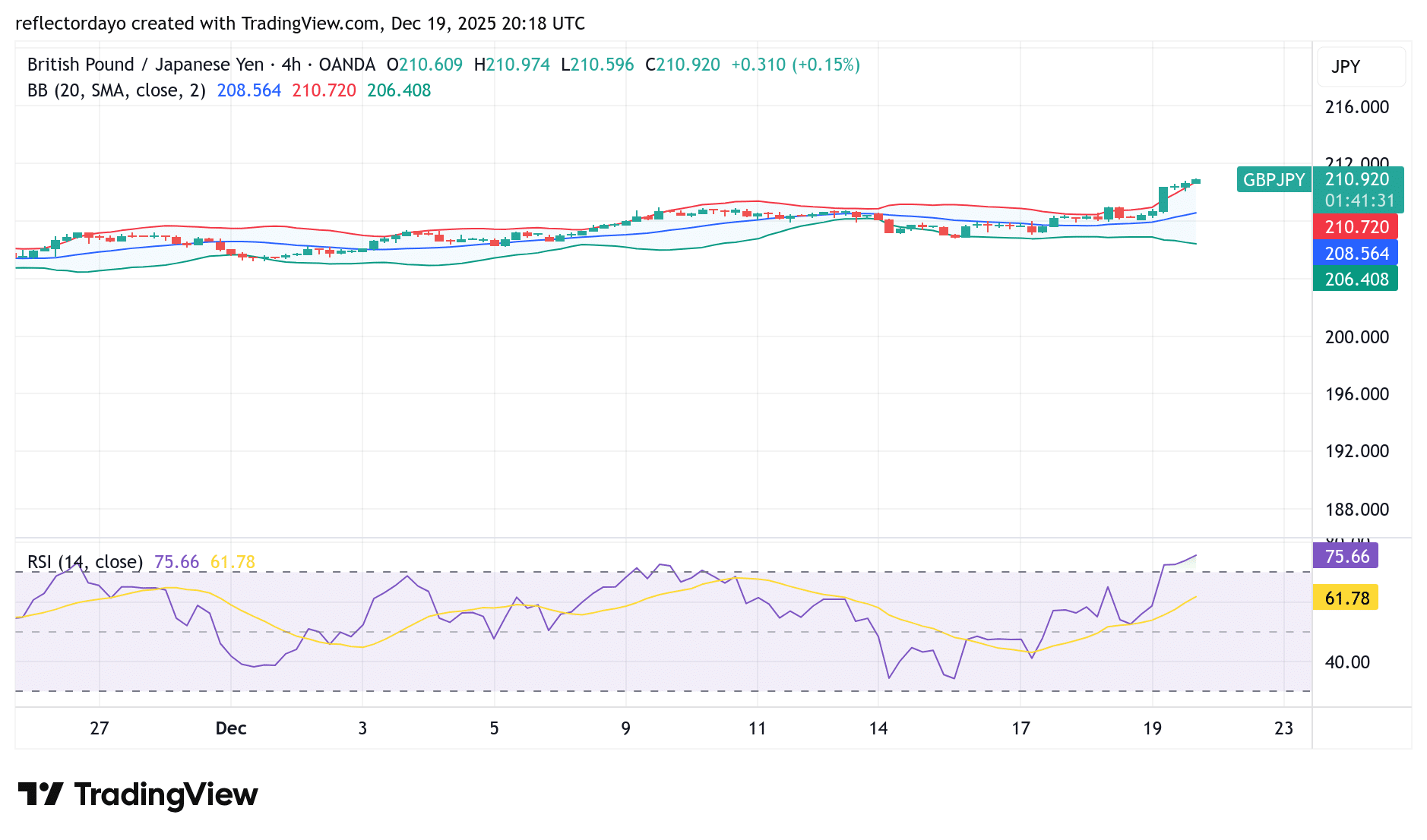

The market opened today around the 208.00 price level and quickly surged higher, posting a strong bullish move that decisively broke above the key 210.00 resistance. The candlestick structure resembles a Marubozu, signaling overwhelming bullish control with little to no room for bearish pressure.

This powerful price action suggests that the market may be in the process of establishing a higher support zone, reinforcing the broader bullish structure. From a momentum perspective, the RSI has crossed above the 70 threshold into overbought territory, indicating strong buying interest. While this suggests continued upside strength, it also raises the possibility of a short-term pullback.

Price may continue its advance toward the 212.00 level before a corrective move sets in, as traders begin to lock in profits.

GBP/JPY Short-Term Trend: Strong Bullish Price Action

While bearish sentiment is largely absent on the daily chart, a closer look at the 4-hour timeframe reveals early signs of mild bearish pressure as price approaches the 212.00 level. Recent candlesticks show signs of momentum exhaustion, with reduced volume suggesting that traders are becoming more cautious at higher levels.

Despite this hesitation, the market continues to edge higher, making gradual progress toward the 212.00 resistance. This price behavior reflects a tug-of-war between profit-taking sellers and persistent bullish interest, indicating that while the broader trend remains bullish, short-term consolidation or a modest pullback cannot be ruled out.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.