FTSE 100 Analysis – December 10

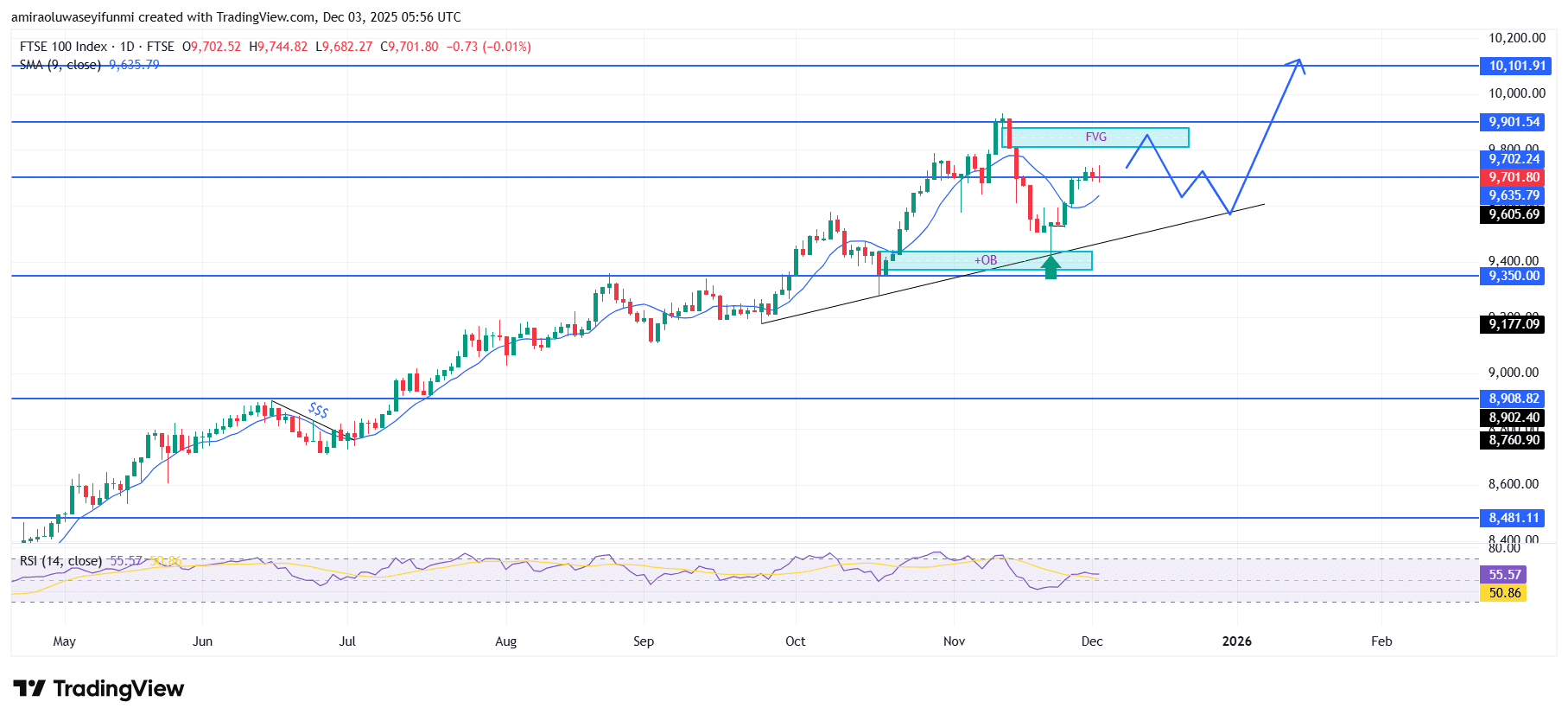

FTSE 100 exhibits an orderly advance within a sustained bullish framework. The FTSE 100 continues to follow a well-defined upward structure, with price respecting its rising trendline and holding above the short-term moving averages. Momentum conditions further indicate that market sentiment remains supportive. Overall, the index is maintaining elevation above its mid-range support zone, reinforcing the continuation of its broader upward trajectory.

FTSE 100 Key Levels

Supply Levels: $9700.0, $9900.0, $10100.0

Demand Levels: $9350.0, $8900.0, $8480.0

FTSE100 Long-Term Trend: Bullish

From a technical perspective, buyers have consistently defended the dynamic support area near $9,610, allowing the prevailing uptrend to remain stable through multiple controlled pullbacks. Recent attempts to pressure the index downward from the $9,680 region were absorbed efficiently, and price has remained above the broader demand zone anchored near $9,350. This pattern of steady higher lows and measured retracements reflects disciplined accumulation, strengthening confidence in the bullish continuation outlook.

