FTSE 100 Analysis – July 30

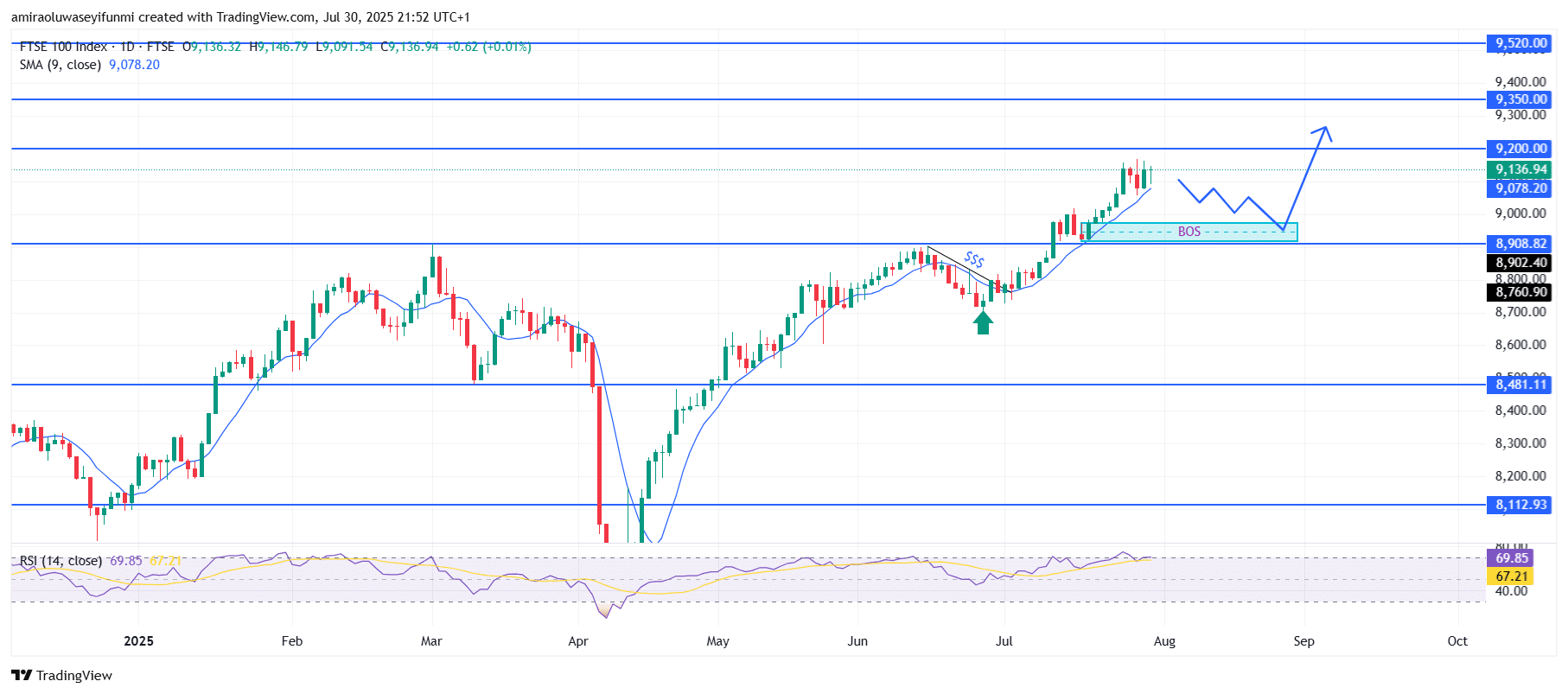

FTSE 100 maintains bullish strength with a poised continuation structure. The index has upheld a strong upward trajectory, consistently trading above the 9-period Simple Moving Average (SMA), currently positioned near $9,080. This bullish bias is further supported by the Relative Strength Index (RSI), which is hovering close to the 70 mark, indicating sustained buyer momentum. The market structure continues to respect a pattern of higher highs and higher lows, with the SMA offering dynamic support throughout the trend. These aligned bullish indicators suggest strong investor confidence and ongoing demand.

FTSE 100 Key Levels

Resistance Levels: $9,200, $9,350, $9,520

Support Levels: $8,900, $8,480, $8,110

FTSE 100 Long-Term Trend: Bullish

The market recently broke out of a short-term descending structure, forming a bullish order block around the $8,900 zone and establishing a bullish break of structure (BOS). This area has since been retested and confirmed as a valid support zone. Following the breakout, price movement has shown a series of tight, upward candles, reflecting steady momentum rather than overextended activity. The current consolidation above the $9,100 level suggests that market participants may be accumulating positions in anticipation of another upward move.

