FTSE 100 Analysis – May 28

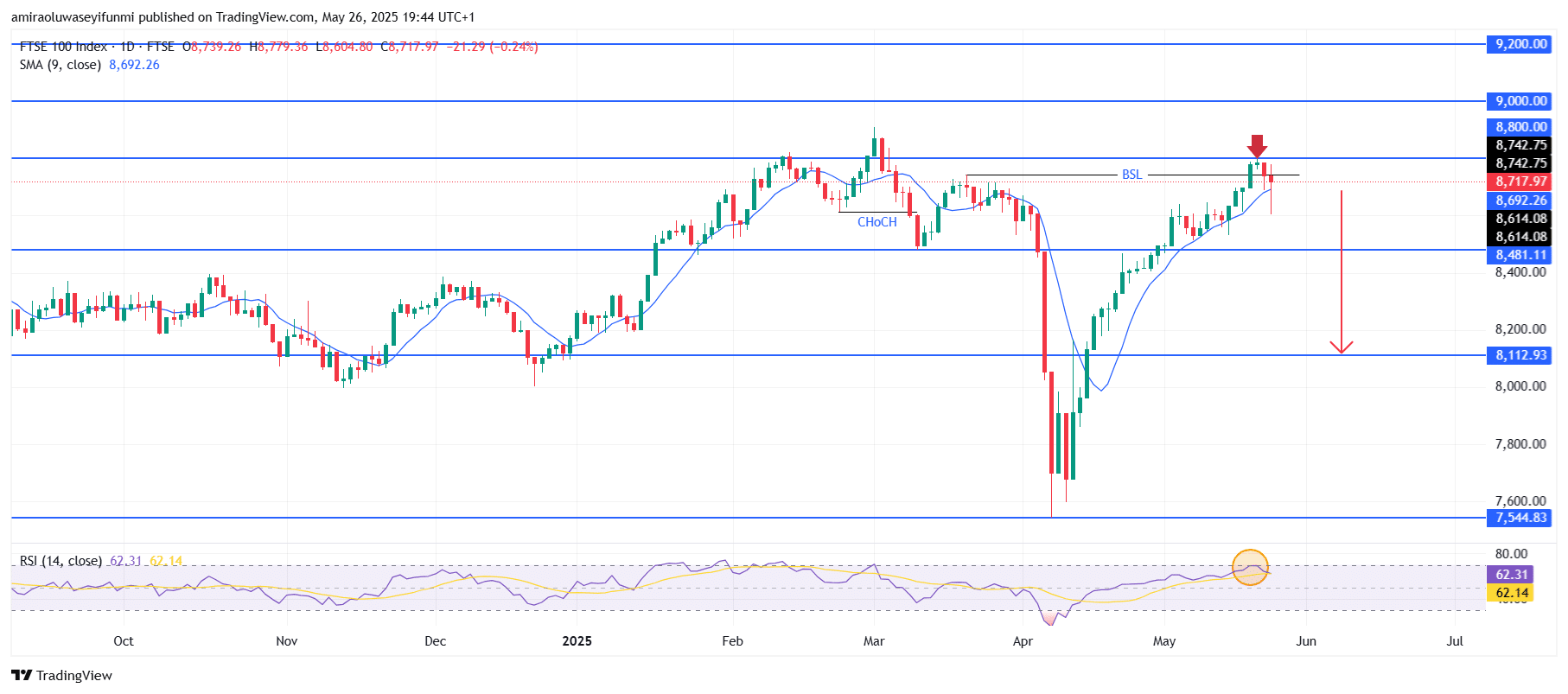

FTSE 100 rejects resistance as downside pressure intensifies. From an indicator perspective, the Relative Strength Index (RSI) currently reads 62.3, a level that traditionally approaches overbought conditions. However, the RSI has recently begun to decline, indicating a slowdown in bullish momentum. The 9-day Simple Moving Average (SMA) is positioned around $8,690 and has served as a dynamic support level in recent weeks. A price drop below this level sends early signals of a potential bearish shift, especially if accompanied by continued RSI divergence or an inability to recover higher price levels.

FTSE 100 Key Levels

Resistance Levels: $8800, $9000, $9200

Support Levels: $8480, $8110, $7540

FTSE100 Long-Term Trend: Bearish

The chart pattern analysis shows that the FTSE 100 index has clearly rejected the $8,800 resistance level, as evidenced by the recent red candle with a noticeable upper wick. This took place shortly after a breakout above the Buy-Side Liquidity level near $8,740, hinting at a possible liquidity sweep prior to distribution. A Change of Character earlier this year around $8,480 set the stage for the prevailing volatility, and recent price action confirms rejection from a key supply zone.

