FTSE 100 Analysis – October 1

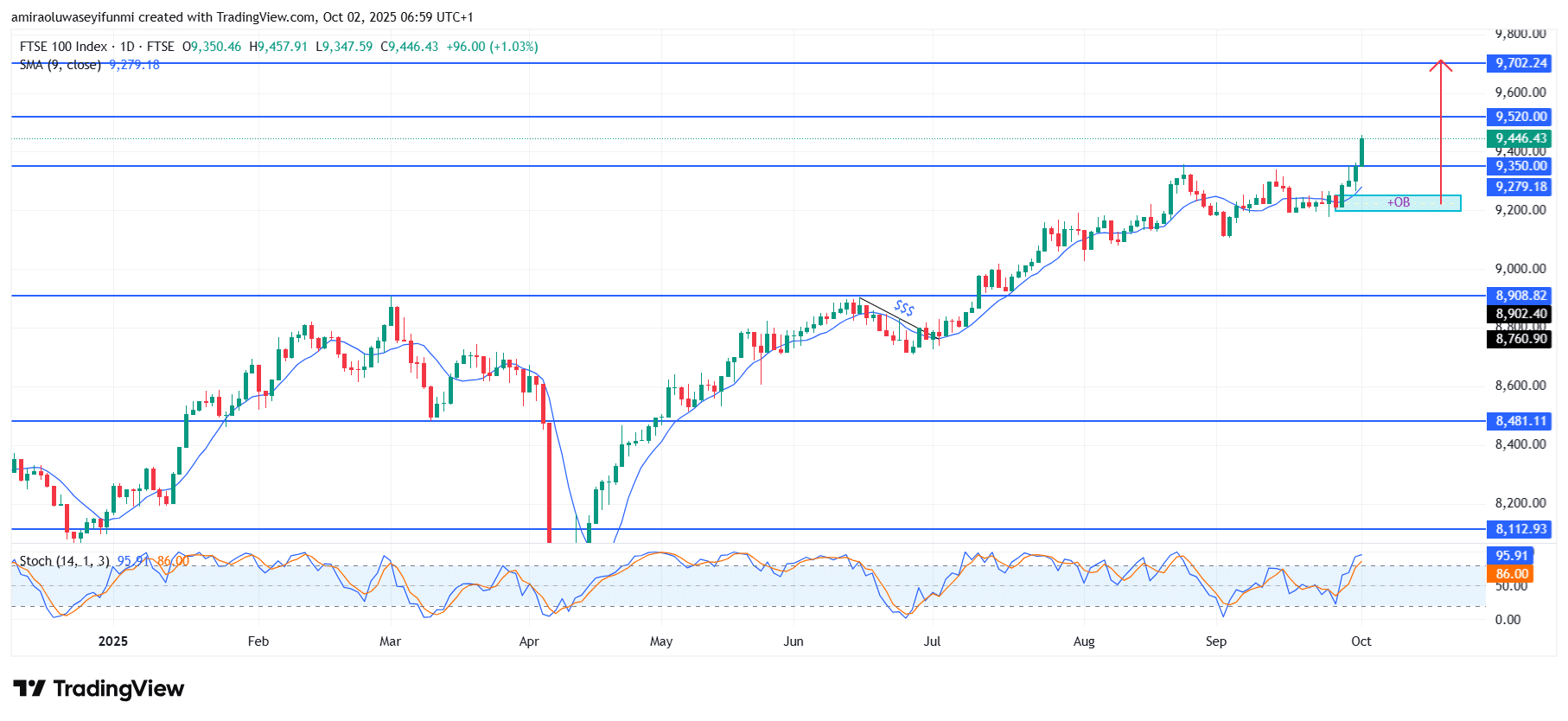

FTSE 100 sustains an upward drive with a resilient technical posture. The FTSE 100 Index is charting a strong upward path, supported by solid momentum signals and a stable price structure. The Stochastic Oscillator remains positioned above the 80 threshold, indicating persistent accumulation despite overbought conditions. Current pricing holds well above the $9,280 moving average baseline, reflecting the durability of the prevailing trend. This alignment between oscillators and trend markers emphasizes the strength of bullish forces and leaves room for further advancement.

FTSE 100 Key Levels

Resistance Levels: $9350, $9520, $9700

Support Levels: $8900, $8480, $8110

FTSE 100 Long-Term Trend: Bullish

From a structural perspective, the index has broken decisively through the $9,350 resistance level and now trades near $9,450. This move out of its consolidation range highlights renewed demand and strengthens the case for continuation. The demand area around $9,200 has served as a base, preventing deeper pullbacks and maintaining the upward rhythm. The steady sequence of higher highs and higher lows since midsummer confirms that the bullish framework remains intact.

