Gold is edging closer to its record peak of $2,072.50 per ounce, last seen in August 2020 during the height of the COVID-19 pandemic. As of the recent Friday close, gold is trading at $2,071.88 per ounce, just a fraction below its historic zenith.

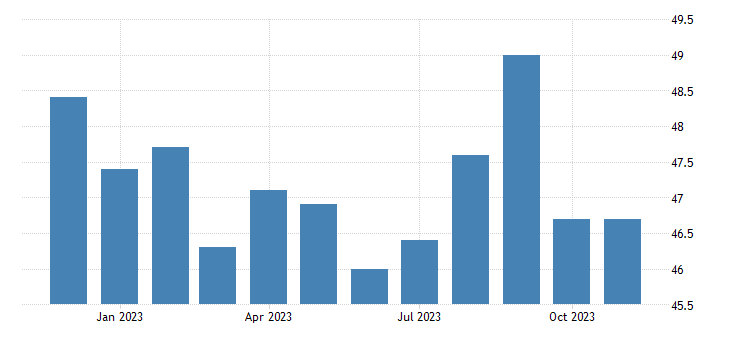

The rally in gold is propelled by a trifecta of factors. Firstly, disappointing US ISM manufacturing PMI data revealed a contraction in the sector, setting a cautious tone for economic recovery.

Next, Federal Reserve Chair Jerome Powell’s dovish remarks hinted at a potential easing in the Fed’s tightening cycle, sending the US dollar lower and elevating gold’s allure as a safe-haven asset. Lastly, the sustained conflict between Israel and Hamas in Gaza intensified geopolitical uncertainties, further boosting demand for gold.

Powell’s indication that the Fed may not pursue aggressive interest rate hikes as previously expected spurred a decline in US Treasury yields, with the 2-year yield approaching the 4.5% support level. The market now anticipates interest rates to be below 4% by December 2024, contributing to the weakening of the US dollar and strengthening gold’s position.

Factors to Look Out for Ahead of Market Open for Gold

The upcoming release of the US ISM services PMI data and the highly anticipated Non-Farm Payrolls (NFP) report will be pivotal for gold traders. A strong NFP figure could temper the gold rally, while a weak one may reinforce it. Simultaneously, ongoing developments in the Middle East remain a crucial factor, with any escalation likely to drive gold prices even higher.

XAU traders are closely monitoring the $2,072.50 resistance level, hoping for a breakthrough, while bears eye the $2,035 support level for signs of a reversal. The delicate balance between economic indicators and geopolitical tensions will continue to shape the path ahead for gold, keeping investors on the edge of their seats.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.