FTSE 100 Analysis – December 17

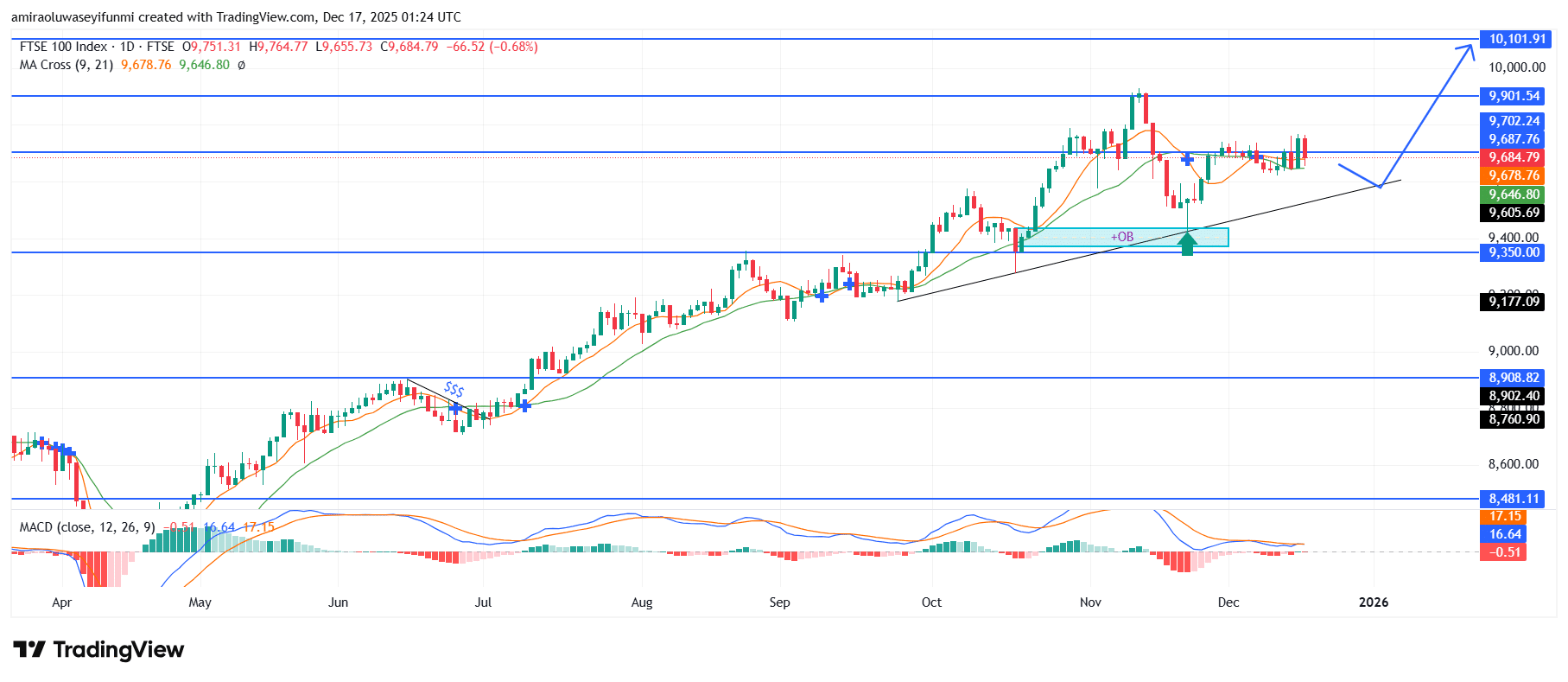

FTSE 100 preserves its uptrend while holding key structural levels. The index remains positioned within a measured upward phase, supported by positively sloped moving averages and gradually improving momentum conditions. Price continues to trade above the intermediate trend reference near $9,650, with the shorter moving average maintaining a lead over the longer one, confirming stable trend alignment. The MACD profile is flattening close to neutral territory, indicating that selling pressure is easing within an otherwise constructive technical backdrop.

FTSE 100 Key Levels

Supply Levels: $9700.0, $9900.0, $10100.0

Demand Levels: $9350.0, $8900.0, $8480.0

FTSE100 Long-Term Trend: Bullish

From a structural perspective, price action reflects a consolidation phase following a strong directional advance, with higher lows consistently defended above the $9,350 support region. This area continues to function as a base for demand absorption, while upside progress has been temporarily capped by resistance around $9,900. Candle behaviour suggests range compression rather than active distribution, reinforcing the view that the market is consolidating rather than transitioning into trend weakness.

