Bitcoin remains stuck in a difficult spot, with prices trapped between $81,000 and $93,000 as heavy selling pressure blocks recovery attempts, according to the latest analysis from blockchain analytics firm Glassnode.

According to the Glassnode report, the current situation stems from a dense cluster of investors who bought Bitcoin at much higher prices—between $93,000 and $120,000. These buyers accumulated near the market’s peak and are now sitting on losses.

This creates what analysts call overhead supply: coins held by investors who purchased at higher levels and may sell as soon as the price reaches their break-even point.

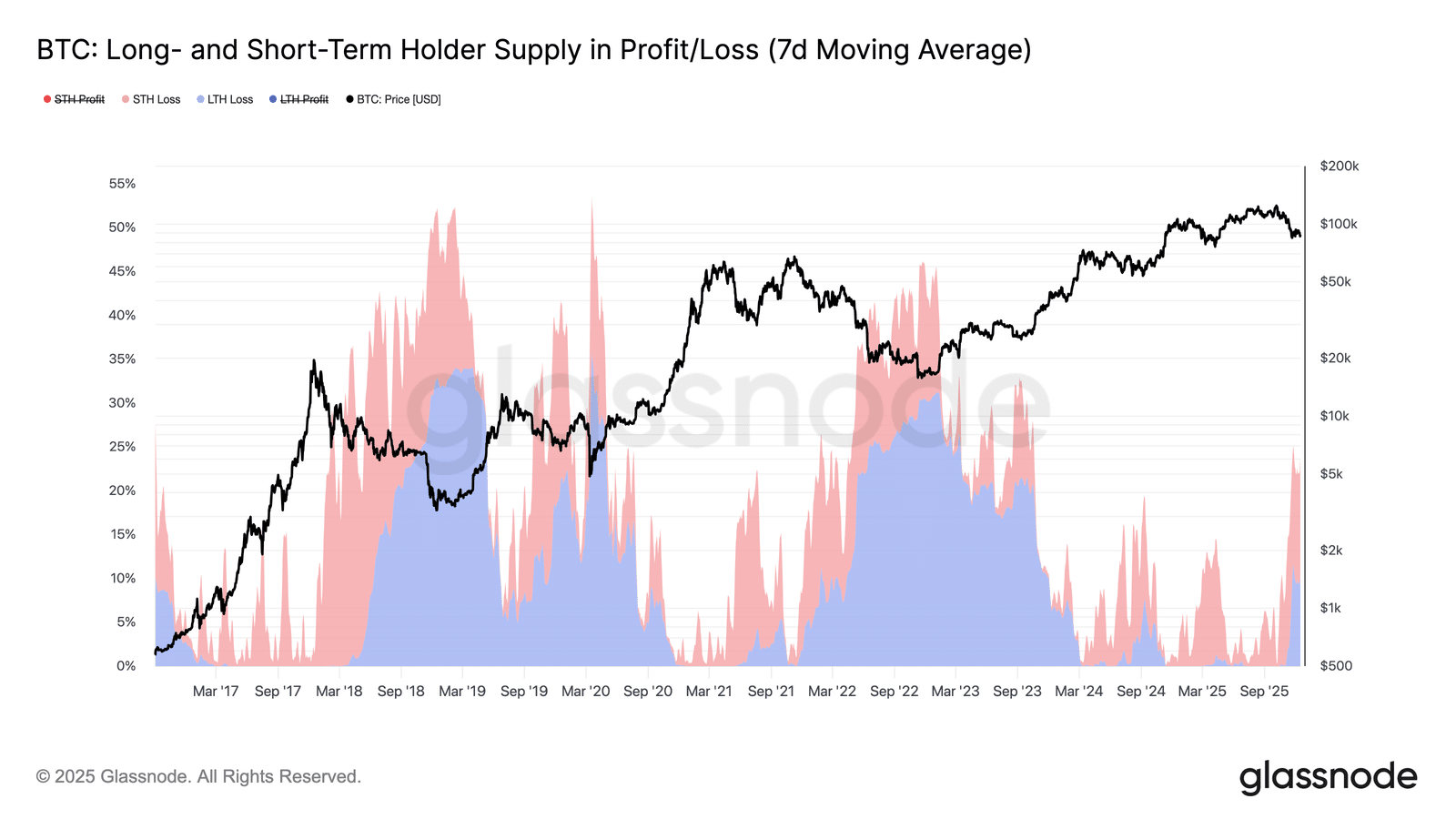

The numbers paint a concerning picture. About 6.7 million BTC are currently held at a loss, representing 23.7% of all circulating supply. This marks the highest level of underwater holdings seen this cycle.

What makes this particularly troubling is how this supply is maturing—10.2% belongs to long-term holders who’ve owned their coins for over 155 days, while 13.5% sits with newer buyers.

Growing Pressure from Loss-Taking Investors

The report identifies a worrying trend: investors holding losing positions are starting to capitulate.

Loss sellers now control roughly 360,000 BTC, up from previous levels. If prices drop below the True Market Mean at $81,300, this cohort could expand rapidly, adding more selling pressure to an already strained Bitcoin market.

According to the report, key resistance sits at $101,500—the Short-Term Holder Cost Basis. Until Bitcoin reclaims this level, bulls face an uphill battle.

Weak Demand for Bitcoin Across Multiple Markets

Spot buying activity shows occasional bursts but lacks consistency. Coinbase demonstrates steadier US-based interest, while Binance flows remain choppy and directionless.

Corporate treasury purchases continue sporadically rather than providing sustained demand.

Looking at the futures market, open interest has declined from cycle highs as traders reduce positions rather than add leverage. Funding rates hover near neutral, suggesting neither excessive speculation nor strong directional conviction.

Options markets reinforce the range-bound outlook. December expiries concentrate heavily around December 19 and 26, with positioning that encourages dealers to sell rallies and buy dips—suppressing volatility and keeping price action contained.

The takeaway? Bitcoin needs either complete seller exhaustion above $95,000 or fresh buying capable of absorbing the overhead supply before any meaningful upside emerges.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.