The rejection at $8,800 strongly suggests that a bearish retracement is underway, with price likely to retest the intermediate support at $8,480 in the near future. If this level does not hold, further downside could reach the $8,110 area, which aligns with prior consolidation support. A break below this zone opens the possibility of a bearish target near $7,540. To invalidate this bearish scenario, the index would require a strong close above $8,800 supported by high trading volume and RSI confirmation above 70—a condition not currently reflected in market behavior.

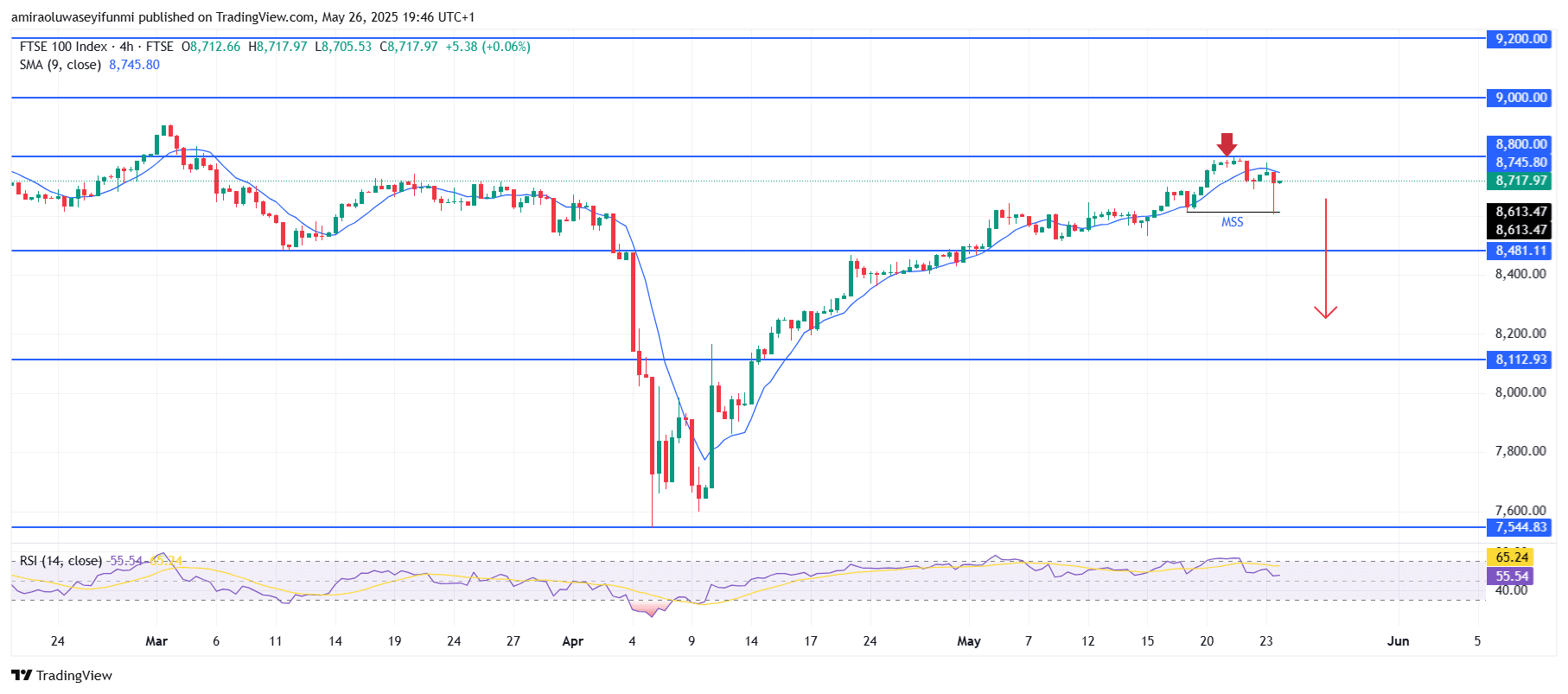

FTSE100 Short-Term Trend: Bearish

FTSE 100 has rejected the $8,800 resistance level, creating a clear market structure shift to the downside. The price is now trading below the 9-period SMA at $8,750, indicating a decline in short-term bullish momentum.

The RSI has dropped from a peak of 65 to 55, highlighting decreasing buying pressure. A continued move below $8,610 could prompt additional losses toward $8,480 and potentially $8,110. Traders interpreting forex signals may see this as confirmation of sustained bearish sentiment, reinforcing short-term selling opportunities.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.