Market Analysis – July 18

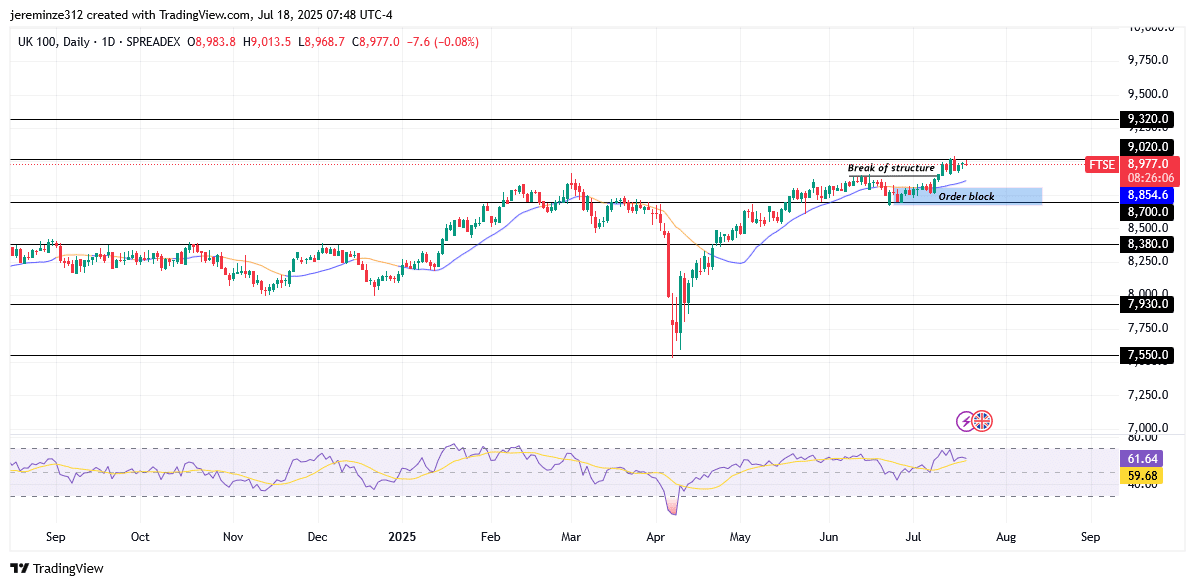

The FTSE 100 has entered a new phase of bullish momentum following a decisive break above the 8700.0 supply level. Before this bullish move, the index had been locked in a prolonged consolidation period from September 2024 to January 2025. This extended sideways trend eventually gave way to a bullish breakout, marking the onset of an upward trajectory.

FTSE 100 Key Levels

Demand Levels: 8380.0, 7930.0, 7550.0

Supply Levels: 8700.0, 9020.0, 9320.0

FTSE 100 Long-Term Trend: Bullish

The initial bullish phase extended until early April 2025, when the market faced a sharp bearish retracement that pulled the price down to the 7550.0 level. Despite the intensity of this decline, the broader bullish structure remained unbroken. The price swiftly rebounded, beginning a steady recovery that ultimately led to a breakout above the 8700.0 resistance level — the same level that had triggered the April pullback.

This breakout indicates a bullish structural shift and sets the stage for a potential continuation toward higher price levels. As long as the price holds above the 8700.0 threshold, the long-term bullish outlook remains intact, with a new upward wave likely to develop.

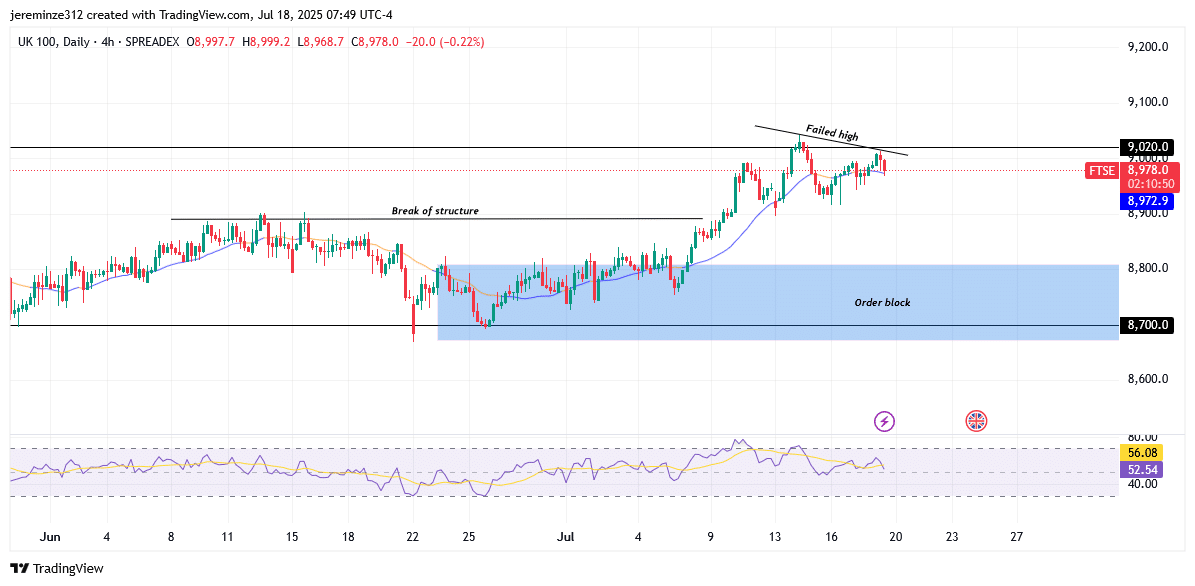

FTSE 100 Short-Term Trend: Bearish

On the 4-hour chart, a temporary bearish pullback appears to be in progress. The index is currently retracing into a daily bullish order block after forming a failed high, pointing to potential short-term weakness. The Relative Strength Index (RSI) on the 4-hour timeframe also indicates declining momentum, supporting the case for a pullback.

This retracement is expected to serve as a healthy correction within the broader bullish context. It may reactivate the order block before the bullish trend resumes. Traders might consider using forex signals to monitor key reversal points and entry opportunities during this phase.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.