Looking ahead, a confirmed daily close above $9,900 would likely restore upside momentum and open the path toward the $10,100 target. As long as price remains supported above $9,650, interim pullbacks should be viewed as tactical pauses within the broader trend rather than signals of reversal. The prevailing bullish structure remains intact into early 2026, with sustained weakness only implied by a decisive break below $9,350, a scenario that remains unlikely under current forex signals.

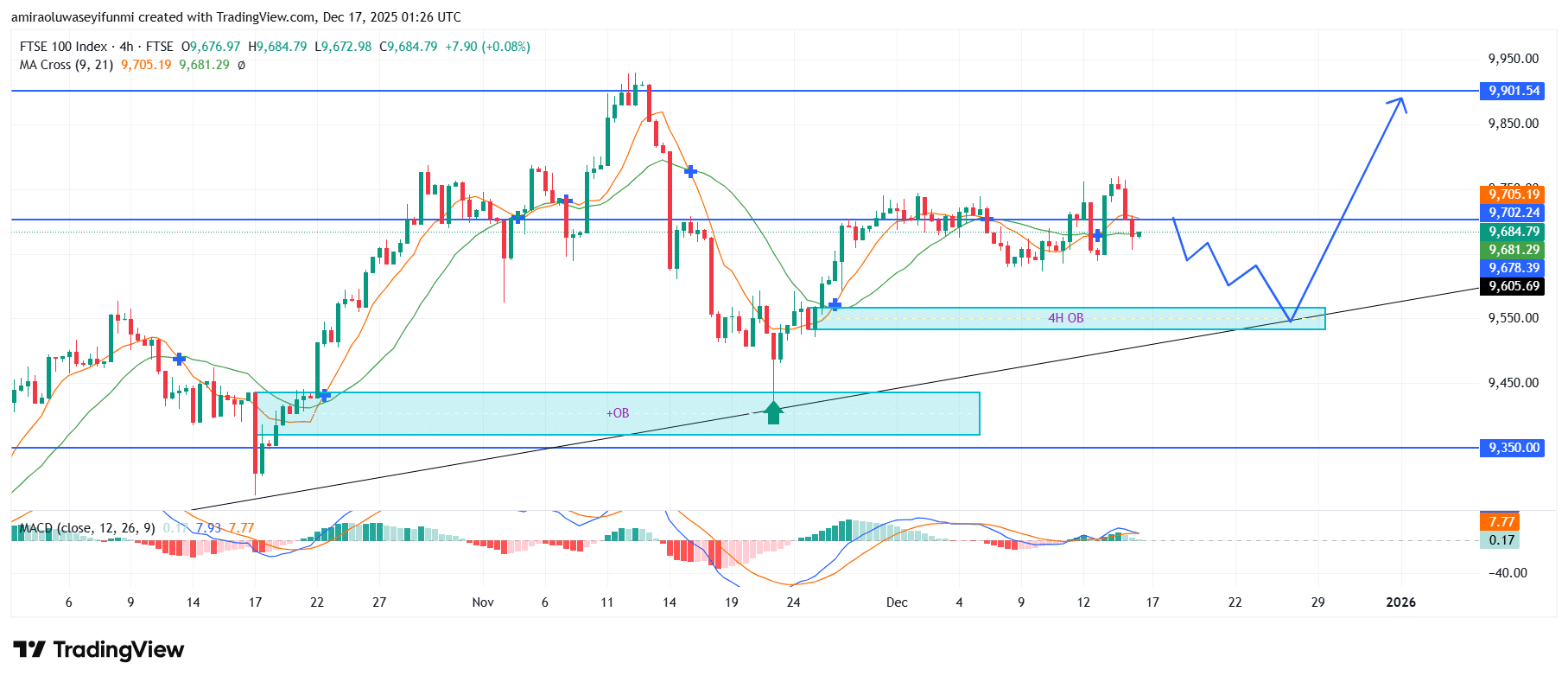

FTSE100 Short-Term Trend: Bullish

FTSE 100 is experiencing a controlled pullback within a broader four-hour bullish structure, with price rotating toward trend support near $9,560. The rising trendline and overlapping moving averages continue to reinforce directional stability despite the short-term retracement.

Demand is expected to re-emerge around the $9,550–$9,580 zone, where prior accumulation and structural support intersect. A successful defence of this region would likely encourage a renewed advance toward $9,900 in the near term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.