FTSE 100 Analysis – May 21

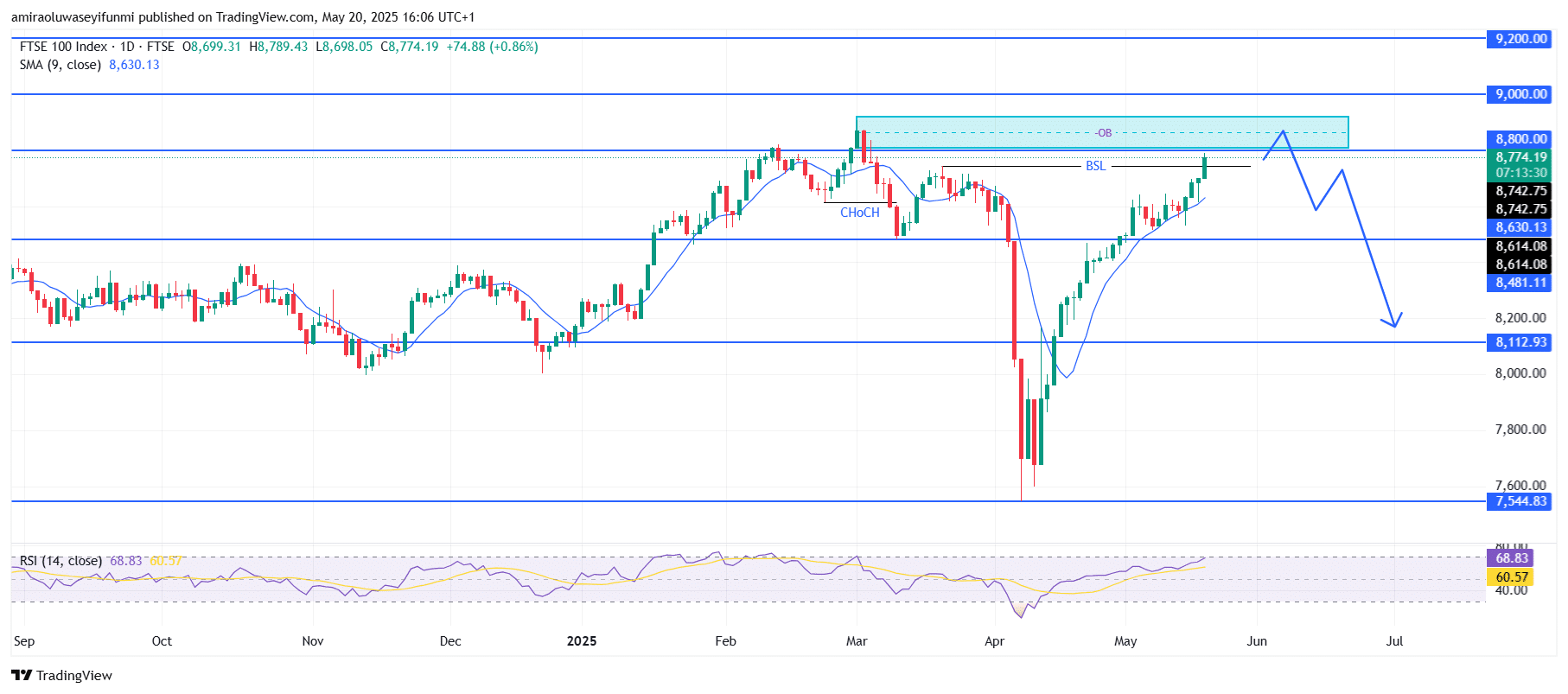

FTSE 100 signals a late-stage rally at the key supply level of $8,800. Technical indicators are beginning to highlight signs of exhaustion in the recent upward movement. The 9-period Simple Moving Average (SMA) has been steadily climbing near the $8,630 level, confirming short-term bullish sentiment. However, the 14-day Relative Strength Index (RSI) is hovering around 69, indicating overbought conditions and fading upside momentum.

FTSE 100 Key Levels

Resistance Levels: $8,800, $9,000, $9,200

Support Levels: $8,480, $8,110, $7,540

FTSE 100 Long-Term Trend: Bearish

On the price chart, the FTSE 100 has established a series of higher highs and higher lows over the past several weeks, signaling sustained bullish activity. This upward progression recently culminated in a retest of the $8,800 resistance level, which aligns with a previously identified supply zone where selling pressure typically intensifies. Buyers are now struggling to push prices decisively above this barrier, and trading volumes have been declining with each new attempt. These developments raise concerns about a possible false breakout, especially as momentum appears to stall at a point where it was expected to strengthen.