Looking ahead, price is expected to retrace into the $8,900–$9,000 demand zone before launching a fresh bullish impulse toward the $9,200 resistance. If this level is successfully cleared, further upside potential could extend to $9,350 and eventually approach the significant psychological and technical level near $9,520. However, a failure to hold above the $8,900 support region would indicate fading bullish strength and could challenge the current trend. Still, the prevailing technical landscape, supported by reliable forex signals, points to continued upside potential in the medium term.

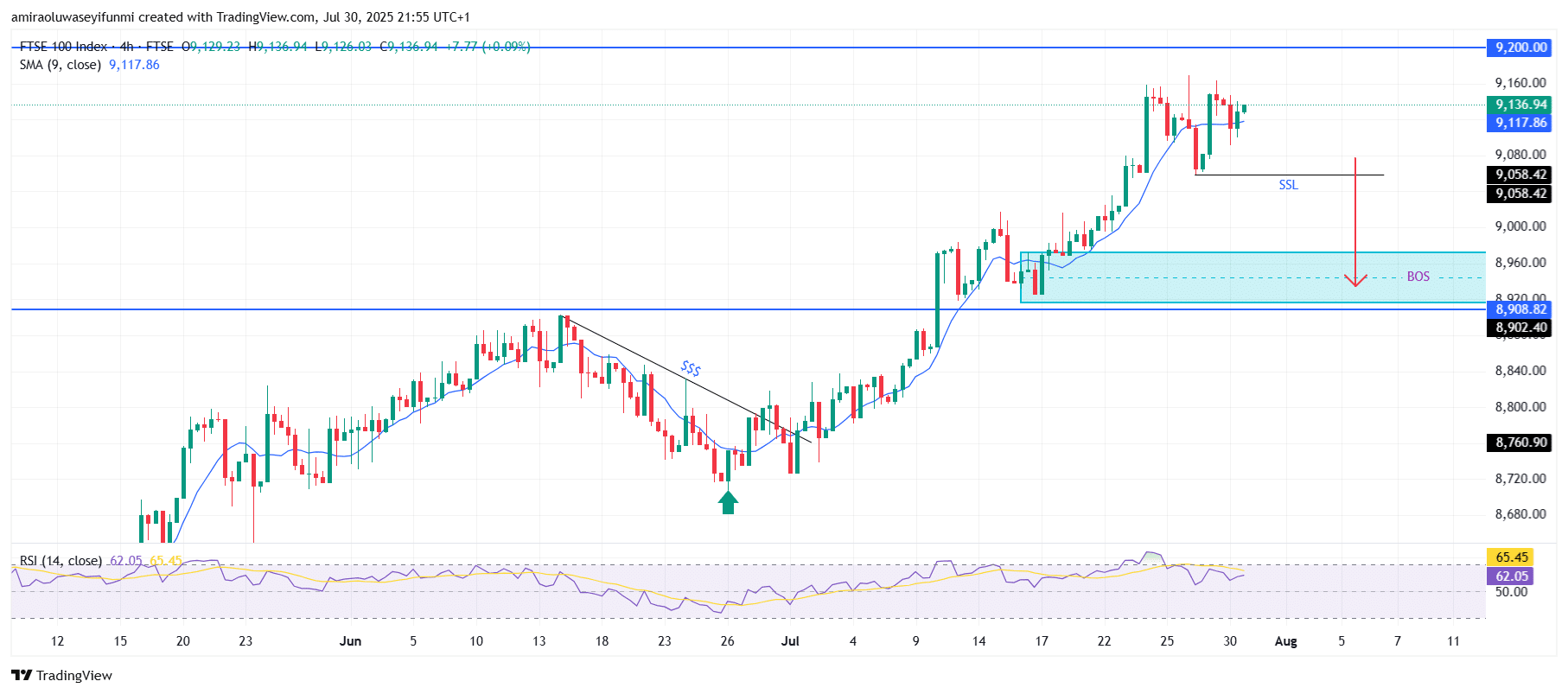

FTSE 100 Short-Term Trend: Bearish

On the 4-hour chart, the FTSE 100 is beginning to show early signs of bearish momentum as price forms a lower high around the $9,140 zone. The short-term structure appears vulnerable, with evident Sell-side Liquidity (SSL) located below the $9,060 support. A break beneath this level could confirm a short-term bearish continuation, targeting the demand zone near $8,900.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.