Fast forward to 2021 and it is now possible to trade crypto with a fully-regulated platform – with the likes of FBS now holding licenses with ASIC, CySEC, and other reputable bodies.

Perhaps even more importantly for experienced traders, FBS not only offers leveraged crypto instruments but also the ability to go long or short.

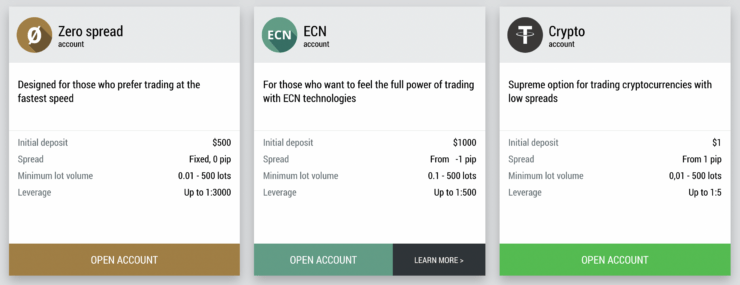

FBS - Top-Rated Broker With 0% Commission and ZERO Spread Accounts

- Trade forex, stocks, indices, crypto, and more

- Various 0% commission and ZERO spread accounts to choose from

- Heavily regulated and solid reputation

- Minimum deposit of just $1

Secure Leveraged Crypto Trading

Crypto traders that seek leverage through derivative products are often forced to use unlicensed platforms – such as BitMEX. This offers virtually nothing in the way of regulatory protection.

This is why FBS – an online CFD broker with over 17 million clients, has since seen a wave of new account signups for its crypto accounts. In a nutshell, FBS allows traders of all shapes and sizes to access leverage facilities in a safe environment.

With leverage limits of 1:5 on offer, this allows traders to magnify their account balances by a factor of five. That is to say, a $100 position can be boosted to $500 at the click of a button. Due to regulatory compliance, limits are often determined by the trader’s location. For instance, EU residents can apply leverage of up to 1:2 when trading crypto, while other jurisdictions get the full 1:5.

With that said, even those based in the EU can get access to much higher limits if they fall within the remit of a professional-client. On top of being able to apply leverage, FBS is also popular with experienced traders that seek access to short-selling tools. Unlike a traditional brokerage setup, there is no requirement to ‘borrow’ assets to go short on a cryptocurrency.

On the contrary, as FBS specializes in contracts-for-differences (CFDs), short-selling has never been easier. For instance, if you felt that Bitcoin was overvalued, you could simply place a sell order on BTC/USD. If your prediction was correct, you would make a profit on this position.

In full recognition that the crypto retail client sector is growing at a rapid pace, FBS also offers a trading path for newbies. This is because the platform requires a minimum deposit of just $1 – so those on a budget can trade crypto assets without needing to risk too much capital.

The Verdict?

With regulated brokers like FBS now looking to fill a gap in the cryptocurrency trading market, it is no wonder that the platform is experiencing sizable growth in terms of new account requests.

Most crucially, no longer do traders need to go through unregulated exchanges to obtain leverage and short-selling facilities. Instead, FBS offers a fully-licensed platform for both beginners and experienced pros alike – with the minimum first-time deposit requirement set at an attractive $1.

FBS - Top-Rated Broker With 0% Commission and ZERO Spread Accounts

- Trade forex, stocks, indices, crypto, and more

- Various 0% commission and ZERO spread accounts to choose from

- Heavily regulated and solid reputation

- Minimum deposit of just $1

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.