Looking forward, the next resistance target appears at $9,520, with a breakout there opening the way toward $9,700 in the near term. The index is well-positioned to follow this trajectory as long as $9,350 holds as immediate support. If the current structure is preserved, the broader outlook remains constructive, with room for valuations to climb higher before any meaningful corrective phase develops.

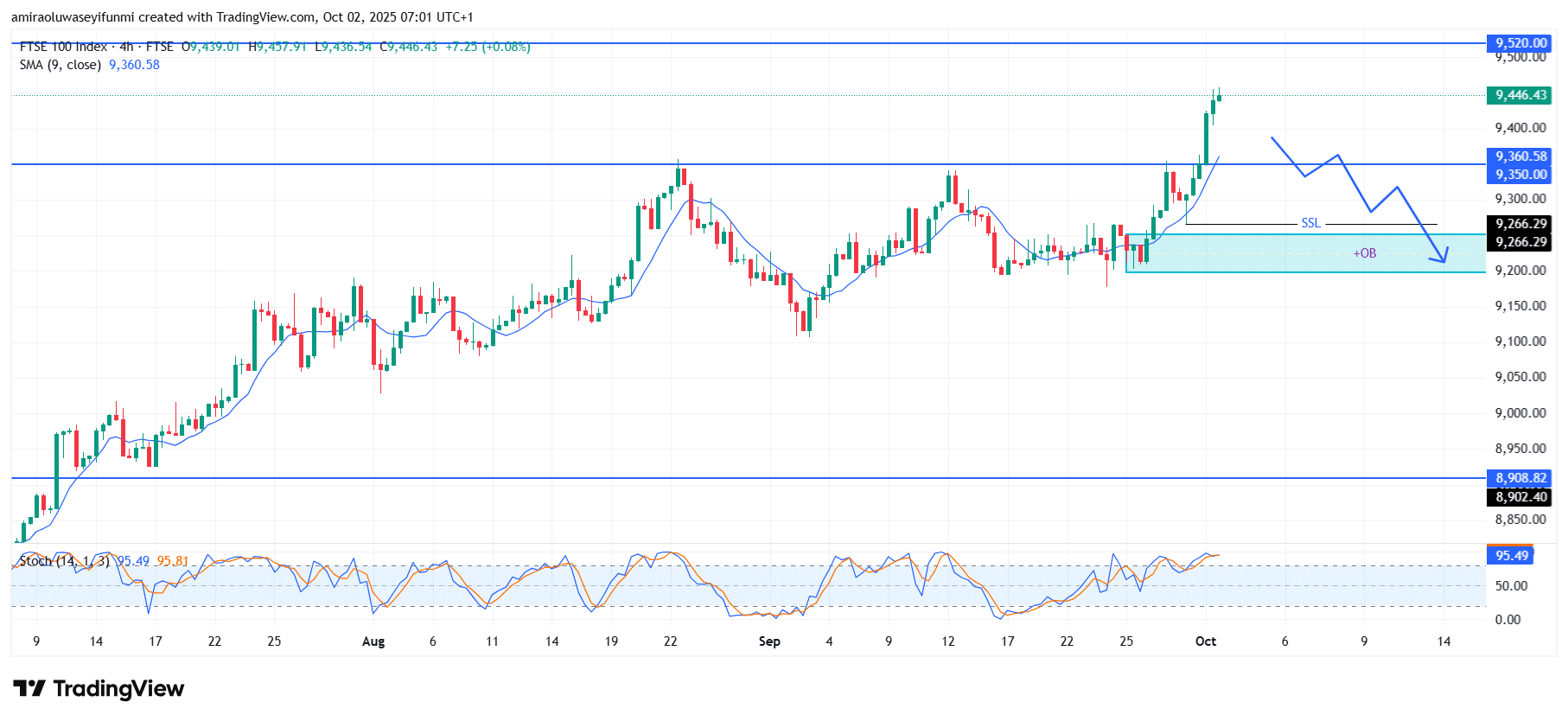

FTSE 100 Short-Term Trend: Bearish

The FTSE 100 has faced rejection around the $9,520 resistance zone after a sharp rally, signaling potential fatigue in bullish momentum. Price is expected to retrace toward the $9,350 and $9,270 support levels, with sellers looking to take advantage of overbought stochastic conditions.

The short-term structure reflects a shift in momentum as lower highs may begin to form beneath the recent peak. If $9,270 breaks decisively, the index could extend its decline toward $8,910, presenting traders with an important forex signals cue for monitoring downside pressure.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.