Market Analysis – December 6

The currency market is currently fixated on an epic tug-of-war: the British Pound versus the Japanese Yen (GBP/JPY). The pair has staged a remarkable rally over recent weeks, soaring nearly 3.5% since early November as the Pound rode a wave of supportive UK data and high interest rate differentials.

GBP/JPY Key Levels

- Demand Levels: 207, 209, 210

- Supply Levels: 200, 190, 180

The GBP/JPY Standoff: Fundamentals Clash at the 207 Barrier

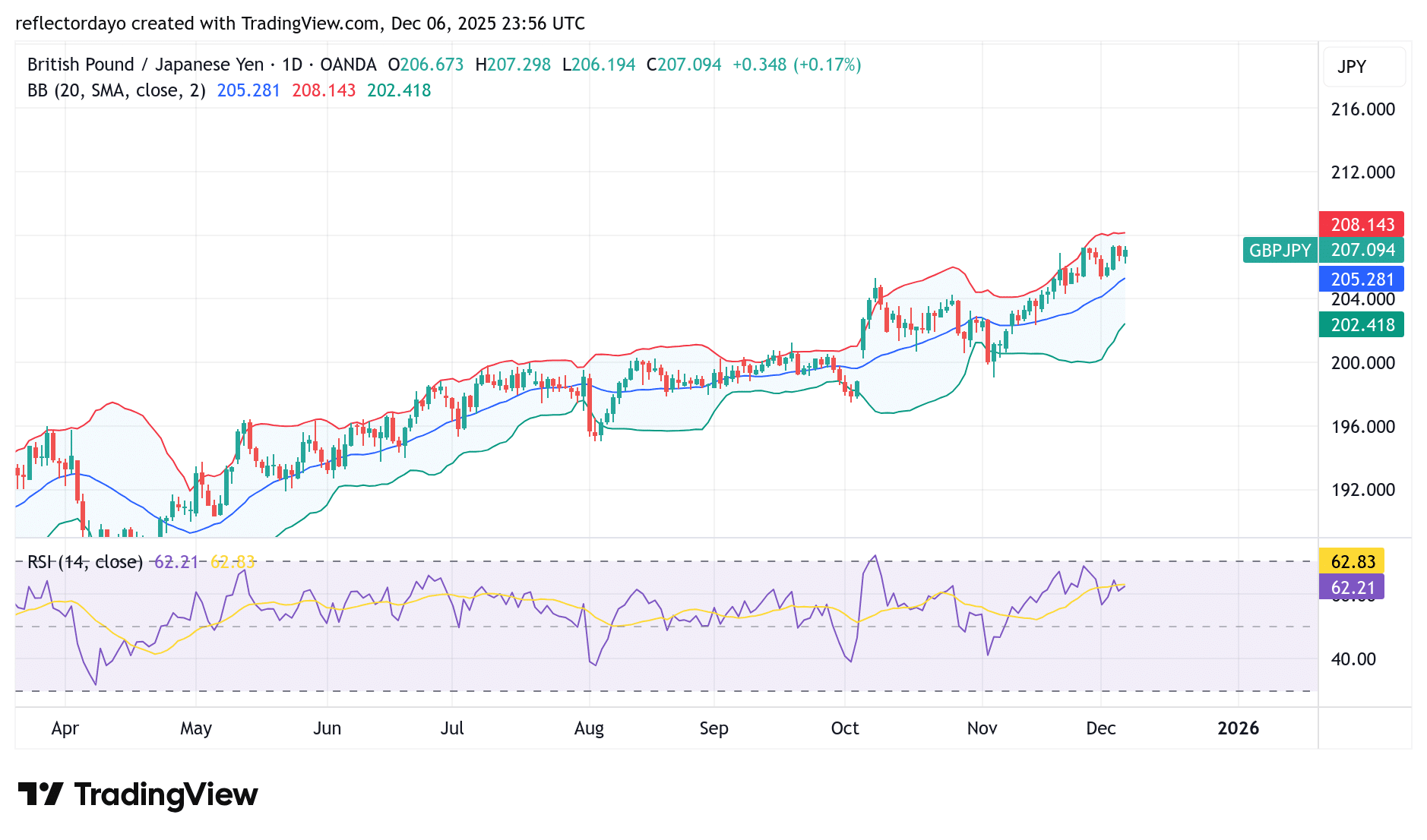

From the daily chart perspective, GBP/JPY has pushed into new highs for 2025. A broader view using the weekly chart shows that the 207 price region was last reached in July 2024, which helps explain why traders are approaching this area with caution. Now, as the pair retests these multi-year highs, bullish momentum is meeting strong resistance. The key technical zone around 207.35 has consistently held firm, rejecting every attempt at a breakout. At this point, GBP/JPY finds itself at a critical crossroads—shaped not only by price action but by a deeper fundamental tension between two diverging central bank policies.

