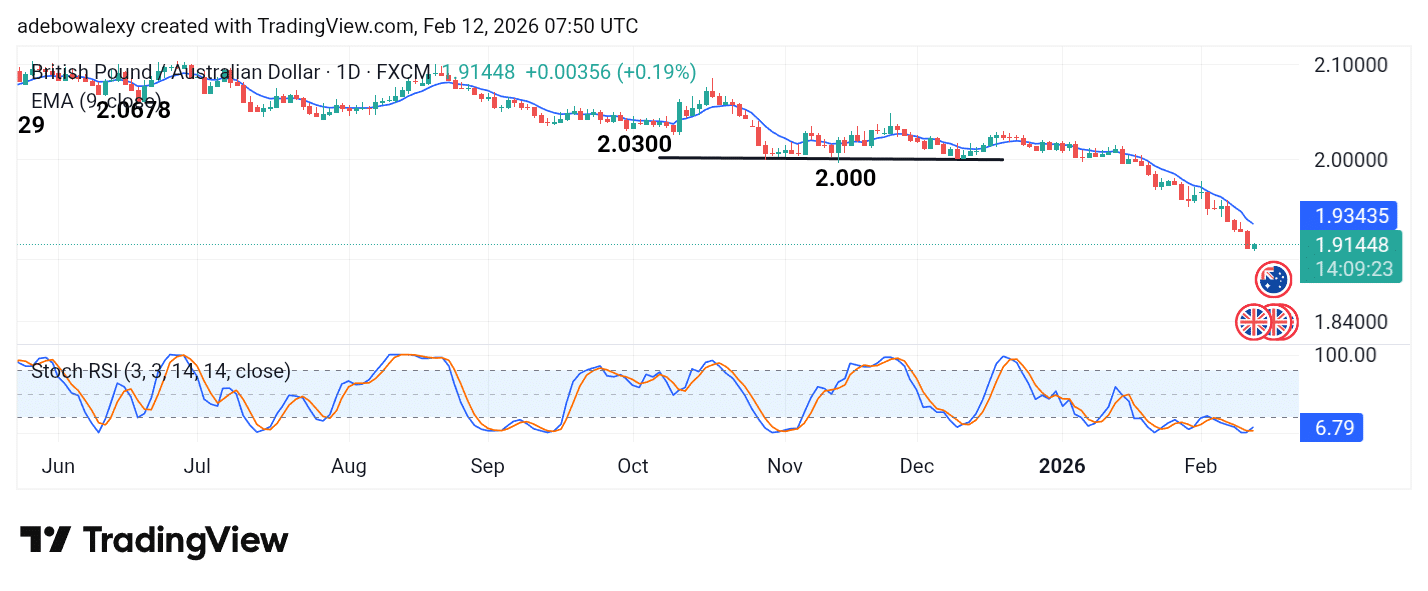

The UK economy has not been performing well recently. As such, this has generated a significant amount of headwinds in the GBP/AUD market. Lately, however, there has been a pullback to the upside, but the pair still lacks the technical strength to suggest a significant recovery.

Key Levels

Resistance: 1.9250, 1.9500, 1.9750

Support: 1.9100, 1.8900, 1.8700

GBP/AUD Minimal Gains Look Overwhelmed

The ongoing session in the GBP/AUD market appears green. This signifies a potential shift in the broader downward trend. However, price action remains below the 9-day Exponential Moving Average (EMA) line and, as such, lacks the conviction needed to confirm a long-term upward correction.

The Stochastic Relative Strength Index (SRSI) indicator lines have formed an upward crossover and are now trending higher, suggesting only a short-term shift in momentum.

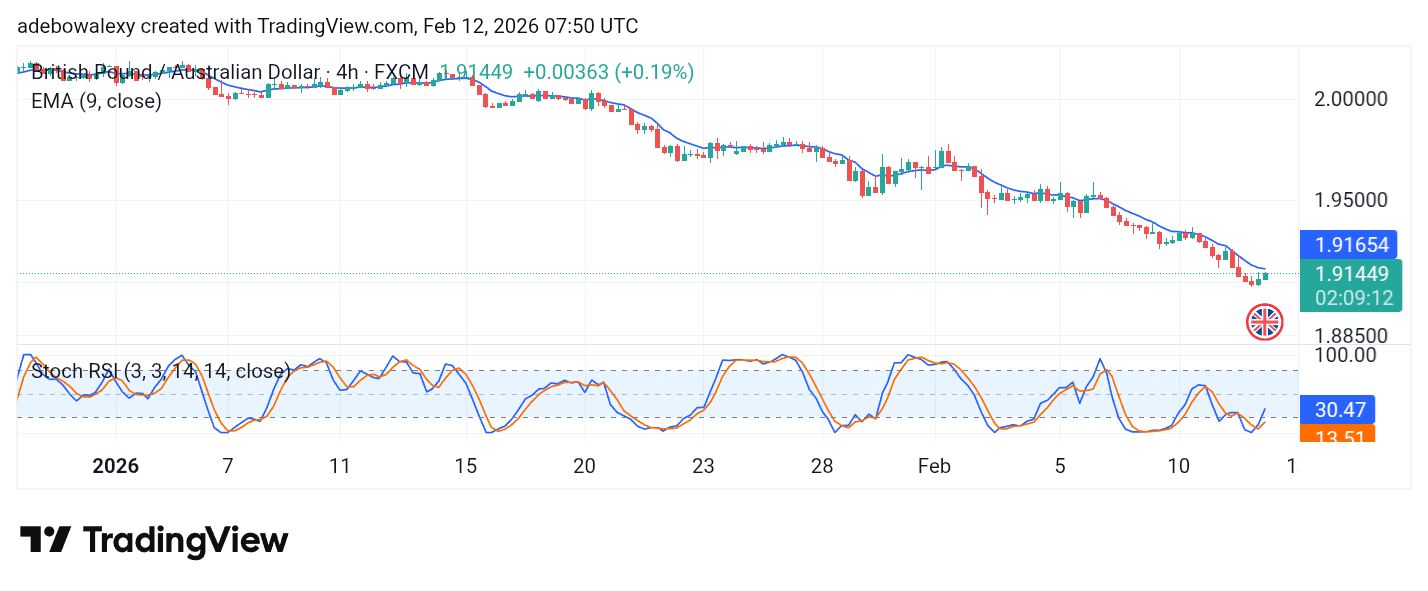

Market Maintains a Steady Gaze in the Short Term

In the short term, the GBP/AUD market has maintained an upward path. The pair has edged higher for the second consecutive session. The latest price candle also remains green and is climbing toward the resistance formed by the 9-day EMA curve.

Similarly, the SRSI indicator lines are still trending upward following a bullish crossover. However, the lines remain below the 40 level of the indicator. As such, traders may want to stay on the sidelines a bit longer to see whether the market can break above the 9-day EMA before targeting the 1.9250 level.

Make money without lifting your fingers: Start trading smarter today

Related Resources

- Forex Signals — live EUR/USD, GBP/USD and more

- What Are Trading Signals? — beginner’s guide to signal services

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.