Looking forward, there is a realistic possibility of a bearish reversal within the broader $8,800–$8,900 range. If the index fails to break and hold above this upper limit, profit-taking and short-covering may give way to renewed selling pressure. In such a scenario, the FTSE 100 could pull back toward initial support near $8,100, where buyers may attempt to reestablish control. Should this level fail to hold, a deeper correction toward the $7,500 area becomes increasingly plausible. Traders monitoring this movement may consider integrating forex signals to anticipate turning points more effectively.

FTSE 100 Short-Term Trend: Bearish

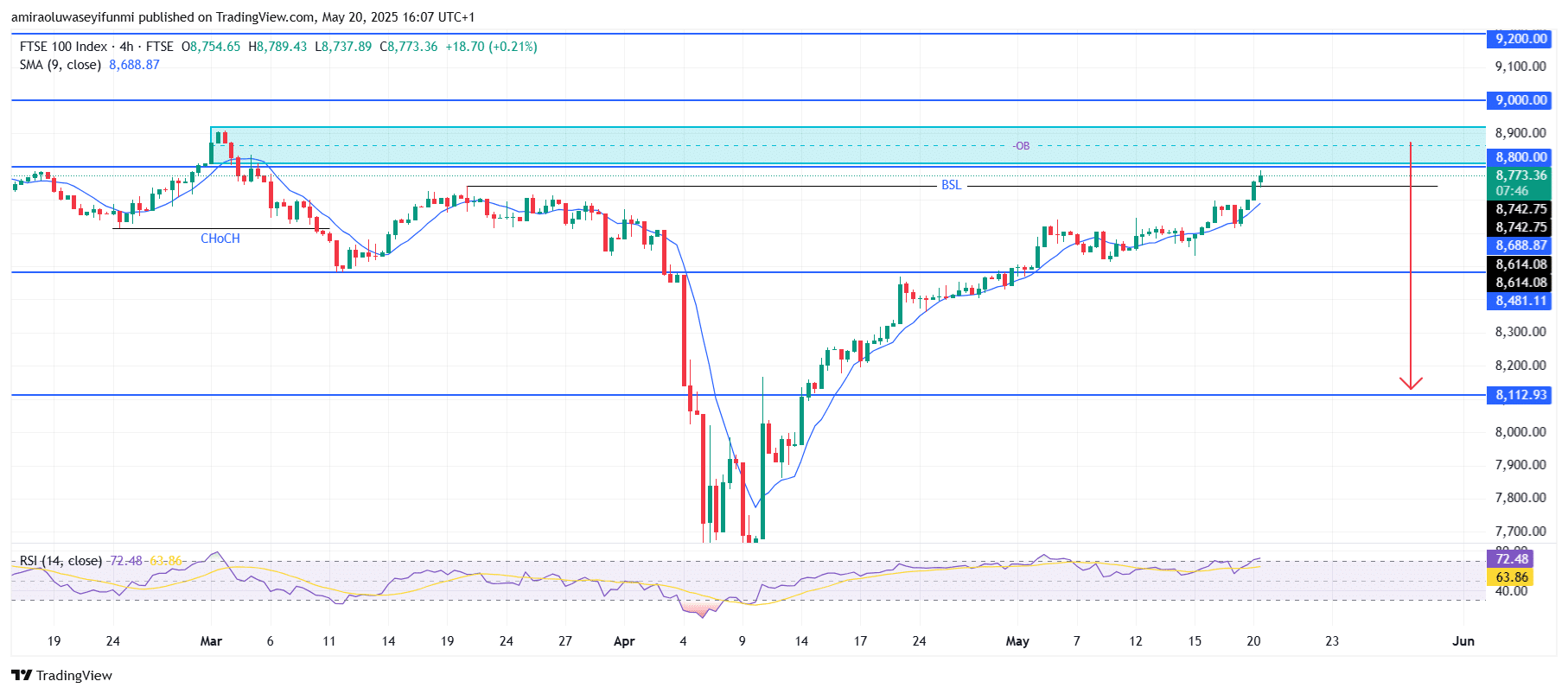

On the four-hour chart, FTSE 100 is confronting a significant supply zone. The RSI confirms that the market is currently overbought. A notable reversal is anticipated as the price moves past the $8,740 swing low and enters the supply region.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.