FTSE 100 Analysis – September 10

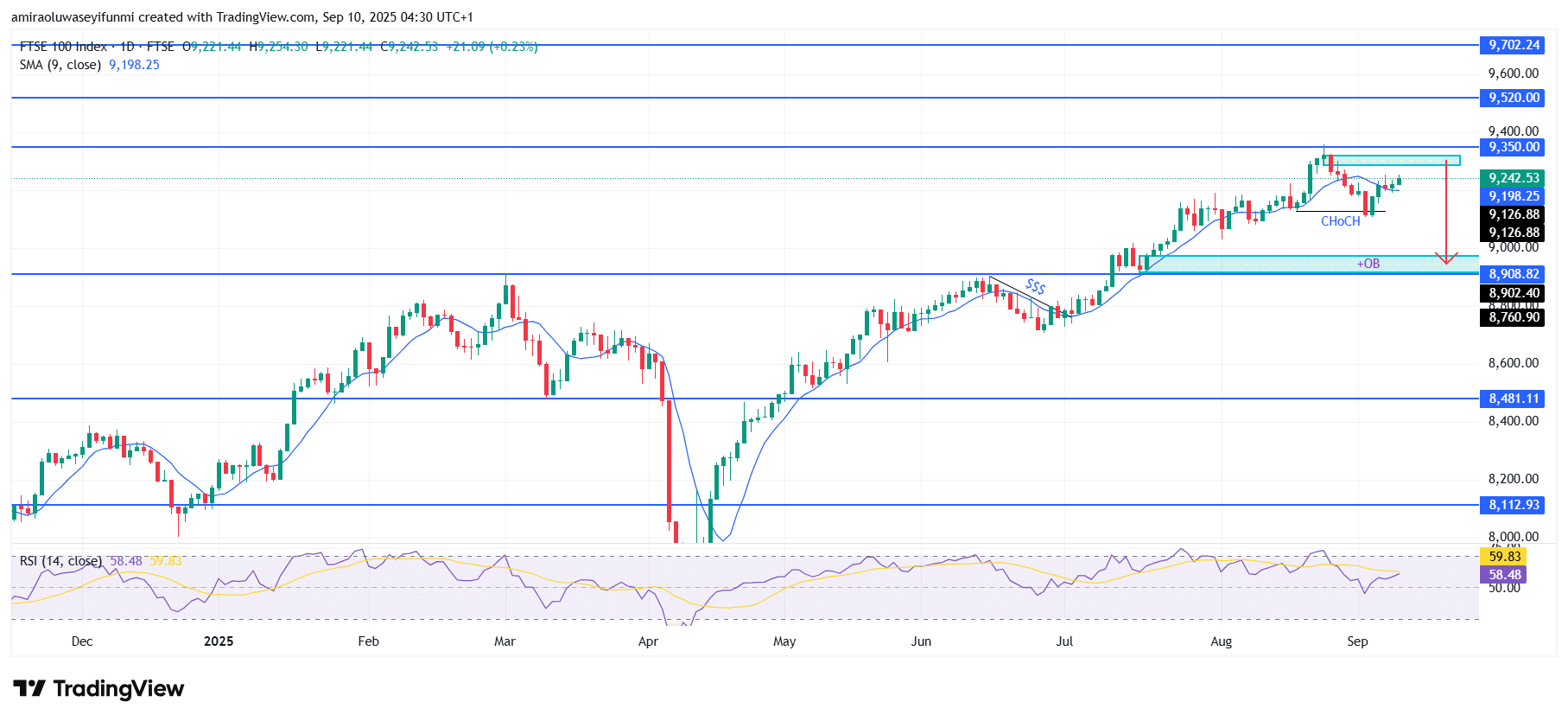

FTSE 100 signals downside pressure with weakening bullish momentum. The index has faced significant resistance around the $9,350 level, with recent price movements indicating a loss of upward strength. Although it is still trading above the short-term 9-day SMA, the index has struggled to maintain momentum at higher levels. The RSI hovering near 59 reflects fading buying interest, suggesting that bullish momentum is losing traction and increasing the likelihood of a corrective pullback.

FTSE 100 Key Levels

Resistance Levels: $9350, $9520, $9700

Support Levels: $8900, $8480, $8110

FTSE 100 Long-Term Trend: Bearish

From a technical perspective, the index has repeatedly failed to break and close above the $9,350 resistance level, underscoring the strength of this price ceiling. The rejection and bearish response near this area point to possible market exhaustion and potential profit-taking. The presence of a change of character (CHoCH) and an order block around $8,910 further indicates that sellers are regaining control in the near term.

