In a recent turn of events, Binance, the global cryptocurrency giant, suffered a significant shakeup as its CEO and co-founder, Changpeng Zhao, stepped down following admissions of violating US anti-money laundering regulations. The aftermath saw Binance agree to pay over $4 billion in fines without admitting guilt, leading to a ripple effect across the crypto market.

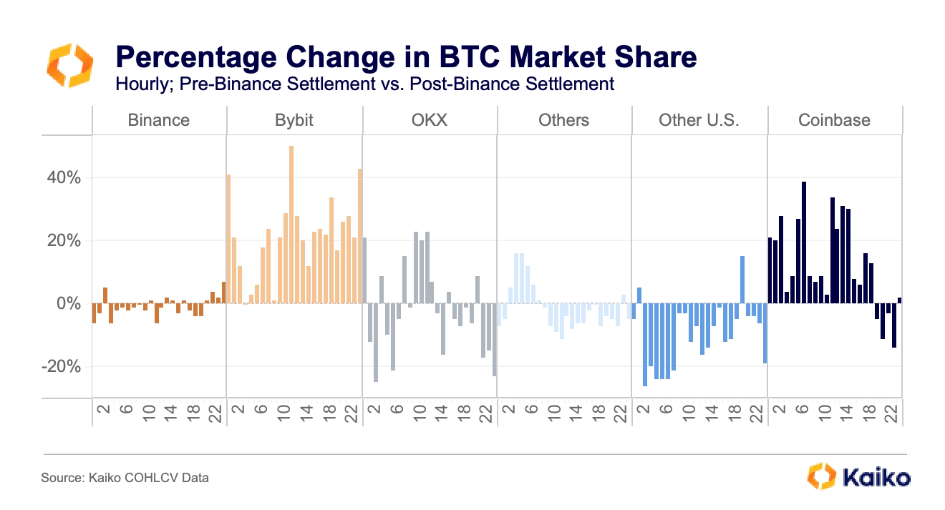

The incident triggered a mass migration of investors seeking refuge in alternative platforms, with Coinbase Pro and Bybit emerging as the primary beneficiaries, according to a comprehensive report by Kaiko, a leading crypto data provider.

Coinbase Pro, Binance’s US-based rival, witnessed an impressive 34% surge in market share in the days post-settlement. Simultaneously, Bybit, a Singaporean derivatives exchange, experienced an even more substantial boost, boasting a remarkable 50% increase in its market share.

Binance Is Still the Leading Crypto Exchange

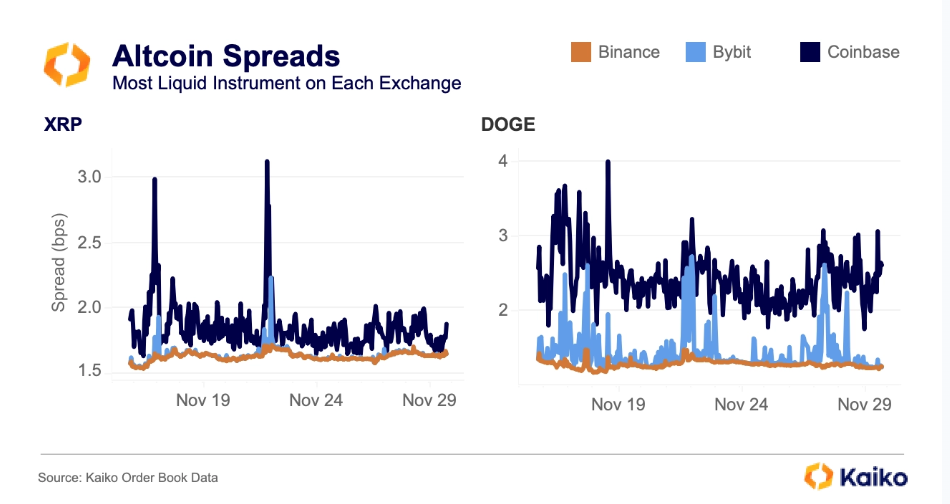

Despite these challenges, Binance remains resilient. Kaiko’s analysis highlights that Binance continues to lead in liquidity for both Bitcoin (BTC) and altcoins. CryptoQuant’s on-chain data further substantiates this claim, revealing that Binance still holds a substantial reserve of around 500,000 BTC, down from 634,000 in May.

Interestingly, Kaiko emphasized that Binance’s dominance extends to specific altcoins, especially Dogecoin. The report underscores that Binance maintains the lowest spreads for DOGE, showcasing its strength in market stability compared to competitors Bybit and Coinbase, which exhibit higher and more volatile spreads.

“It’s too early to make sweeping predictions, but early trends look far from dire for Binance, while also promising for Coinbase and Bybit. This competition developed an interesting wrinkle this week in the form of an email from Coinbase to customers, which informed them that Coinbase received a subpoena from the CFTC related to Bybit,” Kaiko concluded.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.