FTSE 100 Analysis – October 15

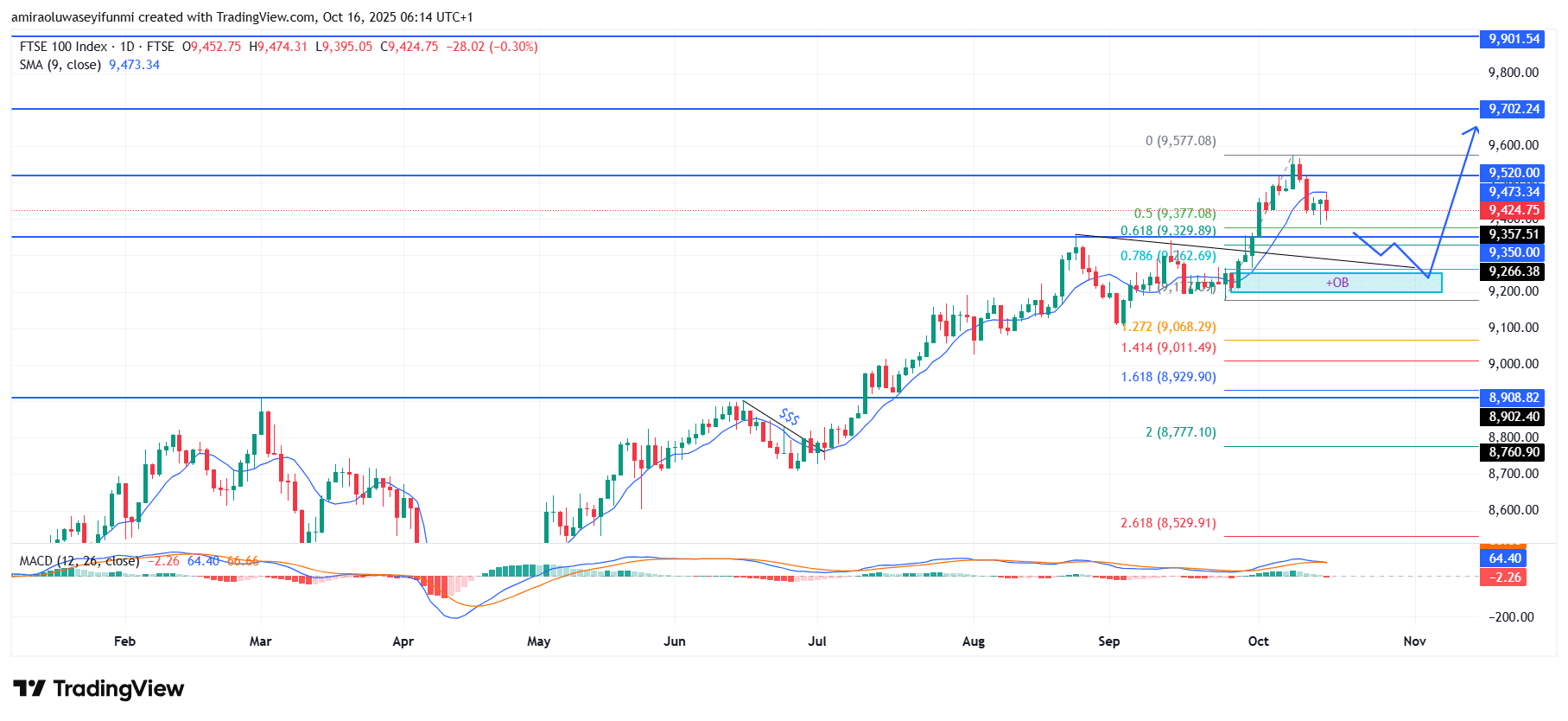

FTSE 100 prepares for bullish recovery after retracement phase. The FTSE 100 Index is currently experiencing a short-term correction within a broader bullish structure, as price consolidates slightly below the 9-day SMA near $9,470. Despite mild histogram contraction, the MACD remains positioned above the signal line, indicating that bullish momentum is still intact. This retracement phase appears to be a healthy consolidation following the index’s strong advance from the $8,900 support region, suggesting renewed accumulation before the next upward leg.

FTSE 100 Key Levels

Resistance Levels: $9520, $9700, $9900

Support Levels: $9200, $8900, $8760

FTSE100 Long-Term Trend: Bullish

From a technical standpoint, the price has pulled back from the recent swing high around $9,580, coinciding with the 0.618 Fibonacci retracement level near $9,330. The $9,260–$9,350 range, identified as an order block, continues to function as a key demand zone capable of absorbing selling pressure. A rebound from this level would reaffirm the market’s bullish intention to sustain higher lows while preserving structural integrity.