If bearish pressure continues, the FTSE 100 could retreat toward the $9,000 psychological level, with additional downside risk targeting the $8,910 demand zone. A clear break below this level could accelerate losses toward $8,760, where stronger support is located. Conversely, a sustained break and close above $9,350 would negate the bearish outlook and pave the way toward $9,520. However, current forex signals and technical readings favor a bearish scenario.

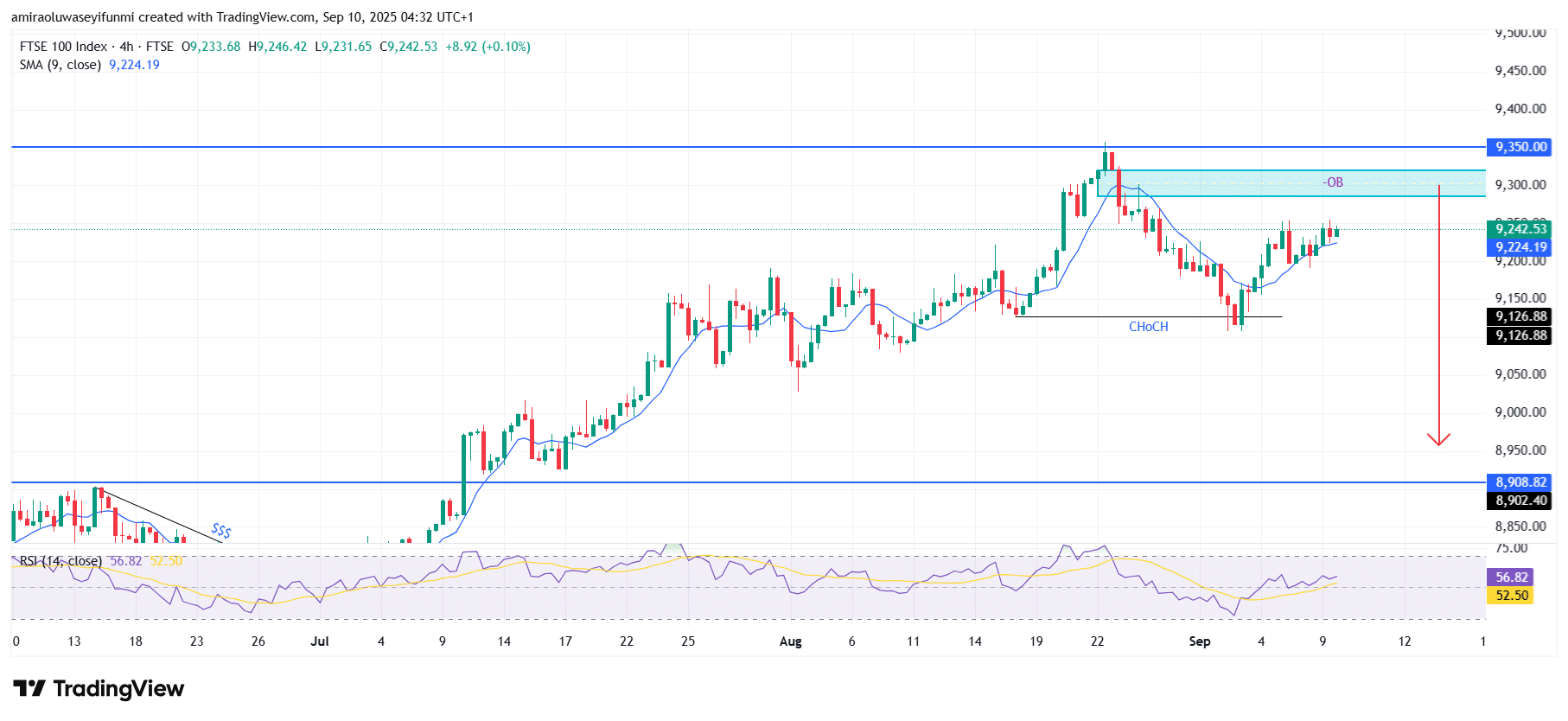

FTSE 100 Short-Term Trend: Bearish

FTSE 100 remains capped below the $9,350 resistance, showing rejection from the order block area. The RSI at 56 reflects limited upside potential, aligning with a weakening market structure.

Recent price action confirmed a change of character (CHoCH), signaling that sellers are regaining control. This may lead to a bearish continuation, potentially driving the index down toward the $8,910 support level.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.