On one side, a resilient Pound looks for reasons to continue its ascent. On the other, renewed hawkish speculation surrounding the Bank of Japan (BoJ)—coupled with stark warnings from Japanese officials about potential currency intervention—has injected a heavy dose of caution into the market. This potent mix of diverging monetary policies creates a volatile equilibrium. Will the BoJ’s looming policy shift finally tame the high-flying Pound, or will UK fundamentals provide the decisive push needed to breach the 207 fortress? Traders are holding their breath, waiting for the fundamental spark that determines the next major move.

GBP/JPY Short-Term Trend: Indecision

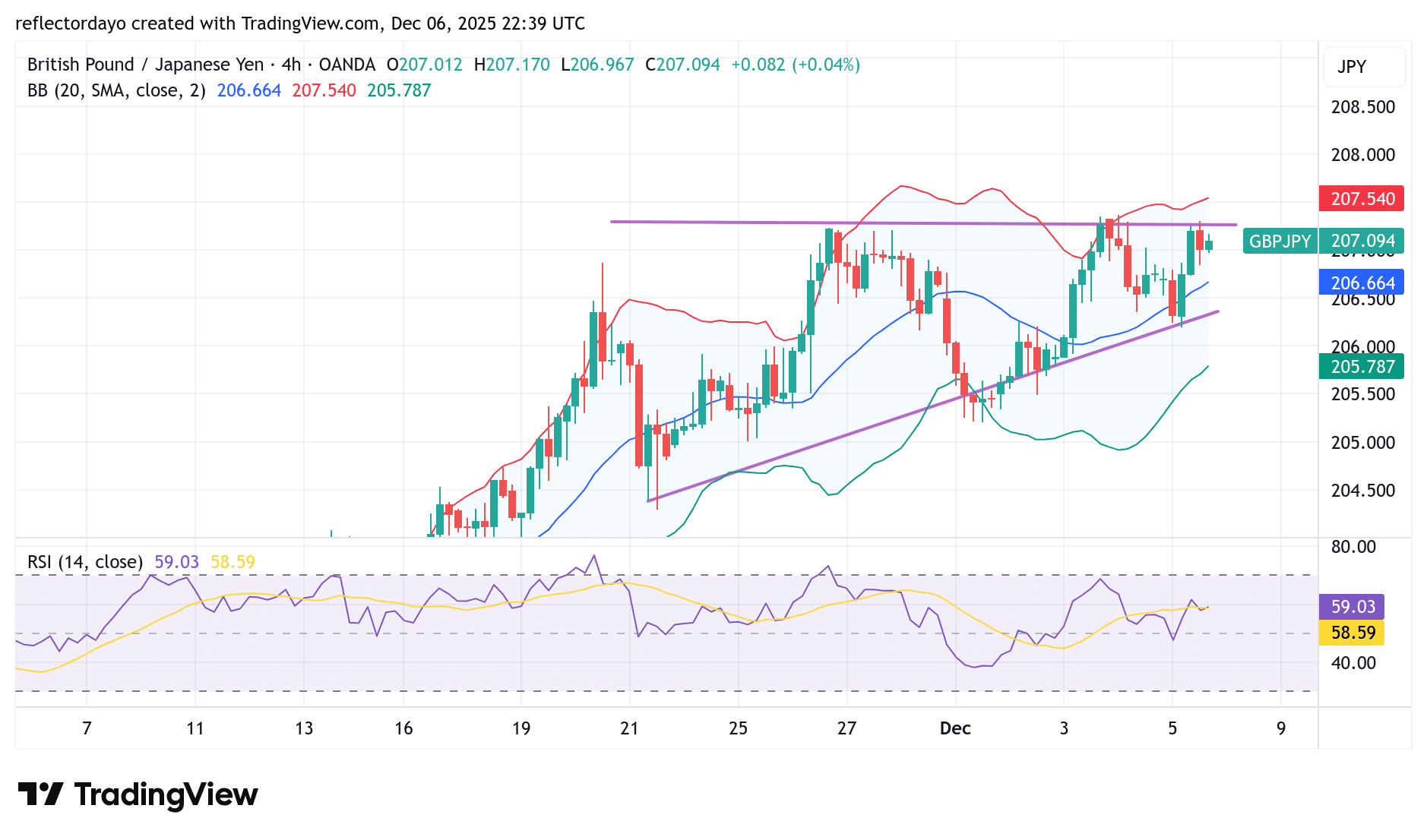

Bringing the market into a lower-timeframe perspective, we observe that while sellers continue to defend the 207 level, buyers are consistently entering long positions at progressively higher price points. This steady formation of higher support levels is pushing the market closer to the key resistance zone. As a result, price action has developed into an ascending triangle pattern, a structure that reflects mounting bullish pressure.

Despite 207 being a major resistance level—reinforced by last year’s highs—buyers have not relented. If bullish momentum continues to build, this barrier may eventually give way, opening the door for a potential sustained move above the level. Although the market closed slightly lower this week, price remains very close to the key resistance, keeping a breakout scenario firmly on the radar.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.