Looking ahead, the FTSE 100 Index is expected to resume its upward movement once stability is established around the $9,350 region. A firm defense of this zone could propel price toward $9,700 initially, with a potential advance toward $9,900 in the medium term. As long as the index maintains its footing above the $9,260 structural support, the overall bullish outlook remains valid. Traders monitoring forex signals may find this technical setup favorable for aligning with potential upward opportunities.

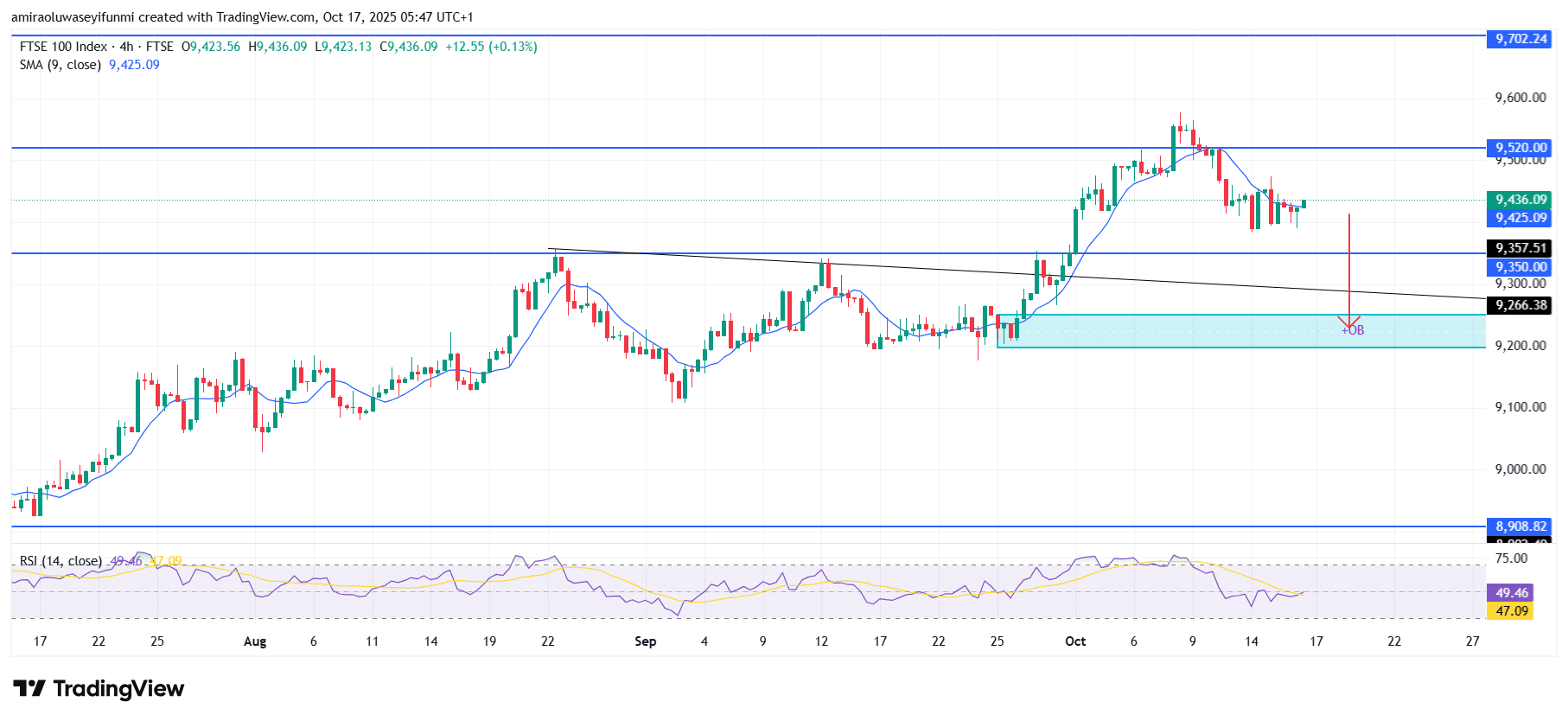

FTSE100 Short-Term Trend: Bearish

The FTSE 100 currently shows short-term bearish momentum as price trades below the 9-period SMA on the four-hour chart. Sellers appear to be regaining control following a rejection near the $9,520 resistance zone. The RSI remains below the midline, indicating declining bullish strength and potential for further downward movement. Price may retest the $9,266 order block area, where buyers could attempt a temporary rebound.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.