Looking ahead, expectations continue to favor an upward extension as long as theq ascending structure stays intact. A firm reaction from the $9,600–$9,620 zone would likely trigger a move toward the intermediate upside target around $9,900, with potential for an additional extension toward $10,100 if buyers maintain momentum. Provided the structural base at $9,350 remains unbroken, the bullish bias is expected to guide price action in the coming sessions.

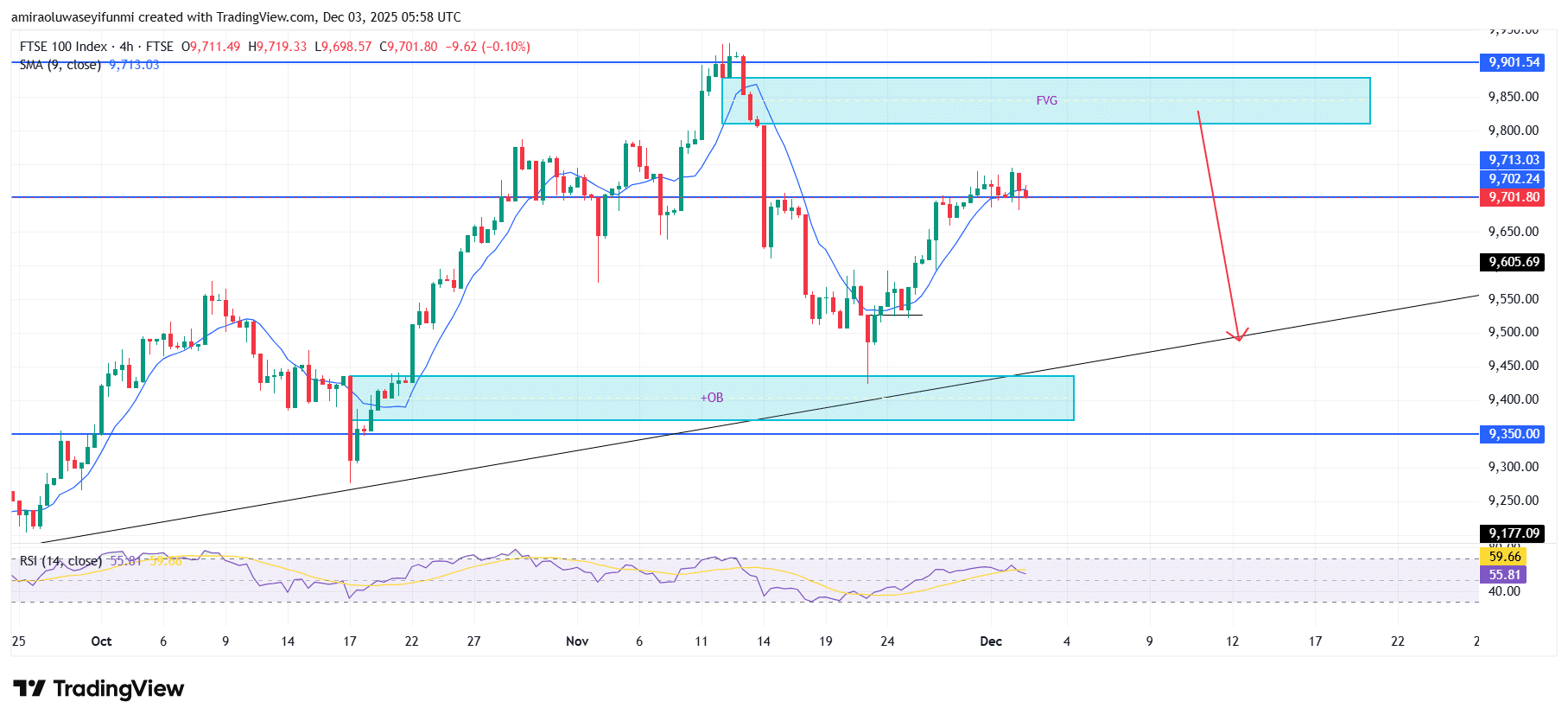

FTSE100 Short-Term Trend: Bearish

FTSE 100 is displaying short-term bearish pressure as price struggles to sustain movement above the $9,700 resistance region. Rejection from this level, coupled with weakening momentum on the MACD, suggests diminishing buyer strength. Price now appears poised for a retracement toward the ascending trendline support around $9,520–$9,540. A decisive break below the moving averages would further validate this short-term corrective bias, a development closely monitored by traders relying on forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution.

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.